PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851004

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851004

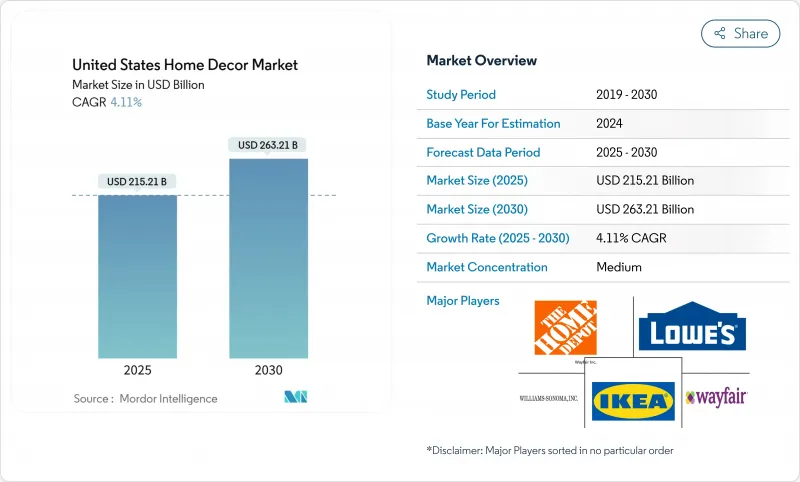

United States Home Decor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Home Decor Market size is estimated at USD 215.21 billion in 2025, and is expected to reach USD 263.21 billion by 2030, at a CAGR of 4.11% during the forecast period (2025-2030).

The United States home decor market size reached USD 215.2 billion in 2025 and is forecast to reach USD 263.21 billion by 2030, advancing at a 4.11% CAGR. Remote-work adoption keeps living and working spaces blended, sustaining demand for versatile furnishings. Housing starts rose 11.2% month-on-month in February 2025, providing a steady pipeline for decor purchases . Consumers are gravitating toward sustainable materials, while digital tools such as augmented-reality apps shorten the path to purchase. Competitive intensity is moderate, yet scale, omnichannel reach, and installation services continue to differentiate leading retailers in the United States home decor market.

United States Home Decor Market Trends and Insights

Aging housing stock driving renovation-led decor spend

More than one-third of U.S. homes are now over 30 years old, spurring spending on both functional updates and interior refreshes. Renovation budgets increasingly bundle structural work with style upgrades, widening the addressable pool for the United States home decor market. Retailers are tailoring assortments by region, as the Northeast and Midwest house the oldest stock. Building-permit volumes confirm sustained investment in improvements even when new construction slows. Installation-service uptake also rises because aging homes require skilled labor for complex retrofits.

Growth in single-family housing starts and existing-home sales

Housing starts hit 1.5 million units in December 2024, their highest level since February 2024. Each sold or newly built house triggers a wave of decor purchasing during early occupancy. Regional divergence persists, but healthy migration flows to the Sun Belt add incremental volume to the United States home decor market. Government data on residential sales shows that first-time buyers allocate larger shares of move-in budgets to furnishings. Existing homeowners, encouraged by rising equity, continue to refresh interiors as they stay put longer.

Volatile lumber and textile input costs compressing margins

Lumber futures swung widely through 2024, often pricing furniture makers into squeezed gross margins. Cotton markets faced similar instability due to weather shocks in major producing countries. Producer-price indices published by the Bureau of Labor Statistics capture these fluctuations . Mid-tier brands are most exposed because raising list prices risks share erosion. Compliance with new stability standards adds cost layers, yet failure to meet them curbs market access. This restraint limits short-term pricing power in the United States home decor market.

Other drivers and restraints analyzed in the detailed report include:

- Remote-work adoption boosting home-office decor purchases

- Social-media-led trend cycles accelerating purchase frequency

- Global supply-chain disruptions extending lead-times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Furniture held 37.22% of the United States home decor market size in 2024. The sub-segment for home-office furniture is advancing at 9.90% CAGR through 2030 as remote work normalizes. Wall decor enjoys budget-friendly refresh appeal, and lighting evolves into a blend of task functionality and design statement. Decorative accessories cater to impulse purchases heavily influenced by social media. Home textiles, the lowest-ticket category, allow quick seasonal updates.

Cross-category integration shapes merchandising as consumers seek cohesive room aesthetics. Bureau of Economic Analysis data shows increasing spending on furniture bundled with decor accents. Smart features such as built-in charging ports or voice-controlled lighting differentiate offerings. Sustainability drives flooring suppliers to prioritize recycled content and low-VOC adhesives. Retailers leveraging virtual design services bundle multiple categories to unlock higher basket sizes within the United States home decor market.

Wood commanded 42.75% United States home decor market share in 2024 as its warmth and authenticity resonate with buyers. Reclaimed or certified-sourced wood is the fastest grower at 8.83% CAGR, benefitting from heightened environmental awareness. Metal frames underscore minimalist styles, while glass elements create perceived space in urban dwellings. Performance textiles address durability for pet- and child-friendly households.

Hybrid material designs-such as wood-metal composites-balance aesthetics with structural integrity. Stone and ceramic accessories accrue share thanks to tactile qualities aligned with nature-inspired themes. Plastics now include recycled feedstocks that mimic organic textures. NSF-certified sustainability standards guide purchasing decisions, particularly within institutional channels. Material choices increasingly express personal values inside the United States home decor market.

