PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637876

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637876

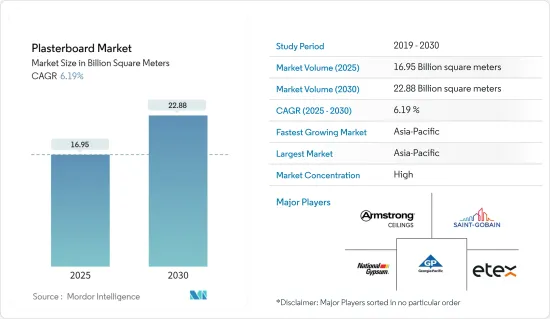

Plasterboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Plasterboard Market size is estimated at 16.95 billion square meters in 2025, and is expected to reach 22.88 billion square meters by 2030, at a CAGR of 6.19% during the forecast period (2025-2030).

The outbreak of COVID-19 impacted plasterboard market growth in 2020 due to slowed construction industry growth. Because the income of a relatively large part of society was affected, it had a negative effect on the liquidity of money, which in turn had a negative effect on the performance of the construction sector. Also, problems with getting raw materials and workers were some of the biggest things that slowed down construction in 2020.But the increase in building projects after the pandemic has made more people want plasterboard.

Key Highlights

- Most of the growth in the plasterboard industry can be attributed to the rise in residential construction and the need for more fire-resistant building materials.

- Environmental concerns and high moisture sensitivity are likely to slow the growth of the market.

- In the future, rising emphasis on the use of green building materials will give the market a chance to grow.

- Asia-Pacific was the biggest market for plasterboard because the building industry in developing countries like China, India, and Indonesia was growing so quickly.

Plasterboard Market Trends

Increasing Demand from Residential Construction

- The number of people in the middle class is growing, and their disposable income is also going up. This has helped the middle-class housing market grow, which will increase the use of plasterboard over the next few years.

- Even though there is more demand, there is still a big shortage of housing around the world.This gives investors and developers a big chance to use different ways of building and make new partnerships to move development forward.

- The Asia-Pacific region is expected to have the most growth because the housing construction market in China and India is growing. China, India, and Southeast Asian nations are in charge of the largest low-cost housing construction segment in Asia-Pacific.

- The construction sector is an important pillar for the growth of the Indian economy. The Indian government has been actively boosting housing construction, aiming to provide houses to about 1.3 billion people.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to the investments in the construction sector. According to the US Census Bureau, the new annual construction output in the United States grew by over 131 USD billion in 2023, as compared to 2022 Therefore, the growth in the construction industry will likely drive the current market studied in the country.

- In the European region, residential construction activities have been increasing in recent years. Germany is the largest residential market in the region. The country is implementing several residential projects that are driving the demand for liquid roofing materials. Some of the residential projects include:

- The Hochmuttinger Strasse Residential Quarter project involves the construction of the Hochmuttinger Strasse residential quarter on an area of 8.4 hectares in Munich-Feldmoching, Bavaria, Germany, with an investment of around USD 225 million. The construction work was started in Q2 2022 and is projected to finish in Q4 2025. The project intends to build an affordable, ecological residential quarter in the country.

- Due to the increasing middle-class population and residential building construction, coupled with government initiatives and investments, the demand for plasterboard in the residential sector across all regions is expected to increase during the forecast period.

The Asia-Pacific Region to Dominate the Market

- In Asia-Pacific, China is the largest economy in terms of GDP. The growth rate in the country remains high, but it is gradually diminishing as the population is aging and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- China is the dominant force in the Asia-Pacific construction landscape, fueled by substantial investments in residential and infrastructure projects. Meanwhile, nations like India, Indonesia, South Korea, and Vietnam are emerging with significant growth potential.

- Data from China's National Bureau of Statistics highlights that in 2023, the construction sector contributed approximately 6.8% to the nation's GDP.

- In 2023, China undertook renovation projects for 53,700 aging residential communities in urban areas, benefiting 8.97 million households, as the Ministry of Housing and Urban-Rural Development reported in January 2024. These renovation endeavors attracted hefty investments of nearly CNY 240 billion (around USD 33.78 billion) for the year.

- India has a vast construction sector and is expected to become the world's third-largest construction market. Various policies implemented by the Indian government, such as the Smart Cities project, Housing for All, and Sustainable Urban Development, are expected to give the Indian construction industry the impetus.

- The availability of affordable housing in India is expected to rise by around 70% by 2024. As per Invest India, India's construction industry is expected to reach USD 1.4 trillion by 2025. By 2030, more than 30% of the population is expected to live in urban India, creating a demand for 25 million additional mid-end and affordable units.

- Overall, the market that was looked at is expected to grow at high rates. This is because the construction industry in the country and region is growing quickly.

Plasterboard Industry Overview

There are only a few big players in the global plasterboard market. The top five players make up a big chunk of the market. Key players in the plasterboard market include Etex Group, National Gypsum Services Company, Saint-Gobain, Georgia-Pacific, and AWI Licensing LLC, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand for Dry Construction Methods over Wet Methods

- 4.1.2 Increasing Demand from Residential Construction

- 4.2 Restraints

- 4.2.1 Environmental Concerns and High Moisture Sensitivity

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Square-edge

- 5.1.2 Tapered

- 5.2 Type

- 5.2.1 Standard Plasterboard

- 5.2.2 Fire-resistant Plasterboard

- 5.2.3 Thermal Insulated Plasterboard

- 5.2.4 Moisture-resistant Plasterboard

- 5.2.5 Sound-resistant Plasterboard

- 5.2.6 Impact-resistant Plasterboard

- 5.3 End-use Sector

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 NORDIC Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ahmed Yousuf & Hassan Abdullah Co. (AYHACO)

- 6.4.2 American Gypsum Company, LLC

- 6.4.3 AWI Licensing LLC

- 6.4.4 AtIskan AlcI

- 6.4.5 Etex Group

- 6.4.6 Fletcher Building

- 6.4.7 Georgia-Pacific

- 6.4.8 GYPSEMNA CO LLC

- 6.4.9 Gyptec Iberica

- 6.4.10 Holcim

- 6.4.11 Jason New Materials

- 6.4.12 Knauf Group

- 6.4.13 Mada Gypsum Company

- 6.4.14 National Gypsum Services Company

- 6.4.15 Saint-Gobain

- 6.4.16 USG Boral

- 6.4.17 VOLMA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Emphasis on the Use of Green Building Materials

- 7.2 Other Opportunities