Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637770

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637770

Southeast Asia Oil and Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

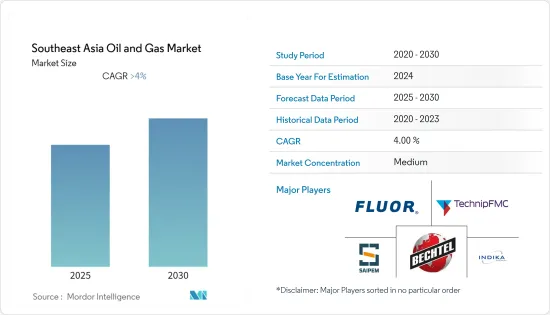

The Southeast Asia Oil and Gas Market is expected to register a CAGR of greater than 4% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the country's energy transition from coal to natural gas is expected to drive the market during the forecast period.

- On the other hand, declining crude oil reserves along with a lack of investments in the upstream sector are expected to restrain market growth.

- Nevertheless, countries such as Brunei, Vietnam, and Burma have enormous potential for the oil and gas industry across all three sectors: upstream, midstream, and downstream. This will likely act as an opportunity for the Southeast Asian oil and gas market.

- Indonesia is expected to dominate the Southeast Asian oil and gas market, owing to the large number of new refineries being constructed.

Southeast Asia Oil & Gas Market Trends

The Downstream Sector to Dominate the Market

- The refining sector in Southeast Asia is expanding rapidly due to increased demand for refined products from sectors such as chemical, petrochemical, and transportation. By 2030, the region's total population is expected to increase by roughly 13%.

- According to the BP Statistical Review of World Energy 2022, Singapore had the largest refining capacity of 1,461 thousand barrels per day as of 2021, followed by Thailand, Indonesia, Malaysia, Vietnam, and other Southeast Asian countries.

- With rising demand for petroleum products and countries working to become self-sufficient, downstream infrastructure in the region is anticipated to expand significantly in the coming years. Indonesia, Malaysia, Brunei, Singapore, Thailand, Vietnam, the Philippines, and other countries have developed plans to enlarge existing refineries or build new ones.

- Malaysia has invested heavily in refining activities over the last two decades, and it can now meet the majority of its domestic demand for petroleum products after depending on Singapore refineries for many years. In addition, three major integrated petrochemical complexes (IPCs) in Malaysia have been built in Kerteh, Gebeng, and Pasir Gudang-Tanjung Langsat.

- Furthermore, economies such as Brunei and Vietnam are on the verge of receiving several EPC contracts in the downstream sector in the coming years.

- For instance, in August 2022, PetroVietnam, a state-owned subsidiary of the Vietnam Oil and Gas Group, revealed plans to construct an oil refinery with a crude oil processing capacity of 24 to 26 MT/year in Ba Ria, Vung Tau Province, southern Vietnam. The building process will be divided into two stages. The first and second phases are anticipated to cost USD 13.5 billion and USD 5 billion, respectively. The first section of the petrochemical and refinery plant will process 12 to 13 metric tons of crude oil per year. The plant's annual production will be 7 to 9 MT of petroleum and 2 to 3 MT of petrochemicals. In the second phase, the plant will receive extra investments to double its processing capacity and raise its output by 3 to 5 metric tons of petroleum and 5.5 to 7.5 metric tons of petrochemicals per year.

Therefore, owing to the above points, the downstream sector is expected to dominate the Southeast Asian oil and gas market.

Indonesia to Dominate the Market

- As of 2021, Indonesia had proven oil reserves of 2.5 billion barrels and proven gas reserves of 49.7 trillion cubic feet. In addition, it has a varied geographical profile. The geological basins include 60 sedimentary basins, 36 of which have already been fully explored in Western Indonesia, and 14 of which produce oil and gas. Significant oil and gas reserves boost the country's research and production activities, which will most likely stimulate the oil and gas market during the forecast timelines.

- Oil output in 2022 was 834 thousand barrels per day, down from 858 thousand barrels per day in 2021. The nation is seeing increased activity in the upstream sector to compensate for declining output from maturing fields.

- Further, the Indonesian government announced its plans to double the refining capacity by 2025, aiming to reach 2.2 million barrels daily. As a result of these plans, major refinery and petrochemical plant construction and upgrade projects are upcoming and are in the pipeline.

- For instance, in January 2023, the Indonesian Energy Ministry announced plans this year to offer ten oil and gas working areas, including a block in the South China Sea, as part of efforts to boost energy production and make new discoveries. By 2030, the country hopes to reach a crude oil lifting capacity of 1 million barrels per day (bpd) and a gas lifting capacity of 12,000 million standard cubic feet per day (mmscfd).

- Therefore, owing to the above points, Indonesia is expected to dominate the Southeast Asian oil and gas market during the forecast period.

Southeast Asia Oil & Gas Industry Overview

The Southeast Asian oil and gas market is moderately fragmented. Some of the major players in the market (in no particular order) include TechnipFMC PLC, Fluor Corporation, Bechtel Corporation, Saipem SpA, and PT. JGC Indonesia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46932

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Oil and Gas Production and Forecast, till 2028

- 4.3 Market Size and Demand Forecast in USD billion, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 Indonesia

- 5.2.2 Thailand

- 5.2.3 Vietnam

- 5.2.4 Malaysia

- 5.2.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TechnipFMC PLC

- 6.3.2 Saipem SpA

- 6.3.3 Bechtel Corporation

- 6.3.4 Fluor Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Petrofac Limited

- 6.3.7 PT Barata Indonesia (Persero)

- 6.3.8 PT Meindo Elang Indah

- 6.3.9 PT Indika Energy Tbk

- 6.3.10 PT Rekayasa Industri

- 6.3.11 Sinopec Engineering (Group) Co. Ltd.

- 6.3.12 Samsung Engineering Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.