PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640684

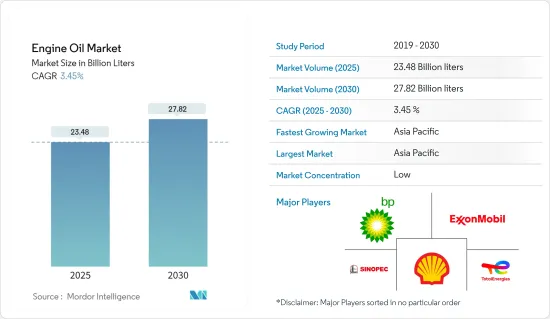

Engine Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Engine Oil Market size is estimated at 23.48 billion liters in 2025, and is expected to reach 27.82 billion liters by 2030, at a CAGR of 3.45% during the forecast period (2025-2030).

The COVID-19 crisis impacted the global automotive industry, as both the production and sales of motor vehicles came to a sudden halt in most regions. These work stoppages led to a loss in the production of millions of vehicles across the world. The automobile industry has a direct effect on the engine oil market as it is used to improve the overall efficiency of an engine and reduce emissions. However, the market growth picked up steadily, owing to increased automotive activities after the lifting of restrictions in the second half of 2021, leading to market recovery.

Key Highlights

- Over the medium term, the increasing automotive production and sales and the increasing adoption of high-performance lubricants are significant factors driving the growth of the market studied.

- However, extended drain intervals and the modest impact of electric vehicles (EVs) are key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing automotive industry in the Middle East and Africa and numerous upcoming construction projects in North America and APAC are likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Engine Oil Market Trends

Increasing Demand from Automotive Industry

- Engine oils are widely used to lubricate internal combustion engines. They are composed of 75-90% base oils and 10-25% additives and are mostly used in automotive and other transport segments across the world.

- The major advantages of using engine oils are wear and tear reduction, corrosion protection, and the engine's smooth operation. They function by creating a thin film between the moving parts for enhancing heat transfer and reducing tension during the contact of parts.

- The increasing production and sales of light-duty vehicles are estimated with a direct impact on engine oil consumption. It, in turn, is anticipated to drive the demand for engine oil during the forecast period.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production reached 85,016,728 units in 2022, and the production increased by 5.9% when compared to the previous year's data. Motor vehicle production growth year-on-year between the 2021 and 2022 markets was at 6%.

- Similarly, as per OICA, commercial vehicle production reached 57.49 million units in 2022 and registered growth when compared to 56.44 in 2021.

- Meanwhile, as per the Bureau of Economic Analysis of the United States Department of Commerce, light vehicle retail sales reached 13,754.3 thousand units, registering the lowest production when compared to 14,946.9 thousand units in 2021.

- Further, according to the German Association of the Automotive Industry (Verband der Automobilindustrie), automobile production in Germany reached 3.4 million in 2022 and registered a growth of 9.6% when compared to 3.1 million in 2021.

- As a result, the factors above are anticipated with a substantial beneficial influence on the engine oil market in the future years.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the engine oil market primarily due to the huge growing demand for automotive production and power generation industries.

- China holds the title of the world's leading automobile manufacturer. The nation's automotive industry is poised for product advancement, emphasizing the production of vehicles aimed at enhancing fuel efficiency and reducing emissions, addressing escalating environmental concerns attributed to increasing pollution levels in the country

- According to the China Association of Automobile Manufacturers(CAAM), in 2022, approximately 23.56 million passenger cars and 3.3 million commercial vehicles were sold in China.

- Similarly, according to the India Brand Equity Foundation, in the financial year 2022, India's power generation capacity rose to nearly 400 GW. Thereby, the growth in generation capacity from the previous years continues. Between 1992 and 2022, the country's electricity capacity experienced a five-fold increase.

- As per Cabinet Office Japan, in 2022, the order value for heavy electrical machinery from manufacturers in Japan amounted to approximately JPY 2.25 trillion (~USD 15.22 billion), increasing from around JPY 2.15 trillion (~USD 14.55 billion) in the previous year.

- As a result, the factors above are projected to have a substantial influence on the engine oil market in the region in the coming years.

Engine Oil Industry Overview

The engine oil market is fragmented in nature. The major players include (not in particular order) Total Energies, Exxon Mobile Corporation, BP p.l.c., Shell PLC, and China Petrochemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Automotive Production and Sales

- 4.1.2 Increasing Adoption of High-performance Lubricants

- 4.2 Restraints

- 4.2.1 Extended Drain Intervals

- 4.2.2 Modest Impact of Electric Vehicles (EVs) in the Future

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Power Generation

- 5.1.2 Automotive and Other Transportation

- 5.1.3 Heavy Equipment

- 5.1.4 Metallurgy and Metalworking

- 5.1.5 Chemical Manufacturing

- 5.1.6 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Philippines

- 5.2.1.6 Indonesia

- 5.2.1.7 Malaysia

- 5.2.1.8 Thailand

- 5.2.1.9 Vietnam

- 5.2.1.10 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.2.4 Rest of North America

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Russia

- 5.2.3.6 Spain

- 5.2.3.7 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Qatar

- 5.2.5.4 United Arab Emirates

- 5.2.5.5 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP p.l.c

- 6.4.4 Chevron Corporation

- 6.4.5 China Petrochemical Corporation

- 6.4.6 Eni SPA

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 FUCHS

- 6.4.9 Gazpromneft - Lubricants, Ltd

- 6.4.10 Gulf Oil International

- 6.4.11 Hindustan Petroleum Corporation Limited

- 6.4.12 Idemitsu Kosan Co.,Ltd

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 Indian Oil Corporation Ltd

- 6.4.15 JX Nippon Oil & Gas Exploration Corporation

- 6.4.16 LUKOIL

- 6.4.17 Motul

- 6.4.18 Petrobras

- 6.4.19 PETRONAS Lubricants International

- 6.4.20 Phillips 66 Company

- 6.4.21 PT Pertamina Lubricants

- 6.4.22 Repsol

- 6.4.23 Shell PLC

- 6.4.24 SK Enmove CO., Ltd

- 6.4.25 Tide Water Oil Co. (India) Ltd

- 6.4.26 TotalEnergies

- 6.4.27 Valvoline Cummins Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Automotive Industry in Middle East and Africa

- 7.2 Numerous Upcoming Construction Projects In North America and APAC