Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637745

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637745

Dry-Type Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

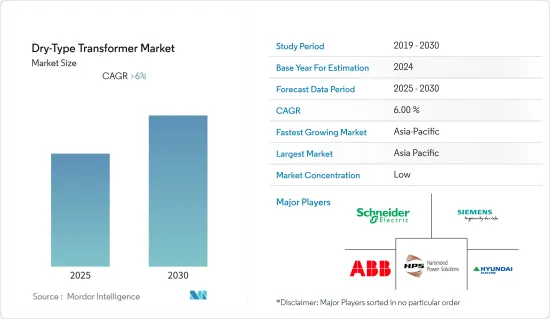

The Dry-Type Transformer Market is expected to register a CAGR of greater than 6% during the forecast period.

The dry-type market was adversely affected by COVID-19 due to disruptions in the supply chain. However, the market rebounded in 2022.

Key Highlights

- Factors such as growing electricity demand, the integration of renewable-based power generation, and increasing investments in the transmission and distribution (T&D) network globally are expected to drive the market during the forecast period.

- However, the advantages that oil-cooled transformers offer over dry-type transformers are expected to slightly restrain the growth of the market during the forecast period.

- The increasing rate of electrification in African and Asian countries provides immense opportunities for the market to grow in the coming years.

- Asia-Pacific was the dominant region for the market in 2022, owing to the growing population and industrialization that caused a rise in electricity demand.

Dry-Type Transformers Market Trends

Distribution Transformer to Dominate the Market

- The dry-type transformer technology does not cause any environmental degradation and possesses better impulse and short circuit strengths, thereby providing a vast array of applications ranging from residential buildings to small commercial complexes.

- Distribution transformers are designed to offer maximum efficiency at lower loads. Moreover, the transformers' voltage regulation is kept to a minimum to improve efficiency. As a result, distribution transformers are designed to have a small leakage reactance.

- The Middle East and African countries, such as Oman and Saudi Arabia, are also investing in expanding and restructuring distribution power grids, which is expected to increase the growth prospects of the dry-type transformer market.

- In January 2022, the Government of India approved Green Energy Corridor (GEC) Phase II. It is expected to facilitate grid integration and power evacuation for approximately 20 GW of renewable energy (RE) power projects in seven states: Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu, and Uttar Pradesh. The estimated investment in this phase is INR 12,031 crore. Under this phase, 10,750 kilometers of transmission lines will be constructed, and 27,500 MVA of new substations are planned to be added. This is expected to drive the dry-type transformer market.

- Additionally, the European Network of Transmission System Operators stated that around USD 10 billion of annual transmission spending is required through 2030. In Europe, investments have remained stable at nearly USD 50 billion, with an increase in spending to support upgrading and refurbishing the existing grid as variable renewables and electrification have grown significantly in the region.

- Therefore, owing to the above points, the distribution transformer type is expected to witness dominant growth during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to dominate the dry-type transformer market during the forecast period, owing to the growing industrialization and urbanization.

- China's National Energy Administration (NEA) is promoting the concept of green certificates along with an aggressive renewable energy portfolio (REP). This is expected to boost the wind power market in China. With increasing renewable energy integration, particularly from wind and solar PV, the demand for dry-type transformers is expected to remain high in the country.

- Fossil-based power generation dominated India's power sector in 2022, making up almost 60% of the total installed capacity. The country has identified the potential of renewable energy for decarbonizing the economy and meeting targets as per the Paris Agreement.

- The country's renewable energy (including hydro) accounted for 40% of the total installed capacity by the end of 2022. With the increasing share of renewable energy, demand for upgrading the existing transmission and distribution (T&D) infrastructure is expected to increase.

- With countries like the Philippines, South Korea, and Australia targeting renewable integration to meet their energy demand, the need for dry-type transformers in the Asia-Pacific region is expected to register robust growth during the forecast period.

Dry-Type Transformers Industry Overview

The dry-type transformer market is fragmented. The key players in the market include (not in any particular order) Siemens AG, Schneider Electric SE, ABB Ltd, Hyundai Electric & Energy Systems Co. Ltd, and Hammond Power Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46633

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voltage

- 5.1.1 Low Voltage

- 5.1.2 Medium Voltage

- 5.2 Type

- 5.2.1 Power Transformer

- 5.2.2 Distribution Transformer

- 5.3 End Phase

- 5.3.1 Single Phase

- 5.3.2 Three Phase

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Schneider Electric SE

- 6.3.3 Eaton Corporation PLC

- 6.3.4 ABB Ltd.

- 6.3.5 TBEA Co. Ltd.

- 6.3.6 Hyundai Electric & Energy Systems Co. Ltd

- 6.3.7 Hammond Power Solutions Inc.

- 6.3.8 Kirloskar Electric Company Ltd.

- 6.3.9 Hitachi Energy Ltd.

- 6.3.10 Gujarat Transformers Private Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.