PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910484

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910484

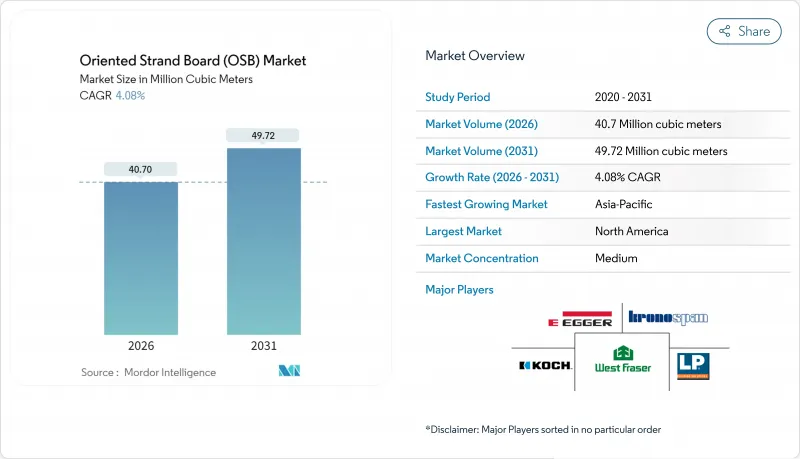

Oriented Strand Board (OSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Oriented Strand Board (OSB) market size in 2026 is estimated at 40.7 Million cubic meters, growing from 2025 value of 39.10 Million cubic meters with 2031 projections showing 49.72 Million cubic meters, growing at 4.08% CAGR over 2026-2031.

This steady trajectory highlights how cost advantages over plywood, regulatory tailwinds favoring low-embodied-carbon materials, and process-automation investments are reinforcing demand across the oriented strand board market. Builders in mature regions seek operating efficiencies, while governments in emerging economies channel infrastructure funds toward engineered wood, collectively underpinning healthy volume growth. Competitive activity centers on mill automation and grade innovation; Weyerhaeuser's AI-guided dryer optimization exemplifies how digital tools are lifting throughput and down-line panel quality.

Global Oriented Strand Board (OSB) Market Trends and Insights

Cost-effective Substitution for Plywood

Manufacturers continue to narrow production spreads versus softwood plywood, leveraging strand-alignment software and precision resin dosing to cut variable costs. Louisiana-Pacific booked USD 267 million in OSB revenue in Q1-2025 and maintained shipment volumes despite an 11% spot-price slide, underscoring how the oriented strand board market absorbs demand displaced from constrained plywood capacity. Predictable panel pricing supports budget certainty for residential framers, especially when lumber volatility exceeds USD 100 per m3 swings. Consequently, the oriented strand board market now penetrates interior finish and furniture substrates once dominated by plywood.

Expansion of Global Construction Activity

Asia-Pacific's infrastructure drive remains the single largest demand inflection, reflected in the region's 6.34% CAGR outlook. China's stabilized log cost of USD 110 per m3 supports margin visibility for panel buyers, while public-works pipelines in India and Indonesia lift long-term engineered-wood offtake. North American single-family starts rose 7% in 2024, translating into incremental sheathing volume as builders favor OSB's uniform nail-holding capacity. the Middle East, Saudi and UAE decarbonization plans worth USD 180 billion triple timber imports, positioning exporters to tap fresh oriented strand board market pockets. Prefab factories leverage OSB's dimensional tolerance to shorten install cycles, further linking construction momentum with panel consumption.

Formaldehyde and VOC Regulations Tightening

The EU will enforce sub-0.080 mg/m3 formaldehyde ceilings from August 2026, compelling mills still reliant on UF-based resins to re-formulate or cede share. While OSB produced with MDI binders often qualifies for exemption, switching chemistry inflates variable cost 15-20%, squeezing commodity-grade margins. On the U.S. front, EPA's draft risk assessment flags 62 use-cases that might trigger tougher workplace exposure limits, creating capital spend for enhanced ventilation and test labs. Compliance pathways favor vertically integrated operators with adhesive research and development scale, adding strategic weight to technological agility in the oriented strand board market.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-driven Demand for Engineered Wood

- Modular and Prefab Housing Boom

- Wood-fiber Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OSB/3 generated 46.85% of oriented strand board market share in 2025 and is slated to widen its role as the oriented strand board market size for this grade grows at 4.58% CAGR through 2031, buoyed by building-code preference for panels rated for humid conditions. Manufacturers rely on phenol-formaldehyde or MDI resins to deliver water resistance without sacrificing screw-holding, attracting specifiers in multifamily walls and roof decks. In parallel, OSB/4 captures niche heavy-load floors, but its higher density caps price-sensitive uptake. OSB/2 remains cost-effective in dry-interior sheathing, yet faces share leakage to enhanced OSB/3 as designers adopt one-grade fits-all procurement to streamline inventories.