The US Home Decor Market Segmented Into by Product Type (Furniture, Home Textiles, and More), Material (Wood, Metal, and More), Distribution Channel (Home-Improvement & Furniture Stores, Specialty Decor Stores, and More), Price Range (Mass and Premium / Luxury), Room (living Room, Bedroom, More), and Region (Northeast, Midwest and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Home Depot Inc.

- Lowe's Companies Inc.

- IKEA USA (Ingka Holding)

- Williams-Sonoma Inc.

- Wayfair Inc.

- Target Corporation

- TJX Companies (HomeGoods)

- Amazon.com Inc.

- Ashley Furniture Industries LLC

- Ethan Allen Interiors Inc.

- La-Z-Boy Inc.

- RH (Restoration Hardware)

- Crate & Barrel Holdings Inc.

- At Home Group Inc.

- Haverty Furniture Companies Inc.

- Bob's Discount Furniture LLC

- Lamps Plus Inc.

- Floor & Decor Holdings Inc.

- Mohawk Industries Inc.

- Pier 1 Imports Online LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Market Landscape

- 3.1 Market Overview

- 3.2 Market Drivers

- 3.2.1 Study Assumptions & Market Definition

- 3.2.2 Aging U.S. Housing Stock Driving Renovation-Led Decor Spend

- 3.2.3 Growth in Single-Family Housing Starts & Existing Home Sales

- 3.2.4 Remote-Work Adoption Boosting Home-Office Decor Purchases

- 3.2.5 Social-Media-Led Trend Cycles Accelerating Purchase Frequency

- 3.2.6 Omnichannel + AR Shopping Enhancing Customer Experience

- 3.2.7 Sustainability Preferences Fueling Eco-Friendly Decor Demand

- 3.3 Market Restraints

- 3.3.1 Volatile Lumber & Textile Input Costs Compressing Margins

- 3.3.2 Global Supply-Chain Disruptions Extending Lead-Times

- 3.3.3 Rising Mortgage Rates Limiting Housing Turnover & Spend

- 3.3.4 Urban Market Saturation Constraining Incremental Growth

- 3.4 Value / Supply-Chain Analysis

- 3.5 Regulatory & Technological Outlook

- 3.6 Porter's Five Forces Analysis

- 3.6.1 Threat of New Entrants

- 3.6.2 Bargaining Power of Suppliers

- 3.6.3 Bargaining Power of Buyers

- 3.6.4 Threat of Substitutes

- 3.6.5 Competitive Rivalry

4 Market Size & Growth Forecasts (Value, USD)

- 4.1 By Product Type

- 4.1.1 Furniture

- 4.1.2 Home Textiles

- 4.1.3 Flooring & Carpets

- 4.1.4 Wall Decor (Paintings, Wallpapers)

- 4.1.5 Lighting Fixtures

- 4.1.6 Decorative Accessories (Vases, Candles, Clocks)

- 4.2 By Material

- 4.2.1 Wood

- 4.2.2 Metal

- 4.2.3 Textile

- 4.2.4 Glass

- 4.2.5 Plastic & Other Synthetics

- 4.2.6 Stone & Ceramic

- 4.3 By Distribution Channel

- 4.3.1 Home-Improvement & Furniture Stores

- 4.3.2 Specialty Decor Stores

- 4.3.3 Supermarkets & Hypermarkets

- 4.3.4 Online / E-commerce

- 4.3.5 Others (Boutiques, Art Galleries)

- 4.4 By Price Range

- 4.4.1 Mass

- 4.4.2 Premium / Luxury

- 4.5 By Room

- 4.5.1 Living Room

- 4.5.2 Bedroom

- 4.5.3 Kitchen & Dining

- 4.5.4 Bathroom

- 4.5.5 Home Office

- 4.5.6 Outdoor & Patio

- 4.6 By Region (United States)

- 4.6.1 Northeast

- 4.6.2 Midwest

- 4.6.3 South

- 4.6.4 West

5 Market Opportunities & Future Outlook

- 5.1 White-Space & Unmet-Need Assessment

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 The Home Depot Inc.

- 6.4.2 Lowe's Companies Inc.

- 6.4.3 IKEA USA (Ingka Holding)

- 6.4.4 Williams-Sonoma Inc.

- 6.4.5 Wayfair Inc.

- 6.4.6 Target Corporation

- 6.4.7 TJX Companies (HomeGoods)

- 6.4.8 Amazon.com Inc.

- 6.4.9 Ashley Furniture Industries LLC

- 6.4.10 Ethan Allen Interiors Inc.

- 6.4.11 La-Z-Boy Inc.

- 6.4.12 RH (Restoration Hardware)

- 6.4.13 Crate & Barrel Holdings Inc.

- 6.4.14 At Home Group Inc.

- 6.4.15 Haverty Furniture Companies Inc.

- 6.4.16 Bob's Discount Furniture LLC

- 6.4.17 Lamps Plus Inc.

- 6.4.18 Floor & Decor Holdings Inc.

- 6.4.19 Mohawk Industries Inc.

- 6.4.20 Pier 1 Imports Online LLC