PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636605

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636605

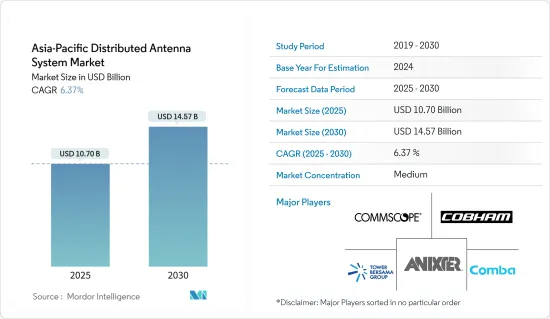

Asia-Pacific Distributed Antenna System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific Distributed Antenna System Market size is estimated at USD 10.70 billion in 2025, and is expected to reach USD 14.57 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

The DAS adoption rate has increased dramatically, providing several advantages over single antenna systems. However, this is achieved at a higher cost and by deploying a complicated system. However, DAS is used across various areas to enable businesses to get the coverage necessary for applications.

Key Highlights

- Although distributed antenna systems have existed for many years, the increased deployment of wireless networks within buildings with potential applications across smart homes and connected devices has encouraged the implementation of DAS systems increasingly in the market.

- Also, DAS and small cells are one of the core infrastructures upon which the new 5G communication standard is expected to be deployed. DAS can be installed in buildings to boost wireless signals inside them. Often, large facilities, such as stadiums or company premises, are expected to adopt these solutions for the upcoming technology increasingly.

- Due to an increase in residential structures and commercial facilities, a growing number of government programs, an increase in 5G-enabled smartphones, the popularity of Bring Your Device, and more enterprise mobility encourage, the market to grow.

- The cost of a DAS solution varies based on the time and range. For example, passive DAS used to identify the coverage of cellular carriers simultaneously is at the lower end and may cost only a couple of hundreds or thousands of dollars; however, active DAS used for enhancing in-building coverage of one or more mobile service provider networks comes at higher costs.

- The COVID-19 outbreak delayed the 5G deployment in various regions, and the importance of the technology gained traction during the time to cope with the surge in demand for faster connectivity solutions. The deployment and demand for telecommunication infrastructure were expected to boost during the pandemic significantly. Post-pandemic, the market grew rapidly with increased demand for public security connectivity.

APAC Distributed Antenna System Market Trends

Increase in Demand for Public Security Connectivity Drives the Market Growth

- High-rise buildings, tunnels, shopping malls, parking garages, and airports, among others, all have public safety networks vital to people's protection. The DAS( Distributed Antenna System) system standard has seen tremendous national, state, and local law expansion in the last decade.

- Furthermore, legislative regulations and new public safety building norms enacted by the International Code Council and the National Fire Protection Association drive demand for in-building wireless solutions for public safety, including repeaters, bidirectional amplifiers, and active DAS.

- The converged system is not only less expensive to deploy, but it also has natural interaction between cellular and public safety DAS. Furthermore, installing separate units would take up more room than an integrated approach. February 2023, Comba Telecom Systems Holdings Limited, a global wireless solutions provider, introduced its Green Base Station Antenna product series, offered by the new and innovative Helifeed Platform, which significantly increased antenna energy efficiency and optimized antenna energy consumption. Comba Telecom provides forward-thinking Helifeed Green Antennas to help operators achieve global carbon neutrality objectives, with green and low-carbon design principles embedded throughout the product life cycle.

- The communication speed would increase due to rapid advancements in DAS, such as Beamforming and MIMO. There are no choppy or lagging conference calls - connect instantly without interruption. The region also has several partnerships and collaborations, paving the way for further technological evolution. For instance, Nokia and China Mobile have jointly developed this 5G low-cost hybrid distributed indoor system to meet these challenges. The smart indoor coverage system leverages the Nokia 5G Pico Remote Radio Head system, passive DAS antennas, and Bluetooth Low Energy (BLE) technology. This new solution also reduces deployment costs compared to the traditional passive-only DAS systems while delivering greater capacity than DAS. The 5G connections are also increasing rapidly in this region. According to GSMA, 5G mobile connections were estimated to grow from a network share of 4% in 2022 to 41% by 2030.

China is Expected to Dominates the Asia Pacific Distributed Antenna System Market

- Because of its high smartphone usage and early adoption of 5G services in AR/VR, autonomous driving, and distributed antenna system traffic per smartphone, China dominates the Asia Pacific distributed antenna system (DAS) market.

- The DAS market in the region would be driven by the growing number of internet subscribers, increased mobile data traffic, and the increasing emphasis of government offices on improving telecommunications infrastructure to meet consumers' need for seamless connectivity.

- Even the government has stepped in to ensure that telecommunications providers share DAS held by them, ensuring that all operators' consumers have access to the required bandwidth everywhere. These new technologies are widely adopted throughout the region.

- Furthermore, the growing acceptance of indoor distributed antenna systems in the healthcare and industrial verticals and organizations would likely propel the China indoor distributed antenna systems market. Aside from this, the increasing popularity of smartphones is one of the significant driving demands for indoor distributed antenna systems in this region.

- According to CNNIC, China's internet population grew by 35 million in December 2022 compared to a year ago. Over one billion people had internet access, and about 75.6 percent of the Chinese population used the internet. The penetration rate denotes the share of the population that has access to a certain communication medium. The global average internet penetration rate was 64.4 percent as of January 2023. Internet penetration in China has also been above the average rate in Asia Pacific Countries.

APAC Distributed Antenna System Industry Overview

The Asia Pacific distributed antenna system market is semi-consolidated with the presence of major players like Anixter, Inc., Cobham PLC, CommScope Inc., PT Tower Bersama Infrastructure TBK, and Comba Telecom Systems Holdings Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In March 2023, Comba Network Systems, a division of Comba Telecom Systems Holdings, was selected by China Mobile Hong Kong (CMHK) to develop, construct, and provide a 5G interior coverage system for Lawsgroup's key technological property, KTR 350. KTR 350 is a new 29-story smart commercial building with a gross floor space of 200,000 square feet situated at 350 Kwun Tong Road in Hong Kong. It is the first major project under the strategic cooperation between CMHK and Lawsgroup. The deployment of the Comba ComFlex Pro Distributed Antenna System (DAS) Solution would allow Lawsgroup to extend and enhance the 5G indoor network coverage for KTR350 while meeting all advanced system criteria.

In December 2022, CommScope announced the introduction of its Infrastructure Distributor Program, the first component of its new Service Provider Channel Partner Program. The Distributor Program honors long-standing CommScope channel partners by giving distributor-specific tools, instructional materials, and client growth opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Public Security Connectivity

- 5.1.2 Supports Multiple Telecom Carriers and Upcoming Technologies

- 5.2 Market Challenges

- 5.2.1 High Cost to Upgrade

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Indoor DAS

- 6.1.2 Outdoor DAS

- 6.2 By Country

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 South Korea

- 6.2.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anixter, Inc.

- 7.1.2 Cobham PLC

- 7.1.3 CommScope Inc.

- 7.1.4 PT Tower Bersama Infrastructure TBK

- 7.1.5 Comba Telecom Systems Holdings Ltd

- 7.1.6 PT MAC Sarana Djaya

- 7.1.7 Boingo Wireless Inc

- 7.1.8 American Tower Corporation IP LLC.

- 7.1.9 Bird Technologies

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK