PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640415

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640415

Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031)

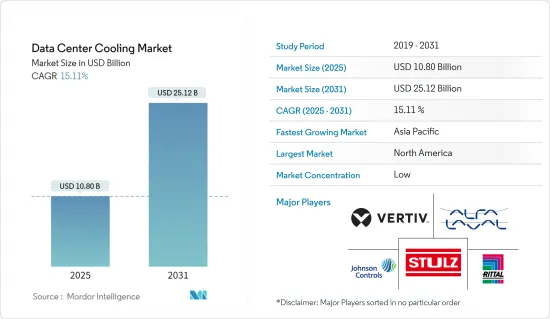

The Data Center Cooling Market size is estimated at USD 10.80 billion in 2025, and is expected to reach USD 25.12 billion by 2031, at a CAGR of 15.11% during the forecast period (2025-2031).

Key Highlights

- Due to the high computational needs of AI and media applications, data centers are being increasingly deployed worldwide. These data centers consume a massive amount of power, generating a significant amount of heat, further creating the need for various efficient cooling systems.

- The data center cooling market is expected to show substantial growth due to increased digitization, leading to greater computer performance and requiring a larger number of integrated small chips. The design of data centers and the need to cool them are mainly influenced by powerful computer hardware for AI workloads. Manufacturers are introducing large silicon chips to optimize the performance of artificial intelligence and high-performance computing workloads. The use of powerful GPUs in artificial intelligence and high-performance computing environments supports the need for data center cooling technologies.

- The increasing use of OTT and streaming services has led to a growth in data, fostering market development. Also, the increasing data from online streaming services such as Disney+ Hotstar, Hulu, and Netflix is expected to drive the demand for data center cooling systems.

- Market players are taking action to augment their consumer base by focusing on expanding their global footprint and service offerings. For instance, in March 2024, the intelligent power management company Eaton declared the North American launch of an innovative modular data center solution for organizations that are seeking to rapidly fulfill the increasing requirements for machine learning, edge computing, and AI. Eaton's SmartRack modular data centers primarily combine IT racks and cooling and service enclosures to build a performance-optimized data center solution for critical IT equipment with up to 150 kW of equipment load.

- The market's growth is expected to be hampered by the rising need for various adaptability requirements and power shortages worldwide. Also, the use of inefficient cooling system designs, such as outdated infrastructure or poorly optimized layouts, leading to energy inefficiencies and increased operational costs, and rising energy prices, which might make the cooling expenses prohibitive, are some of the factors that can restrain the market's growth during the forecast period.

Data Center Cooling Market Trends

The IT and Telecom Segment is Expected to Witness the Highest Growth

- The exponential growth of data generated by information technology significantly necessitates efficient data centers, driving demand for advanced cooling solutions. As data centers expand to accommodate increasing workloads and storage demands, the heat generated becomes a significant matter of concern, creating demand for effective cooling solutions.

- The adoption of cloud storage has been increasing over the years. To provide more efficient work processes, cloud storage providers such as Microsoft, AWS, and Google are expanding their capacity to store in the cloud. These companies make their investments in hyperscale transactions. As a result, the demand for data center cooling systems is expected to grow due to the expansion of Software-as-a-Service, enabling cloud storage providers to augment their capacity.

- Immersion cooling can be executed in a single-phase or two-phase solution. Single-phase immersion cooling encapsulates the server in a sealed chassis, and the design can be configured in a rackmount or standalone format. However, two-phase immersion cooling locations the server in the liquid, but the liquid transitions during the cooling process. As the fluid warms up and turns to condensation, the water circuit and heat exchanger withdraw the heat. In 2P immersion cooling, dielectric cooling fluid inside a metal holding tank contained with servers is boiled and condensed in a secured cooling system, exponentially growing heat transfer efficiency.

- In May 2023, KT Cloud signed a deal with Immersion 4, a Swiss provider of liquid cooling solutions, to install next-generation immersion cooling technology at KT Cloud data centers. Immersion cooling removes heat by immersing information and communications technology equipment in a dielectric solution where electricity does not flow. This eliminates the imbalance in server room temperatures and fan noise at data centers that can occur with an air-cooling system.

Asia-Pacific is Expected to Register Significant Growth

- Asia-Pacific is estimated to witness the fastest growth rate during the forecast period, mainly due to the rapid development of the network infrastructure. The demand for data generation is increasing in the region, and government policies are promoting more energy-efficient infrastructure, especially in countries like India and China. Also, advancements in technologies such as AI-driven cooling management and liquid cooling systems are reshaping the landscape, driving further adoption in the region.

- China and Japan are among the most important countries that are expected to fuel the market's growth opportunities, significantly based on their ongoing innovations and developments in domains like IoT, ML, and AI. Moreover, the rapidly growing number of data centers in these countries and the government policies to promote more environmentally sound infrastructure across the region are driving the need for better and more effective cooling solutions within these data centers.

- For instance, in April 2024, GDS, an operator and developer of high-performance data centers in Asia, and Gaw Capital Partners, a private equity fund management firm especially focusing on the real estate markets in Asia-Pacific and other high barrier-to-entry markets worldwide, signed a strategic partnership to build a 40 megawatts (MW) data center campus in Tokyo, Japan.

- The Asia-Pacific data center cooling market is primarily fueled by the exponential growth of data consumption and cloud services. As businesses expand their digital infrastructure, the demand for efficient cooling systems to maintain optimal operating temperatures increases. Additionally, stringent regulations regarding energy efficiency and environmental sustainability encourage the adoption of innovative cooling technologies. With emerging economies investing heavily in IT infrastructure, the need for reliable and scalable cooling solutions further fuels market growth.

- In December 2023, the Australian cloud service provider ResetData launched a test and simulation lab for its pioneering liquid-cooled data center server technology. This was one of the first facilities in Asia-Pacific capable of trialing workloads in a liquid-cooled environment. This step empowered local businesses to utilize a more ecological and high-performance Infrastructure-as-a-Service (IaaS) that is essential for strenuous applications like AI and machine learning.

Data Center Cooling Industry Overview

The data center cooling market exhibits a low level of consolidation among key industry players. Notable market leaders include Stulz GmbH, Alfa Laval AB, Schneider Electric SE, Johnson Controls Inc., Vertiv Group Corp., and Asetek A/S. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability. Moreover, companies such as Schneider Electric SE, Johnson Controls Inc., and Mitsubishi Electric Europe BV offer both liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations with an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling Technology Based on Key Factors Such as Design Complexity, PUE, Advantages, Drawbacks, and Extent of Utilization of Natural Weather Conditions

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization and Adoption of AI and HPC Workload Around the Globe

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Challenges

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.2.2 Supply Chain Disruption Globally

- 5.3 Market Opportunities

- 5.3.1 The Growth of the Digital Economy and Increasing Government's Support across Major Regions

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN GLOBAL

- 6.1 Analysis of IT Load Capacity and Area Footprint of Data Centers (For the Period of 2017-2030)

- 6.2 Analysis of the Current DC Hotspots and Scope for Future Expansion Globally

- 6.3 Analysis of Major Data Center Contractors and Operators Across Major Regions

7 INDONESIA DATA CENTER MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (Covers Direct, Indirect, and Two-stage Cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-chip Cooling

- 7.1.2.3 Rear-door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscalers (Owned and Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Vertical

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional Agencies

- 7.3.6 Other End-user Verticals

- 7.4 By Region

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Co.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Alfa Laval Corporate AB

- 8.1.6 Fujitsu General Limited

- 8.1.7 Johnson Controls Inc.

- 8.1.8 Hitachi Ltd

- 8.1.9 CoolIT Systems Inc.

- 8.1.10 Liquid Stack Inc.

- 8.1.11 Asetek Inc. A/S

- 8.1.12 Asperitas

- 8.1.13 Chilldyne Inc.

- 8.1.14 Fujitsu Ltd

- 8.1.15 Mikros Technologies

- 8.1.16 KAORI HEAT TREATMENT Co. Ltd

- 8.1.17 Lenovo Group Limited

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

11 ABOUT US