Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637751

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637751

Thailand Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

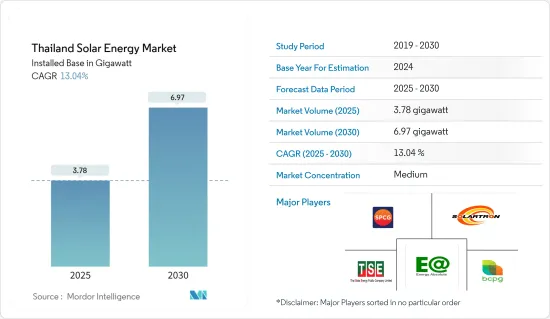

The Thailand Solar Energy Market size in terms of installed base is expected to grow from 3.78 gigawatt in 2025 to 6.97 gigawatt by 2030, at a CAGR of 13.04% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as supportive policies, rising electricity prices, technological advancements, corporate demand, and energy security goals will likely drive Thailand's solar energy market during the forecast period.

- On the other hand, grid limitations, infrastructure gaps, and energy storage challenges significantly hinder the growth of the solar energy market during the forecast period.

- Nevertheless, Thailand's goal of achieving 30 percent renewable energy by 2037 presents significant opportunities for the solar energy market. Furthermore, The integration of smart grid technologies, energy storage systems, and Investments by companies like Energy Absolute in large-scale battery production further support solar projects and grid stability.

Thailand Solar Energy Market Trends

Solar Photovoltaic (PV) Segment Expected to Dominate the Market

- The solar PV segment is likely to hold the major market share during the forecast period, owing to the declining costs of solar modules and the versatility of these systems for various applications, like electricity generation and water heating.

- According to the International Renewable Energy Agency (IRENA), From 2019 to 2023, Thailand's Solar Photovoltaic (PV) Installed Capacity increased from 2979 MW to 3181 MW, with the growth rate over this period being 6.78 percent. Moreover, the solar PV segment is expected to witness massive growth with the increasing solar PV encouraged by government initiatives and falling solar PV costs in Thailand.

- In recent years, Thailand has seen a significant uptick in solar energy projects. These initiatives align with the government's ambitious commitment to renewables, which targets a 50 percent share in the power generation mix by 2037, up from an earlier goal of 20 percent.

- For instance, in October 2024, TotalEnergies ENEOS completed a 1.8 MWp floating solar PV system in Thailand, their second project with S. Kijchai Enterprise. The system, with over 3,000 modules, generates 2,650 MWh annually, reducing CO2 emissions by 1,125 tons, equivalent to planting 16,800 trees. This project is funded and operated by TotalEnergies ENEOS under a long-term PPA.

- Additionally, in May 2024, Gulf Energy Development Private Limited finalized 25-year-long power purchase agreements (PPAs) with the Electricity Generating Authority of Thailand (EGAT) to construct 25 solar PV farms, totaling 1,353 MW. These projects, part of a larger renewables scheme by the Energy Regulatory Commission, will receive feed-in tariffs and are expected to start commercial operations between 2024 and 2029, offering a cost-effective power solution.

- Owing to such developments, the solar PV segment is expected to have a dominant market share in Thailand during the forecast period.

Supportive Government Policies to Drive the Market

- The Thai government is encouraging renewable energy installations across the country to reduce greenhouse gas emissions by 20-25% in seven years. The government has also supported the solar power market by providing various incentives and regulatory support.

- Thailand has set a target for renewables to account for 30 percent of the power mix by 2037. In 2023, the country installed 12,547 MW of renewable energy capacity, which was higher than the 7,902 MW installed in 2015.

- In August 2024, Thailand approved an energy-saving scheme targeting public sector agencies, aiming to save 585 million kWh annually. The program will use the energy service company (ESCO) model to install solar panels and other energy-saving measures through long-term contracts.

- In July 2024, Industry Minister Pimphattra Wichaikul visited Japan to promote a circular economy in Thailand, focusing on sustainable development goals (SDGs) and carbon neutrality. The collaboration includes recycling solar panels as part of the Bio, Circular, and Green (BCG) economy model, aiming to enhance sustainable resource management.

- In May 2023, the Electricity Generating Authority of Thailand (EGAT), under the Smart Grid Pilot Project in Mae Hong Son Province, held a Commercial Operation Date (COD) ceremony for the 3 MW Solar Power Plant and 4 MW Battery Energy Storage System (BESS) Project.

- Moreover, in March 2023, Thailand's National Energy Policy Council (NEPC) introduced quotas for purchasing clean electricity via the Feed-in-Tariff Scheme, which will be implemented in two phases. The feed-in tariff rates are 2.1679 THB per unit for ground-mounted solar and 2.8331 THB per unit for solar + storage. Both types of power plants will have a 25-year term for the feed-in tariff.

- Therefore, supportive government policies and initiatives are expected to drive the Thailand solar energy market in the forecast period.

Thailand Solar Energy Industry Overview

The Thailand solar energy market is semi-concentrated. Some of the major companies in the market (in no particular order) include Energy Absolute Public Company Limited, SPCG Public Company Limited, Solartron PCL, Thai Solar Energy PLC, BCPG Public Company Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46747

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Electricity Prices and Energy Security Goals in Thailand

- 4.5.1.2 Supportive Government Policies to Adopt Solar Energy

- 4.5.2 Restraints

- 4.5.2.1 Grid Limitations, Infrastructure Gaps, and Energy Storage Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION - TECHNOLOGY

- 5.1 Solar Photovoltaic (PV)

- 5.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 SPCG Public Company Limited

- 6.3.2 BCPG Public Company Limited (BCPG)

- 6.3.3 Thai Solar Energy PLC

- 6.3.4 B. Grimm Power Public Company Limited

- 6.3.5 Solaris Green Energy Co. Ltd.

- 6.3.6 Energy Absolute PCL

- 6.3.7 Solartron PLC

- 6.3.8 Marubeni Corporation

- 6.3.9 Black & Veatch Holding Company

- 6.3.10 Jinkosolar Holding Co. Ltd.

- 6.3.11 Trina Solar Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Smart Grid Development and Grid Expansion

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.