Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639371

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639371

Vinyl Acetate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

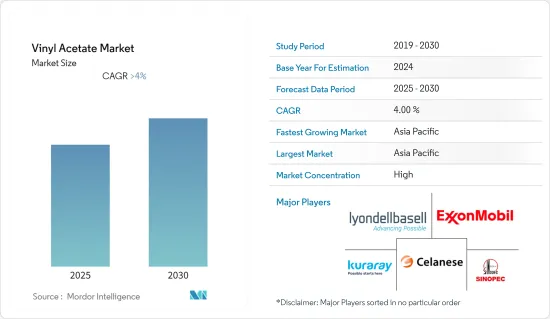

The Vinyl Acetate Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Increased adhesive use in food packaging and growing use in solar power generation are augmenting the market's growth.

- Stringent health and environmental regulations and fluctuating raw material prices will likely hinder the market's growth.

- EVA uses for 3D-printed medical drug delivery devices are projected to act as an opportunity for the market in the future.

- Asia-Pacific is witnessing the highest growth rate due to the growing demand from countries such as China, India, and Japan.

Vinyl Acetate Market Trends

Increasing Demand from the Solar Industry

- Most solar cells use ethylene-vinyl acetate (EVA) to encapsulate photovoltaic (PV) modules. It is due to its advantages, such as good light transmittance and elasticity, excellent melt fluidity, low processing temperature, and adhesive property.

- The use of solar cells is constantly increasing worldwide. With increasing government support, the newly installed solar photovoltaic cell capacity increased worldwide over the past decade.

- The total installed capacity of solar photovoltaics is increasing continually. Global cumulative solar PV capacity reached 940 GW in 2021, according to SolarPower Europe.

- The solar market's growth represents a shift towards distributed and renewable energy technologies. Moreover, the solar PV capacity is expected to surpass 2.3 TW over the next three years, with an increase of over 1.4 TW compared to 2021. Additionally, around 168 GW of new PV capacity was installed in 2021.

- Further, according to the International Renewable Energy Agency (IRENA), the solar energy capacity in India peaked at nearly 49.7 GW in 2021. Thus, boosting the growth of the market studied.

- Therefore, the factors above are expected to increase solar energy usage, increasing the vinyl acetate demand during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific region is to witness robust growth in the vinyl acetate market, owing to the increasing expenditure on construction and the automotive industry in countries like China.

- China stands as the largest producer in the automotive industry. According to the China Association of Automobile Manufacturing, the production of New Energy Passenger Vehicles in the country witnessed a year-on-year increase of 97.8 % in December 2022.

- Further, the production of New Energy Commercial Vehicles in the country witnessed a year-on-year increase of 81% in December 2022. Thus, the expanding automotive market is expected to increase the demand for vinyl acetate in the region.

- Vinyl acetate is widely used to produce paints, coatings, adhesives, and packaging materials. With China being a significant player in these markets, the demand for vinyl acetate is expected to grow during the forecast period.

- Further, the Indian government increased public spending on infrastructure. For instance, according to the Ministry of Statistics and Program Implementation's Infrastructure and Project Monitoring Division, the government had 1,559 projects in the pipeline valued at approx USD 354 billion as of May 2022.

- Furthermore, owing to a strong pipeline of infrastructure projects in several sectors, the Indian construction industry will grow significantly during the forecast period.

- Therefore, as vinyl acetate finds varied applications in end-user industries, such as coatings, adhesives, primers, etc., the demand for vinyl acetate is projected to increase in the country during the forecast period.

Vinyl Acetate Industry Overview

The vinyl acetate market is consolidated in nature. Some of the major players in the market include Celanese Corporation, China Petrochemical Corporation, Exxon Mobil Corporation, KURARAY CO., LTD., and LyondellBasell Industries Holdings B.V., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48953

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Use of Adhesives in Food Packaging

- 4.1.2 Increasing Use in the Solar Power Generation Industry

- 4.2 Restraints

- 4.2.1 Stringent Health and Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Polyvinyl Acetate

- 5.1.2 Polyvinyl Alcohol

- 5.1.3 Ethylene Vinyl Acetate (EVA)

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Solar

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Packaging

- 5.2.5 Textile

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 France

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Celanese Corporation

- 6.4.3 China Petrochemical Corporation

- 6.4.4 CLARIANT

- 6.4.5 DCC

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 INEOS

- 6.4.8 Innospec

- 6.4.9 Kemipex

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 Nippon Chemical Industrial CO., LTD.

- 6.4.12 Sipchem Company

- 6.4.13 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of EVA for 3D Printed Medical Drug Delivery Devices

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.