PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639479

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639479

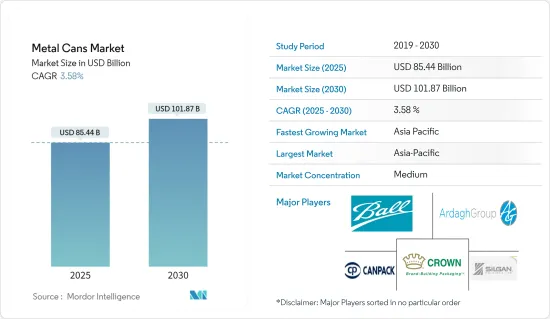

Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Metal Cans Market size is estimated at USD 85.44 billion in 2025, and is expected to reach USD 101.87 billion by 2030, at a CAGR of 3.58% during the forecast period (2025-2030).

The metal cans market is gaining prominence because of its distinct features, like transportation resistance, hermetically sealed cover, rough handling, and easy recyclability.

Key Highlights

- The high recyclability of metal cans is one of the significant drivers of the market. Aluminum cans deliver complete protection against moisture. Cans do not rust, are corrosion-resistant, and provide one of the most extended shelf lives considering any packaging. It also offers many benefits, such as rigidity, stability, and high barrier properties.

- The aluminum can shortage continues to affect the food and beverage industry, as the beverage demand for home consumption and grocery increased compared to restaurants. Many prominent market players have announced investments to set up new manufacturing infrastructures to fulfill the increased orders and tackle the shortage of aluminum cans.

- In September 2023, Novelis Inc., a prominent provider of sustainable aluminum solutions, signed a significant deal with Ball Corporation, a leading aluminum can manufacturer in North America. The agreement entails Novelis supplying aluminum sheets to Ball's manufacturing facilities across North America.

- The rise in consumer awareness concerning the application of non-carcinogenic materials in packaging and increased demand for lightweight packing are generating high growth prospects for the metal cans market. However, metal cans are challenging to use due to the possibility of replacing them with polymer-based packaging materials, including polyethylene and polyethylene terephthalate (PET).

Metal Cans Industry Segmentation

The Food Segment is Expected to Hold a Significant Share in the Market

- Changing lifestyles at a global level resulted in consumers opting for easy-to-cook food. The younger and individually living populations are consuming more canned food. These users have less time and are budget-restrained, thus opting for products with lower costs and higher convenience.

- Many regular consumers of canned foods choose the products due to the convenience offered and lower cost. Canned foods are more convenient and require less energy and cooking time. Most canned foods take 40% less time to prepare than regular meals.

- Aluminum cans help to preserve the quality of food for a long time. Aluminum cans are completely impervious to oxygen, light, moisture, and other pollutants. They don't rust, are corrosion-resistant, and have one of any package's most extended shelf life. The safety record of aluminum-based food canning is unrivaled.

- Consumers may rest certain that their items have been safely prepared and delivered as they are tamper-resistant and have tamper-evident packaging. Aside from food and beverages, aluminum is used for packaging various products, including aerosols, paint, and other consumer goods. According to the Jamaica Agricultural Commodities Regulatory Authority (JACRA), the import volume of aluminum cans to Japan in 2023 was around 60 million empty aluminum cans and 430 million actual aluminum cans.

- According to reports from the FCC and Statistics Canada, 2024 is poised to witness intense rivalry, particularly in private-label canned and frozen goods. Moreover, a confluence of factors, ranging from rising raw material and packaging expenses to escalating wages, is projected to outpace nominal sales growth, thereby constraining margin enhancements for the year.

North America is Expected to Hold a Significant Share in the Market

- North America is anticipated to positively influence the demand for metal cans during the forecast period due to the increasing demand for healthy beverages, carbonated soft drinks, health drinks, and sucralose juices. Additionally, several significant players impact the business's development through extensive promotional efforts and new research.

- The food and retail industries are the primary factors influencing product demand in the United States. The country has more grocery shops and superstores than ever before, and the expansion of the country's food and retail industries is primarily due to the rise in the number of smaller homes. Consequently, it is driving the demand for smaller packing units.

- In June 2023, Novelis Inc., a leading sustainable aluminum solutions provider, announced it had signed a new long-term contract with Coca-Cola Bottlers' Sales & Services Company, the contracting agent for The Coca-Cola Company's authorized North American bottlers. Novelis is expected to supply Coca-Cola's authorized North American bottlers with aluminum can sheets for The Coca-Cola Company's family of brands. This includes supply from Novelis' plant in Bay Minette, which is currently under construction and expected to begin commissioning in 2025.

- Also, because of the way of life in the United States, there is a greater need for metal cans. Individuals choose wholesome food that is ready to eat and can make it quickly since they have hectic schedules that leave them with little time for cooking. By offering easy packaging and foods that are ready to use, canned food accomplishes this goal. Metal cans are expected to boost the market's growth because they can keep food fresh and high-quality for an extended period.

Metal Cans Industry Overview

The metal cans market is semi-consolidated, with the presence of major players like Ball Corporation, Ardagh Group, Mauser Packaging Solutions, Silgan Containers LLC, and Crown Holdings Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023: Mauser Packaging Solutions acquired Taenza SA de CV, a prominent Mexican manufacturer specializing in tin-steel aerosol cans and steel pails. Based in Mexico City, Taenza has an extensive presence with five manufacturing facilities across the country and a workforce exceeding 850 employees. Its product line includes aerosol spray cans, steel pails, and paint cans, catering to a varied clientele in the paint, coatings, and chemical sectors.

- November 2023: Sonoco and Ball Corporation signed a significant agreement. Under this agreement, Sonoco, specifically through its Sonoco Phoenix business unit, exclusively supplies balls with easy-open, full-panel ends for their food cans. This collaboration solidifies Sonoco's role as Ball's primary supplier and also extends to a joint marketing and sales effort for these innovative food cans.

- September 2023: Ardagh Group and Crown Holdings Inc. are collaborating with the Can Manufacturers Institute (CMI) to boost aluminum beverage can recycling rates. They are achieving this by funding a robot from EverestLab, an artificial intelligence and robotics company, for a California recycling facility. Caglia Environmental, operating in Fresno, CA, deployed this robot on its "last chance line" at the material recovery facility (MRF). This strategic move aims to salvage over 1 million additional used beverage cans (UBC) annually, which would otherwise head to the landfill.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability of the Packaging Due to Less Usage of Energy

- 5.1.2 Increasing Consumption of Alcoholic and Non-alcoholic Beverages

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions as Polyethylene Terephthalate

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Cosmetics and Personal Care

- 6.2.4 Pharmaceuticals

- 6.2.5 Paint

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group

- 7.1.3 Mauser Packaging Solutions

- 7.1.4 Silgan Containers LLC

- 7.1.5 Crown Holdings Inc.

- 7.1.6 DS Containers Inc.

- 7.1.7 CCL Container Inc.

- 7.1.8 Toyo Seikan Group Holdings Ltd

- 7.1.9 Pacific Can China Holdings Limited

- 7.1.10 Universal Can Corporation

- 7.1.11 CPMC HOLDINGS Limited (COFCO Group)

- 7.1.12 Showa Denko KK

- 7.1.13 Independent Can Company

- 7.1.14 Hindustan Tin Works Ltd

- 7.1.15 Saudi Arabian Packaging Industry WLL (SAPIN)

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS