Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642121

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642121

Power Tool Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

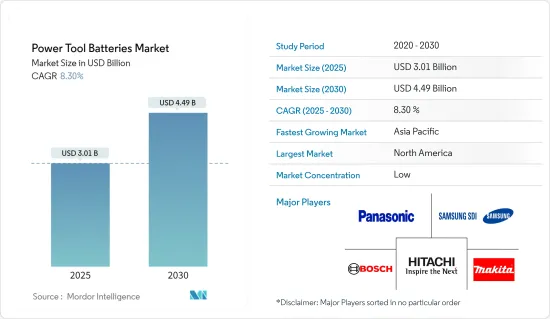

The Power Tool Batteries Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.49 billion by 2030, at a CAGR of 8.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term factors such as the increasing adoption of battery-powered power tools and the rapidly growing automotive industry are expected to drive the power tool batteries market during the forecast period.

- On the other hand, the high cost associated with cordless power tool equipment is likely to restrain the growth of the market during the forecast period.

- Nevertheless, the rising demand for fastening tools and the evolution of smart and connected power tools in the energy and automotive sectors are expected to provide immense opportunities for the market.

- North America is expected to dominate the market, with the majority of the demand coming from countries like the United States, Canada, etc.

Power Tool Battery Market Trends

The Lithium-ion Type is Expected to Dominate the Market

- Lithium-ion batteries are the advanced battery solutions used in power tools. Li-ion batteries are lightweight, have high energy density, and are environment-friendly. The increasing demand from end-user sectors like construction, automotive, and industrial is expected to drive the market.

- Moreover, Li-ion batteries are rechargeable batteries equipped with safety circuits to protect them from overheating, ease of use, longer run times, flexible charging, etc. Lithium-ion batteries are commonly used for portable electronic applications, and cordless power tools have been growing in prominence.

- Lithium-ion batteries, since their introduction, have quickly replaced conventional nickel-cadmium (Ni-Cd) and nickel-metal hydride (Ni-MH) as a power source for power tools. Advancements in battery technologies are also contributing to the increasing adoption of cordless power tools with high-density batteries that can last longer once charged.

- For instance, in January 2023, Bosch Power Tools announced the launch of 32 new 18V Cordless tools to join the CORE18V platform in 2023. The brand's latest offerings expand the 18V line of tools, and the CORE18V battery platform powers the newest innovations.

- Furthermore, after experiencing unprecedented price surges in 2022, battery prices are witnessing a decline in the current year. According to research conducted by BloombergNEF (BNEF), the cost of lithium-ion battery packs has notably decreased by 14%, reaching a historic low of USD 139 per kilowatt-hour (kWh).

- This reduction is attributed to the fall in raw material and component prices, facilitated by an increase in production capacity across various segments of the battery value chain. The observed decline in demand growth, which did not meet certain industry expectations, has also contributed to this price adjustment.

- Therefore, owing to the above points, the lithium-ion technology type is expected to witness dominant growth during the forecast period.

North America is Expected to Dominate the Market

- Over the years, the North American region has emerged as one of the strongest economies in the world, with the United States, Canada, and Mexico being tightly integrated markets. North America, including the United States and Canada, remains a pioneer in the research and innovation in the power tool batteries market.

- The North American region also remains one of the largest consumers of power tool systems due to factors such as increased electric vehicle deployment, increased spending on consumer electronics, and increased consumer and manufacturing activities.

- North America, including the United States and Canada, is the world's largest market for electric power tools. Demand for power tools is expected from the construction industry. The manufacturing industry for power tools in the region is also expected to grow significantly.

- For instance, in July 2023, Makita U.S.A., Inc., a manufacturer of high-quality professional tools and accessories, released three new battery-powered material handling solutions to assist with transportation needs on the job site.

- An increase in public spending on infrastructure is expected to be a significant driver, supported by continued positive growth in the residential and non-residential sectors in the construction industry.

- Construction activity in Canada continues to level off, following the last ten years of extraordinary growth driven by a protracted global resource expansion. In addition to the resource-sector development in oil and gas and mining, Canada's construction sector benefited from coinciding investments in mega electric power generation and transmission and other significant infrastructure. These combined investments propelled growth well ahead of other countries, elevating Canada to one of the top 10 construction markets in the world.

- Therefore, North America is expected to be the dominant region in the power tool batteries market during the forecast period, supported by increasing adoption in numerous end-user applications.

Power Tool Battery Industry Overview

The power tool batteries market is fragmented. Some of the major companies (in no particular order) are Bosch Ltd, Hitachi Ltd, Makita Corporation, Panasonic Corporation, and Samsung SDI Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66741

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Battery-Powered Power Tools

- 4.5.1.2 Rapidly Growing Automotive Industry

- 4.5.2 Restraints

- 4.5.2.1 High Cost Associated With Cordless Power Tool Equipment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology Type

- 5.1.1 Lithium-ion

- 5.1.2 Nickel-cadmium

- 5.1.3 Other Technology Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Qatar

- 5.2.5.4 South Africa

- 5.2.5.5 Egypt

- 5.2.5.6 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Bosch Ltd

- 6.3.2 Hitachi Ltd

- 6.3.3 Makita Corporation

- 6.3.4 Panasonic Corporation

- 6.3.5 Ryobi Limited

- 6.3.6 Samsung SDI Co. Ltd

- 6.3.7 Sony Group Corporation

- 6.3.8 Stanley Black & Decker Inc.

- 6.3.9 Techtronic Industries Company Limited

- 6.3.10 Hilti Corporation

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Fastening Tools In The Energy And Automotive Sectors

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.