PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851460

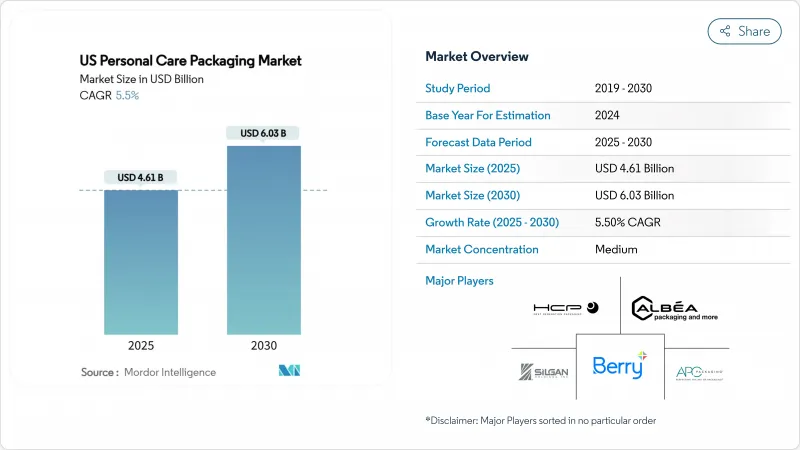

US Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Personal Care Packaging Market size is estimated at USD 4.61 billion in 2025, and is expected to reach USD 6.03 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Persistent PFAS phase-outs, mounting sustainability mandates and the social-media driven quest for eye-catching packs are reshaping material selection and design philosophies. Tight state rules Minnesota's 2025 ban on intentionally added PFAS in cosmetics among them push converters to explore new barrier chemistries and upgrade recycling infrastructure. Regional spending patterns amplify these shifts: households in the West devote USD 1,038 each year to personal-care items, well above the USD 908 national average, which explains the region's early uptake of premium, sustainable formats. Brand owners also intensify vertical integration to lock in packaging innovation capacity, a trend underscored by Amcor's all-stock combination with Berry Global in April 2025, expected to generate USD 650 million in synergies and more than USD 3 billion in cash flow by 2028. Together, these forces support steady value growth, SKU proliferation and rising demand for refill-ready designs across the US personal care packaging market.

US Personal Care Packaging Market Trends and Insights

Rising Disposable Income Fuels Pack Demand

Personal-care outlays reached USD 908 per household in 2024 and climb even higher in the West, where annual spending averaged USD 1,038. Steady wage gains translate into greater SKU variety, premium pack finishes and niche formulations, which in turn boost unit-volume requirements across the US personal care packaging market. Glass and metal formats benefit the most because consumers associate them with quality and sustainability.

Instagram-Ready Aesthetics Accelerate Premiumization

Design now doubles as a marketing channel, prompting brands to invest in striking shapes, embossing and custom colorways that photograph well. Glass jars and brushed-aluminum aerosols outperform conventional HDPE bottles because they align with eco-messaging and visual storytelling on social platforms. L'Oreal's partnership with IBM to train AI on sustainable formulations underscores how tech convergence supports both look and function.

High R&D and Tooling Costs Limit Innovation

Developing a new blow-mold or precision pump can exceed USD 1 million per line. Small converters struggle to fund multiple trials, particularly when bio-based resins demand specialized machinery and extended qualification. Patent filings for collapsible applicators illustrate the complexity as well as the capital intensity behind differentiated dispensing technology.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Drives Ship-Ready Protective Formats

- Subscription and Refill Models Favor Durable Solutions

- State-Level PFAS Rules Add Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 50.6% US personal care packaging market share in 2024 thanks to low cost, design flexibility and well-established supply chains. Yet the paper and paperboard segment is projected to log a 9.5% CAGR through 2030, buoyed by PFAS crackdowns and consumer favor for renewable substrates. Brands experiment with barrier-coated cartons and molded-fiber jars that pass moisture tests without compromising shelf appeal. Recycled PET integration and pilot chemical recycling plants help plastics defend their lead by easing circularity concerns.