Surface innovations are expanding OSB/3 utility into cabinetry and decorative markets previously closed due to rough finish. Fine-OSB lines that overlay particleboard faces onto OSB cores permit high-pressure laminate adhesion, enlarging downstream applications and supporting oriented strand board market penetration in furniture clusters. On the regulatory side, OSB/1 demand wanes amid looming formaldehyde scrutiny, steering mill capital toward converting legacy production to higher-value structural grades.

The Oriented Strand Board Report is Segmented by Grade (OSB/1, OSB/2, OSB/3, and OSB/4), End-User Application (Construction, Furniture, and Packaging), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

North America retained 60.05% oriented strand board market share in 2025 thanks to a deep installed mill base, integrated softwood supply, and builder familiarity with the product. The United States remains the world's largest importer at USD 1.9 billion, primarily sourcing from Canadian and Brazilian plants even while domestic mills modernize with AI-enabled dryers to lift uptime. Canada's export orientation continues, but high fiber costs have forced selective curtailments as illustrated by West Fraser's Fraser Lake shutdown, tightening regional supply, and underpinning pricing.

Asia-Pacific is the growth engine, expanding at a 6.23% CAGR through 2031 as China, India, and ASEAN economies fast-track urban rail, data-center, and mid-rise residential projects. Luli Group's commissioning of China's first Fine-OSB line marks a pivot from reliance on imports toward domestic integrated production that shortens lead times and customizes grades for local codes. India's Smart City program lifts engineered panel adoption, where cost and speed edge out solid timber. Southeast Asian demand rises on tourism-driven hospitality builds, though local capacity lags, opening import lanes for North American and Chilean suppliers.

Europe shows steady but lower growth as stringent climate regulations lock in wood-favoring policies yet mature housing stock tempers volume upside. The EU-wide 2026 formaldehyde limit will likely displace non-compliant suppliers, increasing opportunities for mills already using MDI systems. Southern Europe's renovation credits and Northern Europe's prefab exports provide incremental tailwinds, keeping the oriented strand board market defensible against CLT incursion.

- Arbec Forest Products Inc.

- Besgrade Plywood Sdn. Bhd.

- Coillte

- EGGER

- J.M. Huber Corporation

- Koch IP Holdings, LLC

- Koyuncuoglu Group of Companies

- Kronoplus Limited

- Louisiana-Pacific Corporation

- RoyOMartin

- Sonae Arauco

- STRANDPLYOSB

- Swiss Krono Group

- Tolko Industries Ltd.

- West Fraser

- Weyerhaeuser Company

- Yalong Wood

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective substitution for plywood

- 4.2.2 Expansion of global construction activity

- 4.2.3 Sustainability-driven demand for engineered wood

- 4.2.4 Modular and prefab housing boom

- 4.2.5 Emerging low-VOC MDI-bonded OSB grades

- 4.3 Market Restraints

- 4.3.1 Formaldehyde and VOC regulations tightening

- 4.3.2 Wood-fiber price volatility

- 4.3.3 CLT adoption stealing structural share

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 By End-user Application

- 5.2.1 Construction

- 5.2.1.1 Floor and Roof

- 5.2.1.2 Wall

- 5.2.1.3 Door

- 5.2.1.4 Column and Beam (Shuttering)

- 5.2.1.5 Staircase

- 5.2.1.6 Other Constructions

- 5.2.2 Furniture

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging

- 5.2.1 Construction

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level overview, Market-level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arbec Forest Products Inc.

- 6.4.2 Besgrade Plywood Sdn. Bhd.

- 6.4.3 Coillte

- 6.4.4 EGGER

- 6.4.5 J.M. Huber Corporation

- 6.4.6 Koch IP Holdings, LLC

- 6.4.7 Koyuncuoglu Group of Companies

- 6.4.8 Kronoplus Limited

- 6.4.9 Louisiana-Pacific Corporation

- 6.4.10 RoyOMartin

- 6.4.11 Sonae Arauco

- 6.4.12 STRANDPLYOSB

- 6.4.13 Swiss Krono Group

- 6.4.14 Tolko Industries Ltd.

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

- 6.4.17 Yalong Wood

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment