PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851744

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851744

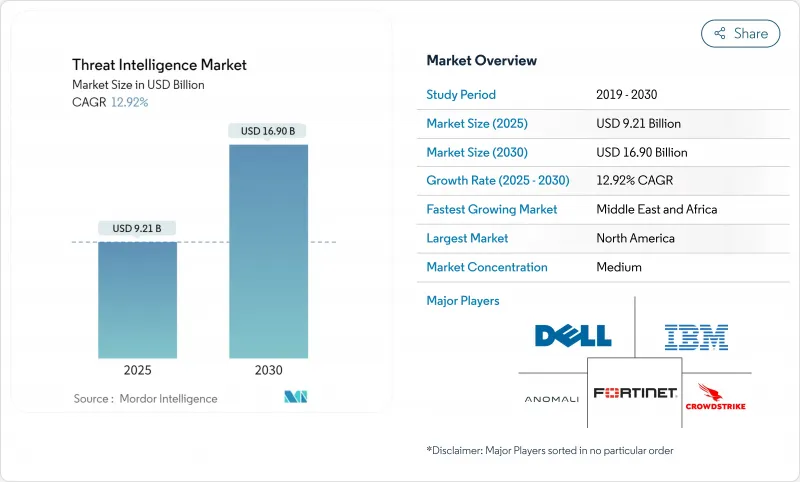

Threat Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The threat intelligence market is valued at USD 9.21 billion in 2025 and is forecast to reach USD 16.90 billion by 2030, reflecting a CAGR of 12.92%.

Expanding cloud adoption, rapid attacker use of AI, and tighter regulatory frameworks such as the EU-NIS2 directive are lifting spending on proactive intelligence platforms. Security leaders are prioritizing context-rich analytics that shorten response times and lower breach costs, while insurers and investors now examine live intelligence feeds before underwriting cyber risk. Consolidation among large vendors is accelerating platform breadth, yet specialist providers remain relevant where sector-specific intelligence is required. Heightened nation-state activity and ransomware cartel funding through cryptocurrencies are expected to keep the threat environment volatile, sustaining investment momentum across every major vertical.

Global Threat Intelligence Market Trends and Insights

AI-driven Polymorphic Malware Targeting Cloud-Native Workloads

AI-generated polymorphic malware can rewrite its code on the fly, defeating traditional signature tools and forcing defenders to rely on behavioural analytics. IBM research shows such malware now negotiates ransoms without human contact and pivots tactics based on cloud configuration, complicating incident response. The U.S. Department of Justice recently dismantled a ring that stole USD 263 million in cryptocurrency through AI-enabled exploits, underscoring the financial risk. North American enterprises are boosting budget for machine-learning detection, making the threat intelligence market essential for cloud workload protection.

EU-NIS2 Compliance Spend by Critical Infrastructure Operators

Effective October 2024, the NIS2 directive subjects roughly 300,000 European entities to mandatory risk assessments, incident reporting, and supply-chain scrutiny. Penalties can reach EUR 10 million or 2% of global turnover, pushing boards to prioritise real-time intelligence. Multinationals outside the bloc must also comply when serving EU customers, widening opportunity for vendors that package ready-to-audit intelligence feeds.

STIX/TAXII Interoperability Gaps in Legacy SOCs

Although STIX and TAXII became OASIS standards in 2021, many legacy platforms still process proprietary formats, preventing seamless data sharing. An exploratory study identified integration complexity and inconsistent notation as primary hurdles. As a result, organisations delay platform upgrades, restraining short-term spending.

Other drivers and restraints analyzed in the detailed report include:

- Zero Trust Roll-outs in APAC Large Enterprises

- RaaS Cartels Fuelling Crypto-Wallet Monitoring Demand

- Escalating Subscription Costs for Actionable Intel Data

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 56% of global revenue in 2024, giving platforms an outsized hold on the threat intelligence market. Microsoft Defender Threat Intelligence alone processes 78 trillion signals per day, highlighting scale advantages. This dominance underlines why the threat intelligence market size attached to platforms is expected to keep rising through 2030. Leading vendors incorporate AI for behaviour analytics, easing analyst workload and improving detection fidelity.

Managed and professional services are outpacing product growth with a 14.5% CAGR, reflecting talent shortages and rising complexity. SANS surveys show many enterprises outsource hunting duties to close skill gaps. Partnerships that wrap training around deployments allow buyers to derive quicker value, propelling service uptake, especially across the threat intelligence industry's mid-market segment.

On-premise deployments held 55% of spending in 2024 as heavily regulated sectors prefer local data residency. Even so, cloud-hosted platforms are the fastest riser at 16.8% CAGR, signalling confidence in provider hardening and FedRAMP expansions such as Microsoft Defender Threat Intelligence gaining High attestation. Segment observers see the threat intelligence market size for cloud deliveries eclipsing on-premise totals late in the forecast window.

Hybrid approaches blend legacy sensors with SaaS analytics, appealing to organisations modernising at their own pace. Financial regulators now publish blueprints for secure cloud adoption that specifically mention continuous intelligence integration, accelerating momentum.

The Threat Intelligence Market Report is Segmented by Component (Solutions, and Services), Deployment (On-Premise, Cloud, and Hybrid), Threat-Intelligence Type (Strategic, Tactical, Operational, and Technical), Organization Size (Large Enterprises, and Small and Medium-Sized Enterprises), End-User Industry (BFSI, IT and Telecommunications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38% of 2024 revenue owing to mature cloud uptake, joint public-private information sharing, and deep vendor presence. Legislators continue to refine disclosure laws, while federal bodies sponsor real-time data-exchange platforms that reinforce the threat intelligence market. AI-enabled malware against cloud workloads remains the top regional concern, keeping platform spending buoyant.

Europe's outlook brightens under NIS2, which scales mandatory coverage from 20 000 to 300 000 entities, greatly enlarging the addressable threat intelligence market. Complementary legislation such as the Cyber Resilience Act furthers demand for continuous vulnerability context across supply chains. Vendors that package audit-ready reporting with multi-lingual threat data are well positioned.

The Middle East shows the fastest CAGR at 15.8% through 2030. National agencies in the UAE and Saudi Arabia invest in sector-focused fusion centres while energy majors receive cyber-insurance discounts tied to live feeds. Rising geopolitical tension in the region elevates the strategic value of the threat intelligence market for both public and private sectors.

Asia-Pacific sees a double-digit attack uptick, notably in Indonesia where weekly incidents top 3,300. Rapid digitalisation, paired with diverse sovereignty rules, produces fragmented demand. Japan, South Korea, and Australia lead Zero Trust pilots that embed live intelligence into access decisions, while China and India's data-localisation laws create preferences for in-country cloud nodes.

South America's adoption is spurred by mid-tier BFSI outsourcing threat-hunting to overcome skills shortages, adding to global revenue even if from a smaller base.

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc.

- CrowdStrike Holdings Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- Palo Alto Networks Inc.

- Fortinet Inc.

- Rapid7 Inc.

- Secureworks Inc.

- FireEye - Trellix

- Recorded Future Inc.

- Anomali Inc.

- LookingGlass Cyber Solutions Inc.

- LogRhythm Inc.

- McAfee LLC

- Broadcom Inc. (Symantec)

- Juniper Networks Inc.

- F-Secure Corporation

- SentinelOne Inc.

- Microsoft Corp. (Defender Threat Intelligence)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-Driven Polymorphic Malware Targeting Cloud-Native Workloads in North America

- 4.2.2 EU-NIS2 Compliance Spend by Critical Infrastructure Operators

- 4.2.3 Zero-Trust Roll-outs in APAC Large Enterprises

- 4.2.4 RaaS Cartels Fueling Crypto-Wallet Monitoring Demand

- 4.2.5 Outsourced Threat-Hunting by South-American Mid-Tier BFSI

- 4.2.6 Cyber-Insurance Premium Discounts Tied to Live Threat Feeds (Middle East Energy)

- 4.3 Market Restraints

- 4.3.1 STIX/TAXII Interoperability Gaps in Legacy SOCs

- 4.3.2 Escalating Subscription Costs for Actionable Intel Data

- 4.3.3 Data-Sovereignty Barriers (China CSL, India DPDP, etc.)

- 4.3.4 Analyst Fatigue and Alert Overload in Resource-Constrained Teams

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Factors on the Market

5 Market Size and Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Threat Intelligence Platforms

- 5.1.1.2 Security Information and Event Management (SIEM) Feeds

- 5.1.1.3 Threat Hunting/Analytics Tools

- 5.1.2 Services

- 5.1.2.1 Managed/Outsourced Services

- 5.1.2.2 Professional and Consulting

- 5.1.2.3 Training and Support

- 5.1.1 Solutions

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Threat-Intelligence Type

- 5.3.1 Strategic

- 5.3.2 Tactical

- 5.3.3 Operational

- 5.3.4 Technical

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium-Sized Enterprises

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecommunications

- 5.5.3 Retail and E-commerce

- 5.5.4 Manufacturing

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Government and Defense

- 5.5.7 Energy and Utilities

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 IBM Corporation

- 6.3.2 Cisco Systems Inc.

- 6.3.3 Dell Technologies Inc.

- 6.3.4 CrowdStrike Holdings Inc.

- 6.3.5 Check Point Software Technologies Ltd.

- 6.3.6 Trend Micro Incorporated

- 6.3.7 Palo Alto Networks Inc.

- 6.3.8 Fortinet Inc.

- 6.3.9 Rapid7 Inc.

- 6.3.10 Secureworks Inc.

- 6.3.11 FireEye - Trellix

- 6.3.12 Recorded Future Inc.

- 6.3.13 Anomali Inc.

- 6.3.14 LookingGlass Cyber Solutions Inc.

- 6.3.15 LogRhythm Inc.

- 6.3.16 McAfee LLC

- 6.3.17 Broadcom Inc. (Symantec)

- 6.3.18 Juniper Networks Inc.

- 6.3.19 F-Secure Corporation

- 6.3.20 SentinelOne Inc.

- 6.3.21 Microsoft Corp. (Defender Threat Intelligence)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment