PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637848

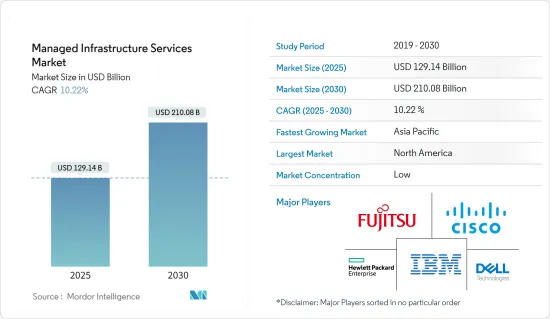

Managed Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Managed Infrastructure Services Market size is estimated at USD 129.14 billion in 2025, and is expected to reach USD 210.08 billion by 2030, at a CAGR of 10.22% during the forecast period (2025-2030).

Technology trends such as analytics, Cloud, IoT, and Cognitive Computing are creating new business imperatives. Companies are adopting these digital technologies to build innovative business models, optimize business processes, empower their workforce, and personalize the customer experience.

Key Highlights

- Redundant downtime is reduced through managed services, which offer specialized value-added services like application testing, service catalog creation, and professional consulting. The market's development is aided by various monitoring tools and numerous layers of infrastructure controlled by separate teams. For instance, in BMC's "BMC Helix ITSM" the system is centralized, cloud-native, connected with observability, and optimized for AIOps. This solution fully exposes data from monitoring tools for IT infrastructure, application performance, network performance, and cloud services. Additionally, team and individual dashboards are customized to each user's needs.

- Technological proliferation and advancement of cloud-based technology boosting the demand is driving the market. Over the past few years, daily operations of break-fix and troubleshooting of servers have been outsourced to reduce their attention over IT, thereby allowing the expertise of IT service vendors. An increase in the adoption of digital transformation with mobility and cloud has led to infrastructure modernization. The need to keep up with the latest technological enhancements has led organizations to opt for infrastructure-managed services.

- Improved cost and operational efficiency and updates of outdated hardware are driving the market. Managed services offer several benefits, relentless focus on continuous improvement of operational and business processes being the most significant one. According to Cisco Systems, managed services reduce recurring in-house costs by 30-40% and increase efficiency by 50-60%. Moreover, as new and enhanced equipment is introduced to the infrastructure, the old hardware might not always be compatible. As data center operations increase, the hardware could become more of a liability which slows down operations, than an asset that enhances them.

- Declining profit margins and integration and reliability concerns are restraining the market to grow. Emerging technologies, such as mobility and cloud computing, are rapidly changing the business landscape. Companies have to be in sync with these technologies to deliver desired benefits to the customers. Reliability concerns are also challenging the market to grow when hiring another partner to host critical business infrastructure.

- Businesses are putting a lot of attention on remote working due to the COVID-19 pandemic. The use of cloud services grew significantly as companies became more concerned with maintaining operations during lockdowns imposed by various governments to stop the spread of the coronavirus. In anticipation of cloud migration becoming more widespread among corporations and, in some cases, even gaining traction, most businesses have already renewed their contracts with managed cloud service providers. Additionally, businesses and organizations prioritized integrating cutting-edge technologies like augmented reality and machine learning into their current IT infrastructure to promote digital transformation.

Managed Infrastructure Services Market Trends

The Cloud Segment is Expected to Exhibit the Highest Growth

- The advent of cloud deployment has brought changes in the managed infrastructure services providers (MISP) space and made them embrace a delivery model for delivering technology services over a public or private cloud. Considering the advantages the cloud offers, businesses are seeking MISPs that have partnerships with cloud providers (such as Google, AWS, Microsoft, etc.) to choose the right cloud providers, migrate to the cloud, and manage cloud services after the transition.

- With the increasing demand from enterprises, various companies have made advancements in their existing managed cloud infrastructure service. For instance, in December 2022, the Swiss finance company Klarpay AG decided to use Amazon Web Services to create its cloud-based infrastructure. Instead of spending its resources to operate a data center, the company concentrated on high-value tasks, such as enhancing its banking product by creating new features like scalable and API-enabled transactional capabilities.

- Increasingly more consumers are using digital platforms, which has increased the demand for ongoing digitalization advancements for high-speed data transport with wide network coverage for large amounts of data storage. Examples of technologies that have accelerated the growth of the consumer base in the IT business include distance learning, multiplayer gaming, videoconferencing, and live streaming. Enormous servers and data storage units are necessary for IT organizations to store large amounts of data and offer improved services.

- Recent technology trends, such as enhanced cloud infrastructure, IoT enabled ecosystems, have provided opportunities in creating new business imperatives across the US IT sector, and the penetration of public cloud in the United States is predicted to be higher during a pandemic. Additionally, Fujitsu has been recognized by Amazon Web Services (AWS) as an official AWS-managed infrastructure provider partner, thereby validating the company's capabilities in accelerating cloud transformation and helping fast-track digital transformation, and accelerating innovation for enterprises and government. Such instances are expected to fuel the demand of the market across the United States during the forecast period.

Asia-Pacific Account for a Significant Market Growth

- Asia-Pacific region accounts for the significant market growth due to dominating sources of IT and IT-enabled services in various countries such as China and India. For instance, the IT & BPM sector has become one of India's most significant economic generators, substantially impacting its GDP and welfare. The IT sector generated 7.4% of India's GDP in FY22; by 2025, it is expected to account for 10% of its GDP. The Indian IT industry's revenue reached USD 227 billion in FY22, a 15.5% YoY growth, according to the National Association of Software and Service Companies (Nasscom). India was predicted to spend USD 110.3 billion on IT in 2023, up from an estimated USD 81.89 billion in 2021.

- One of the key factors contributing to the growth of managed infrastructure services in the Asia-Pacific region is the rapid digitization and technological advancements across various sectors. Enterprises are increasingly relying on advanced IT infrastructure to enhance operational efficiency, agility, and competitiveness. As a result, the need for specialized managed services that can ensure the optimal performance and security of these complex IT environments has become crucial.

- The region's adoption of cloud technologies also influences the Asia-Pacific managed infrastructure services market. As organizations migrate to the cloud for enhanced flexibility and scalability, managed infrastructure services extend to cloud-based infrastructure management, ensuring seamless integration between on-premises and cloud environments. This hybrid and multi-cloud approach allows businesses to optimize their IT resources while adapting to changing workloads and demands.

- Further, according to an MIT Technology publication, Singapore ranked highest on the Cloud Ecosystem Index 2022, with a score of 8.48, for cloud computing infrastructure worldwide. South Korea, Japan, Australia, and New Zealand were top-scoring Asia-Pacific nations with favorable ecosystems for cloud services in 2022. This recognition emphasizes the region's commitment to advancing its digital infrastructure, making it an attractive hub for cloud services and, by extension, managed infrastructure services.

Managed Infrastructure Services Industry Overview

The managed infrastructure services market is highly fragmented as many large, technologically established players are present in the industry, and the rivalry is expected to be on the higher side. Additionally, in order to sustain in the market and retain their clients, companies are employing powerful competitive strategies, thereby intensifying competitive rivalry in the market. Key players are Fujitsu Ltd, Cisco Systems Inc., Dell Technologies Inc., etc.

In September 2023, Kyndryl, a prominent provider of IT infrastructure services globally, and Expedient, a Full-Stack Cloud service provider, announced a partnership. This partnership will improve Kyndryl's industry-leading cyber resilience capabilities to customers by utilizing Expedient's reliable cloud infrastructure and data center colocation. Expedient's highly interconnected nationwide network of data centers is dedicated to its award-winning infrastructure, a key component of its Cloud Different multi-cloud services. Infrastructure is offered in VMware-based Expedient Enterprise Cloud, private cloud, and customized configurations to suit the demands of clients and prospects in various geographies and sectors.

In August 2023, AppDirect, a global B2B subscription commerce platform, announced that it had acquired the Network Operations Center (NOC) and VEEUE platform of ADCom Solutions. ADCom Solutions has been a global provider of managed services, specializing in designing, implementing, and comprehensively administrating complex IT infrastructures. AppDirect will be able to offer VEEUE access to the extensive network of technology advisers through this acquisition, allowing AppDirect to introduce a suite of managed network and infrastructure services through its channel of 10,000 advisors.

In November 2022, Atos, a global leader in digital transformation, high-performance computing, and information technology infrastructure, and Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc., today announced a global Strategic Transformation Agreement. This agreement enables Atos customers with large-scale infrastructure outsourcing contracts to accelerate workload migrations to the cloud and complete digital transformation. With the multiyear, first-in-the-industry deal, Atos and AWS can further their strategic partnership. Atos has chosen AWS as its preferred enterprise cloud provider, and AWS has identified Atos as a strategic partner for IT outsourcing and data center transformation. With the help of this arrangement, Atos' clients may hasten their transitions to the cloud by receiving business and technology advisory, digital engineering, and managed services from Atos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing use of Cloud Managed Infrastructure Services

- 5.1.2 Technological Proliferation and Advancement of Cloud Based Technology Boosting the Demand

- 5.1.3 Improved cost and Operational Efficiency and Update of Outdated Hardware

- 5.2 Market Restraints

- 5.2.1 Declining Profit Margins and Integration and Reliability Concerns

- 5.3 Impact of COVID-19 on Managed Infrastructure Services Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Services Type

- 6.2.1 Desktop and Print Services

- 6.2.2 Servers

- 6.2.3 Inventory

- 6.2.4 Other Types

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 UK

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Hewlett Packard Enterprise

- 7.1.6 Microsoft Corporation

- 7.1.7 TCS Limited

- 7.1.8 Canon Inc.

- 7.1.9 Alcatel-Lucent SA (Nokia Corporation)

- 7.1.10 Toshiba Corporation

- 7.1.11 Verizon Communications Inc.

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Deutsche Telekom AG

- 7.1.14 Xerox Corporation

- 7.1.15 Ricoh Company Ltd

- 7.1.16 Lexmark International Inc.

- 7.1.17 Konica Minolta Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS