PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640440

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640440

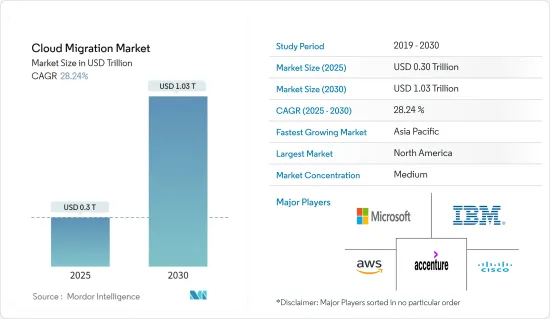

Cloud Migration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud Migration Market size is estimated at USD 0.30 trillion in 2025, and is expected to reach USD 1.03 trillion by 2030, at a CAGR of 28.24% during the forecast period (2025-2030).

Over the past decade, cloud computing adoption has risen owing to increasing investments from small and medium enterprises. Globally, many organizations have already switched to cloud platforms to take advantage of its benefits. In recent years, cloud adoption stands to be a significant consideration for IT cost reduction strategies.

Key Highlights

- The significant reasons for migrating to the cloud are scalability, increased effectiveness, faster implementation, mobility, and disaster recovery. Considerable companies are offering cloud disaster recovery features to their customers, aiding them in expanding their businesses. Cloud migration is gaining traction for its real-time experience, business elements, and accessibility to on-premise data. This technology also aids in setting up several business units in minimal time.

- The growth of cloud and industrialized services and the decline of traditional data center outsourcing (DCO) indicate a massive shift toward hybrid infrastructure services. While the conventional DCO market is shrinking, spending on colocation and hosting, along with infrastructure utility services, is increasing rapidly. This is expected to drive the shift toward cloud IaaS and hosting. Migration for PaaS, IaaS, and SaaS has been most important in recent years. Companies are also embracing DevOps capabilities and automation; hence, they are increasingly seen as critical to realizing cloud adoption's technical and business benefits.

- The growing demand for cloud migration services is attributed to increased scalability, flexibility, remote collaboration, task automation, improved mobility, and robust data protection. Furthermore, the growing network of connected devices has resulted in massive data growth. As a result, the growing need for a low-cost data storage solution is projected to increase the use of cloud migration services.

- The migration to the hybrid cloud has experienced significant overall growth in the past few years compared to other cloud services. Using a hybrid cloud allows companies to scale computing resources and helps eliminate the need for massive capital to handle short-term spikes in demand. Many cloud providers offer the ability to rapidly increase infrastructure in various worldwide locations, enabling a business to expand to new territories quickly.

- Data security issues and application interoperability issues are expected to hamper the growth of the cloud migration market. Increased internet connectivity and digitization provide opportunities to the cloud migration service offering companies.

Cloud Migration Market Trends

BFSI Expected to Witness Significant Growth

- Banking and financial organizations are accelerating the migration toward cloud solutions owing to benefits such as flexibility, agility, and integration of emerging technologies and the FinTech ecosystems. Cloud solutions are helping banks cut down expenses by significantly reducing infrastructure costs.

- Such instances have boosted the adoption of cloud services among the BFSI sector as well as other end-user industries, and market vendors are gaining significant traction.By 2023, the insurance and banking industries had adopted 11.4 and 10.9 cloud services each. Currently, businesses across various sectors typically utilize approximately eight cloud services, often sourced from multiple vendors.

- Many vendors are providing IaaS and PaaS applications to eliminate the need to manage, host, maintain, update, and scale service operations targeted toward the BFSI sectors. Banks widely recognize that a cloud infrastructure can help them pursue sweeping modernization initiatives, including operational and customer-facing programs supported by AI, blockchain, and software containers.

- Banks are also adopting Cloud migration technology through strategic partnerships with cloud service-providing companies. For instance, in May 2022, Jefferies Financial Group Inc. is partnering with Amazon to move its information-technology services to the cloud. This is the latest step by a financial business that has just begun to grow into cloud-based software and data analytics. Jefferies is transferring its essential business processes, internal and customer-facing apps, IT resources, and data to Amazon Web Services under a four-year arrangement.

- To provide a digital banking experience to customers, banking organizations are adopting cloud migration technology. For instance, in June 2024, Kyndryl, one of the leading global IT infrastructure service providers, has unveiled an expanded collaboration with the National Bank of Canada. The goal is to expedite the bank's digital evolution and migration to the cloud. Having long been a stalwart in bolstering the National Bank's essential infrastructure, Kyndryl is spearheading efforts to revamp the bank's setup. This includes optimizing workloads, advanced technical liabilities, and fostering innovation throughout the organization.

North America Expected to Hold the Largest Market Share

- North America is among the leading innovators and pioneers in cloud migration and holds a significant share of the market. The region also has a strong foothold on cloud migration vendors, which adds to its growth. Some companies include IBM Corporation, Microsoft Corporation, Amazon Web Services Inc., Cisco Systems Inc., Cognizant Technology Solutions Corporation, and Google Inc.

- The benefits offered by moving data and applications, among other information, to the cloud are pushing many organizations in the region to adopt cloud migration services, thereby impacting the market's growth positively, and also the companies in the North American region are making strategic collaborations, business expansion to propel the cloud migration.

- In March 2024, Fujitsu Limited and Amazon Web Services (AWS) announced an expanded partnership to accelerate the modernization of legacy applications on AWS Cloud. The Modernization Acceleration Joint Initiative will assess, migrate, and modernize mission-critical applications from on-premise mainframes and UNIX servers to AWS Cloud, supporting industries like finance, retail, and automotive.

- Furthermore, in August 2022, Next Pathway Inc., the Automated Cloud Migration company in Toronto, announced a collaboration with Microsoft to accelerate the migration from legacy data warehouses and data lakes to Microsoft Azure. Shift Analyzer provides a comprehensive review of source legacy application workloads to review the code types and objects present. Shift Translator accelerates the translation, testing, and migration of complex workloads such as SQL, Stored Procedures, ETL pipelines/workflows, and various other code types. Furthermore, Next Pathway's technology can easily and efficiently transfer workloads from other cloud platforms and cloud data warehouses to Azure.

Cloud Migration Industry Overview

The cloud migration market is moderately consolidated and consists of several major players. In terms of market share, few major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- January 2023: Digital solutions firm LTIMindtree announced that it had partnered with Duck Creek Technologies, the intelligent solutions provider, and Microsoft to build a solution enabling insurers to migrate their on-premises core systems to the cloud quickly and efficiently.

- February 2022: IBM Corporation announced a collaboration with SAP to deliver technology and consulting skills to help clients embrace a hybrid cloud strategy and migrate mission-critical workloads from SAP solutions to the cloud in regulated and non-regulated sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Benefits Of Cloud To Organizations

- 5.1.2 Increasing Use of BYOD

- 5.2 Market Challenges

- 5.2.1 Data Security And Application Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 By Type of Deployment

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By Type of Service

- 6.3.1 PaaS

- 6.3.2 IaaS

- 6.3.3 SaaS

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Government

- 6.4.5 IT and Telecommunication

- 6.4.6 Manufacturing

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Amazon Inc.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Cognizant Technology Solutions Corp

- 7.1.5 DXC Technology

- 7.1.6 Evolve IP LLC

- 7.1.7 Google LLC

- 7.1.8 IBM Corporation

- 7.1.9 Microsoft Corporation

- 7.1.10 Oracle Corporation

- 7.1.11 Rackspace Hosting Inc.

- 7.1.12 Rightscale Inc. (Flexera)

- 7.1.13 Tech Mahindra Ltd

- 7.1.14 VMware Inc.

- 7.1.15 WSM International LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET