PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637882

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637882

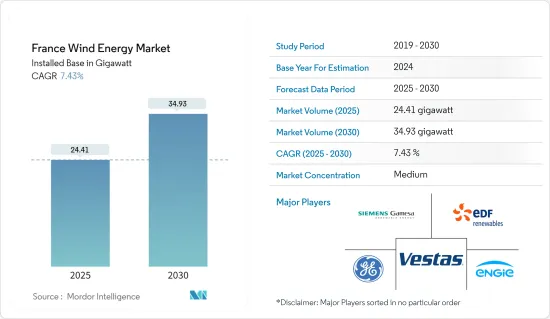

France Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The France Wind Energy Market size in terms of installed base is expected to grow from 24.41 gigawatt in 2025 to 34.93 gigawatt by 2030, at a CAGR of 7.43% during the forecast period (2025-2030).

Over the medium term, factors such as increasing investments, upcoming and ongoing wind energy projects, and expansion of wind energy capacities are expected to be significant drivers for the French wind energy market during the forecast period.

On the other hand, the widespread electricity generation from alternative renewable energy sources such as hydropower and solar and other sources such as nuclear energy are expected to be a significant restraint for the growth of the French wind energy market.

Nevertheless, the supportive government policies and related incentive schemes to support renewable energy production, particularly wind energy, have a strong backhold by the country to reduce its carbon footprints. This will create opportunities for the French wind energy market in the coming years.

France Wind Energy Market Trends

The Onshore Segment is Expected to Dominate the Market

- As of 2022, the majority of the wind energy installed capacity came from onshore wind farms, and a tiny portion came from offshore wind energy. Wind energy production has been growing in France over the past decade. France's wind energy sector is the second-largest renewable energy source after hydropower.

- In 2022, France's installed onshore wind energy capacity accounted for 20.63 GW, compared to 16.42 GW in 2019. Onshore wind energy increased by 25.6% as compared to 2019. As of 2022, the total wind energy installed was about 31.5% of France's renewable installed capacity.

- According to the National Climate and Energy Plan, France aims to install up to 35 GW of onshore wind by 2028, up from 17 GW as of 2020. This is expected to increase the use of onshore wind energy during the forecast period.

- In November 2023, SSE Renewables started construction of the 27.2 MW Chaintrix-Bierges and Velye Wind Farm, its first French onshore wind farm located between Chaintrix-Bierges and Velye in the Marne departement and comprises eight Siemens Gamesa SG 3.4-132 wind turbines, each capable of producing 3.4MW of output. The site is SSE Renewables' first project to enter construction outside of the UK and Ireland and the first from its Southern Europe pipeline acquired last year.

- Further, in November 2023, RWE AG and its project partners have been awarded 119 MW of gross capacity, or 80 MW, on a pro-rata basis. RWE is the controlling owner of three winning projects, while two more will be developed in partnership with Vent du Nord and David Energies/Energiter. Overall, 37 turbines will be installed across the regions of Centre-Val de Loire, Hauts-de-France, Pays de la Loire, and Nouvelle-Aquitaine, with the first projects to be launched at the end of 2024. The wind farms are planned to go online by 2025 at the earliest.

- Therefore, forthcoming and ongoing onshore wind energy projects will dominate the French wind energy market during the forecast period.

Increasing Adoption of Alternative Renewable Energy Sources is Restraining the Market Growth

- France's renewable energy mix is dominated by wind, hydropower, and nuclear energy. But this scenario has begun changing fast with solar energy and bioenergy growth.

- France is one of the few countries in the world which produces the largest source of electricity by nonfossil fuel, i.e., renewable energy sources.

- Solar energy has been growing significantly in France in recent years. The country's solar potential is widespread throughout the country. The solar power capacity in 2022 was 17.41 GW, according to the International Renewable Energy Agency.

- In February 2022, the French government planned to have more than 100GW of installed solar PV capacity by 2050. The following key developments are expected to restrain the wind energy market in the country.

- Further, Bioenergy capacity in the country increased from 1931 MW in 2020 to 2051 MW in 2022, which accounted for a 6.21 % increase from 2019.

- In January 2023, TotalEnergies commissioned the BioBearn biogas production unit in Mourenx, southwest of France, with an annual production capacity of 160 gigawatt hours (GWh). BioBearn has been built on a seven-hectare former brownfield site in the center of the Lacq basin and represents TotalEnergies' 18th biogas production unit1 in France. The unit will be capable of converting 220,000 tons of organic waste every year from local farming activities and the agri-food industry.

- Therefore, the adoption of alternative renewable energy sources in the country has been growing faster during the last decade, and it is expected to restrain the French wind market during the forecast period.

France Wind Energy Industry Overview

The French wind energy market is semi-consolidated. The key players in the market include (in no particular order) include Engie SA, EDF Renewables, Vestas Wind Systems AS, General Electric Company, and Siemens Gamesa Renewable Energy SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Renewable Energy Mix, 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies for Renewable Energy

- 4.6.1.2 Adoption of Cleaner Power Generation Sources

- 4.6.2 Restraints

- 4.6.2.1 Competition from Nuclear Energy and Other Renewable Energy Alternatives

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 EDF Renewables

- 6.3.3 Vestas Wind Systems AS

- 6.3.4 General Electric Company

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Albioma SA

- 6.3.7 TotalEnergies SE

- 6.3.8 Voltalia SA

- 6.3.9 Neoen SA

- 6.3.10 EOLFI SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Strict Emission Targets in the Country