PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640679

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640679

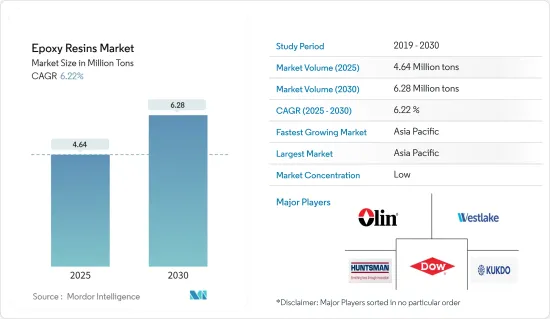

Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Epoxy Resins Market size is estimated at 4.64 million tons in 2025, and is expected to reach 6.28 million tons by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

In 2020, the COVID-19 pandemic and stringent regulations across the globe took a toll on the epoxy resin market. Industries like paints and coatings, adhesives, and electrical and electronics faced challenges, grappling with supply chain disruptions, work stoppages, and labor shortages. However, in 2021, the market rebounded, driven by a surge in demand from the paints and coatings, adhesives and sealants, and electrical and electronics sectors.

Key Highlights

- Over the short term, the increasing demand from the paints and coatings sector and rising demand from electrical and electronics are the major factors driving the demand for the market studied.

- However, stringent regulations regarding the use of epoxy resin are expected to hinder the market's growth.

- Nevertheless, the development of bio-based epoxy resins and technological advancements are anticipated to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the market across the world, with the majority of demand coming from China and India.

Epoxy Resins Market Trends

Paints and Coatings Segment is Expected to Dominate the Market

- Epoxy resins are binders in coating applications, bolstering the durability of coatings used on floors and metals.

- These resins impart fundamental properties to coatings, including strength, durability, and chemical resistance. Their quick-drying nature, toughness, excellent adhesion, effective curing, abrasion resistance, and superior water resistivity make them ideal for safeguarding metals and various surfaces.

- According to the Worlds Paint and Coatings Industry Association (WPCIA), the global paint and coatings market achieved a valuation of USD 185.5 billion in 2023, marking a 3.2% increase from the prior year. This uptick was primarily fueled by heightened demand across the construction, automotive, and manufacturing sectors.

- Furthermore, the Asia-Pacific region is the largest producer of paint and coatings globally, accounting for 54.7% of global production in 2023, followed by Europe (19.6%), North America (15.6%), Latin America (6.4%), and the Middle East & Africa region (3.6%) as per the data from WPCIA. Thus, expansion in the paints and coatings industry is likely to drive the market.

- The United States represents one of the largest and most technologically advanced economies globally. This dominant position enabled the country to become one of the hotspots for the paints and coatings market. It is one of the top global paints and coatings producers, with more than 1,400 manufacturing companies.

- According to the American Coatings Association, the paint and coatings industry's production volume in the United States was approximately 1.32 billion gallons in 2022. Moreover, the industry's production is forecast to surpass 1.34 billion gallons in 2024. PPG, The Sherwin-Williams Company, Axalta Coating Systems, RPM Inc., and Diamond Paints are the major paints and coatings manufacturers and suppliers in the United States.

- The French paints and coating industry has witnessed development in recent years, which is expected to stir up the demand for epoxy resin over the assessment period. For instance, in December 2023, PPG announced the opening of a USD 17 million aerospace application support center (ASC) in Toulouse, France. The facility is set to offer filling and packaging capabilities for aerospace materials, including coatings and sealants for various aircraft.

- Given these dynamics, the paints and coatings sector is expected to see a rising demand for epoxy resins, driving the market's growth in the coming years.

Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is poised to lead the global epoxy resin market. Countries such as India, China, Japan, and South Korea are witnessing a surge in their paints, coatings, and electrical & electronics sectors, driving up the demand and consumption of epoxy resin in the region.

- China, a global hub for industrialization, boasts a staggering 10,000 coatings manufacturers, as reported by European Coatings. Notably, major players like Nippon Paint, AkzoNobel, and PPG Industries have established manufacturing bases in the country.

- Figures from the China Coatings Industry Association reveal that in 2023, China's coatings production hit 35,772 million tons, marking a 4.5% increase from the previous year. Exports surged by 19.6% to 262,000 tons, while domestic consumption rose by 4.2% to 35,663 million tons, underlining the sector's robust growth.

- Manufacturers are either setting up new plants or ramping up the capacities of their existing facilities. These strategic moves bolster the demand for paints and coatings and underpin the overall market growth.

- For instance, in January 2024, Berger Paints India announced plans to inject over INR 1,000 crore (~ USD 120.6 million) into a new greenfield composite plant in Odisha, focusing on decorative and industrial paints. This bold investment is poised to catalyze the demand for paints and coatings in the near future, thus benefiting the market studied.

- China's electronics landscape is vibrant, with products like smartphones and TVs witnessing significant growth. Not only does the nation cater to its domestic electronics appetite, but it also exports extensively, fueling further market expansion.

- China is the largest smartphone manufacturing base in the world. As per the National Bureau of Statistics of China data, in November 2023, the country produced nearly 1.4 billion cell phones. With its established prowess in mobile manufacturing, China's domestic market has emerged as one of the largest globally.

- As per the data from Xinhua News Agency, China's electronics manufacturing industry showcased robust performance in the initial four months of 2024, buoyed by rising production and a rebound in domestic and global demand. As reported by the Ministry of Industry and Information Technology, major companies in China's electronics sector saw their combined profits surge by 75.8% year-on-year, reaching CNY 144.2 billion (~USD 20.3 billion) from January to April 2024.

- The overall electronics production by the Japanese electronics industry was JPY 5,452,56 million (~USD 3,386 million) from January to June 2024, registering a growth rate of 104.7% compared to the previous year at the same period, as per the data from Japan's Electronics and Information Technology Industries Association.

- Given these dynamics, the Asia-Pacific region is poised for a surge in epoxy resin demand during the forecast period.

Epoxy Resins Industry Overview

The epoxy resin market is fragmented in nature. The major players (not in any particular order) include Olin Corporation, Huntsman International LLC, Dow, Kukdo Chemical Co. Ltd., and Westlake Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Paints and Coatings Sector

- 4.1.2 Rising Demand from Electrical and Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Regarding the Use of Epoxy Resin

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Marine

- 5.2.6 Wind Turbines

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Atul Ltd

- 6.4.4 BASF SE

- 6.4.5 Chang Chun Group

- 6.4.6 DIC Corporation

- 6.4.7 Dow

- 6.4.8 Huntsman International LLC

- 6.4.9 Jiangsu Sanmu Group

- 6.4.10 Kukdo Chemical Co. Ltd

- 6.4.11 NAMA Chemicals

- 6.4.12 Nan Ya Plastics Corporation

- 6.4.13 Olin Corporation

- 6.4.14 Robnor ResinLab

- 6.4.15 Sika AG

- 6.4.16 Sinochem Internation Corporation

- 6.4.17 SPOLCHEMIE

- 6.4.18 Westlake Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Epoxy Resins

- 7.2 Technological Advancement to Create Growth Opportunities

- 7.3 Other Opportunities