Circular-economy policies push converters to raise post-consumer-resin (PCR) content and build take-back schemes. Simultaneously, glass and metal profit from luxury positioning: prestige skin-care labels deploy heavy-walled flacons and brushed-aluminum sticks to justify price premiums while touting infinite recyclability. Material innovation is also spurred by vertical integration, exemplified by Amcor's resin-sourcing investments that safeguard PCR supply for the expanding US personal care packaging market.

Bottles commanded 38.2% of the US personal care packaging market size in 2024 due to familiarity, shelf impact and versatility across lotions, shampoos and body washes. However, flexible pouches are projected to log an 11.2% CAGR, propelled by e-commerce cube-efficiency and lower material usage. Reclosable spouts and stand-up formats bolster consumer convenience, while ultra-thin films curb shipping weight.

Tubes, sticks and precision pumps cater to targeted applications think SPF sticks for sun-care or airless pumps for retinol serums where dosing accuracy matters more than unit cost. Folding cartons gain ground as brands migrate to mono-material paper solutions that simplify curbside recycling. Across all formats, NFC chips and QR codes elevate packs into engagement hubs, a key differentiator in the crowded US personal care packaging market.

US Personal Care Packaging Market Report is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard), Product Type (Bottles, Tubes and Sticks, Pumps and Dispensers, Pouches and More), Application (Skin Care, Hair Care, Oral Care, and More), Sustainability Attribute (Recyclable, Post-Consumer-Recycled Content, Refillable/Reusable, Compostable/Bio-based). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Albea Services SA

- HCP Packaging Co. Ltd

- Berry Global Group Inc.

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Kaufman Container

- AptarGroup Inc.

- Amcor PLC

- Cosmopak USA LLC

- APC Packaging

- Rieke Corp (Trimas)

- Berlin Packaging LLC

- Glenroy Inc.

- TricorBraun

- Quadpack

- ProAmpac

- WestRock Company

- Gerresheimer AG

- Sonoco Products Co.

- International Paper Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumption of personal-care SKUs on higher disposable income

- 4.2.2 Demand for premium, "Instagram-ready" pack aesthetics

- 4.2.3 E-commerce boom needing ship-ready protective formats

- 4.2.4 Subscription and refill models driving durable / reusable packs

- 4.2.5 TSA-size travel packs for on-the-go consumers

- 4.2.6 Smart / IoT-enabled packs for engagement and traceability

- 4.3 Market Restraints

- 4.3.1 High RandD and tooling costs for novel formats and materials

- 4.3.2 Tightening U.S. plastics and PFAS regulations

- 4.3.3 Volatile recycled-resin price and supply quality

- 4.3.4 Reverse-logistics friction for refill / return programs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Tubes and Sticks

- 5.2.3 Pumps and Dispensers

- 5.2.4 Pouches

- 5.2.5 Folding Cartons

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Skin Care

- 5.3.2 Hair Care

- 5.3.3 Oral Care

- 5.3.4 Makeup and Color Cosmetics

- 5.3.5 Deodorants and Fragrances

- 5.3.6 Depilatories

- 5.3.7 Others

- 5.4 By Sustainability Attribute

- 5.4.1 Recyclable (mono-material)

- 5.4.2 Post-consumer-recycled (PCR) Content

- 5.4.3 Refillable / Reusable

- 5.4.4 Compostable / Bio-based

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albea Services SA

- 6.4.2 HCP Packaging Co. Ltd

- 6.4.3 Berry Global Group Inc.

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 DS Smith PLC

- 6.4.6 Graham Packaging Company

- 6.4.7 Kaufman Container

- 6.4.8 AptarGroup Inc.

- 6.4.9 Amcor PLC

- 6.4.10 Cosmopak USA LLC

- 6.4.11 APC Packaging

- 6.4.12 Rieke Corp (Trimas)

- 6.4.13 Berlin Packaging LLC

- 6.4.14 Glenroy Inc.

- 6.4.15 TricorBraun

- 6.4.16 Quadpack

- 6.4.17 ProAmpac

- 6.4.18 WestRock Company

- 6.4.19 Gerresheimer AG

- 6.4.20 Sonoco Products Co.

- 6.4.21 International Paper Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment