PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640437

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640437

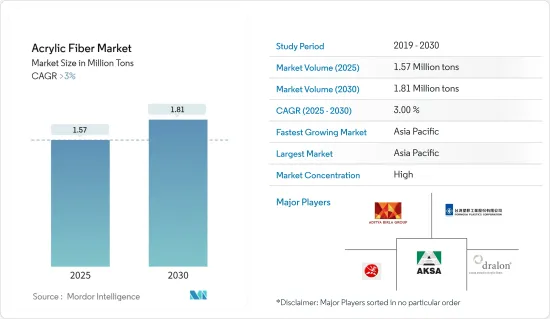

Acrylic Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Acrylic Fiber Market size is estimated at 1.57 million tons in 2025, and is expected to reach 1.81 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2021, as the pandemic resulted in the slowdown of businesses, products, and manufacturing facilities, resulting in less economic activity. However, the market is expected to recover during the forecast period.

Key Highlights

- The major factors driving the growth of the market studied include the high demand for apparel and increasing industrial applications.

- On the flip side, the availability of substitutes like polyester and stringent regulations worldwide on the production of acrylic fiber are expected to hinder the growth of the market.

- However, growing opportunities and the future market for acrylic paper are expected to offer ample growth opportunities during the forecast period.

- Asia-Pacific dominated the acrylic fiber market due to high demand from the ASEAN countries and India.

Acrylic Fiber Market Trends

The Wool Segment to Dominate the Market

- The use of wool for clothing dates back to ancient times. Wool has outstanding properties, such as resistance to wrinkles, moisture absorption, and warmth. A significant feature of wool is its ability to recover from deformation over time. Hence, clothing made from these fibers is attractive.

- Fabrics woven or knitted with 100% wool fiber have become a standard in making apparel, such as sweaters, hoodies, boots, boot lining, hats, gloves, athletic wear, carpeting, blankets, roller brushes, upholstery, area rugs, protective clothing, wigs, and hair extensions.

- A majority of acrylic fiber is used to make wool and acrylic blends, which are very popular. A blend of 55% wool and 45% acrylic fiber is used to make circular knit goods. This blend is particularly used in making sportswear, with characteristics like ease of care, durability, appearance retention, color styling, and palatability.

- Different blends are used worldwide depending on the requirements. The 50/50 and 70/30 acrylic wool blends are popular among those apparel that are inexpensive, look good, and are easy to handle. The 50/50 acrylic wool blend is used to make lightweight apparel that has excellent durability and shape retention, while the 70/30 acrylic wool blend is used to make slacks.

- According to the International Wool Textile Organization, China remains the top buyer of wool fiber globally, yet there is an increasing demand for wool in the United States. During the year that concluded in November 2022, the quantity of wool clothing brought into the United States increased by 47% compared to the same period in 2021.

- Hence, increasing demand for acrylic fiber in the wool segment is expected to dominate the market over the forecast period.

China to Dominate the Market in Asia-Pacific

- China is the largest producer of acrylic fibers in the world, accounting for a share of more than 30% of global acrylic fiber production. Owing to the demand from domestic and international markets, primarily from ASEAN countries, Europe, the United States, and Japan, the textile industry in China has expanded over the years.

- Iran, India, Vietnam, Pakistan, and the United Arab Emirates are some of the largest markets where China exports acrylic fibers. The country also imports acrylic fiber from countries like Japan, Germany, Thailand, South Korea, and Turkey.

- China is the largest textile-producing and exporting country in the world. It holds about 43% share of the world's total textile exports in terms of value. Thus, the growth in China's clothing industry is anticipated to boost the market for acrylic fibers.

- The country has witnessed significant growth in the textiles segment. According to the National Bureau of Statistics of China, in 2023, the combined earnings of China's leading textile companies increased by 7.2% compared to the previous year. In 2023, China's exports of textiles and clothing reached a record high of USD 293.6 billion.

- Hence, all such market trends are expected to add to the demand for the acrylic fibers market in China during the forecast period.

Acrylic Fiber Industry Segmentation

The acrylic fiber market is consolidated in nature. Some of the major players in the market include (not in any particular order) Aksa Akrilik Kimya Sanayii AS, Dralon, Jilin Chemical Fiber Group Co. Ltd, Aditya Birla Management Corporation Pvt. Ltd, and Formosa Plastics Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Use in Apparel

- 4.1.2 Increasing Industrial Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes, like Polyester

- 4.2.2 Stringent Regulations Worldwide on the Production of Acrylic Fiber

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Staple

- 5.1.2 Filament

- 5.2 Blending

- 5.2.1 Wool

- 5.2.2 Cotton

- 5.2.3 Other Blendings (Cellulose)

- 5.3 Application

- 5.3.1 Apparel

- 5.3.2 Household Furnishing

- 5.3.3 Industrial

- 5.3.4 Other Applications (Upholstery)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Management Corporation Pvt. Ltd

- 6.4.2 Aksa Akrilik Kimya Sanayii AS

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 Dralon

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 Indian Acrylics Limited

- 6.4.7 Japan Exlan Co., Ltd

- 6.4.8 Jiangsu Zhongxin Resources Group

- 6.4.9 Jilin Chemical Fiber Group Co. Ltd

- 6.4.10 Kaltex

- 6.4.11 Kaneka Corporation

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Pasupati Acrylon

- 6.4.14 PetroChina Company Limited

- 6.4.15 Taekwang Industrial Co. Ltd

- 6.4.16 Toray Industries Inc.

- 6.4.17 Vardhman Acrylics Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Market for Acrylic Paper

- 7.2 Other Opportunities