PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636572

Short Term Vacation Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

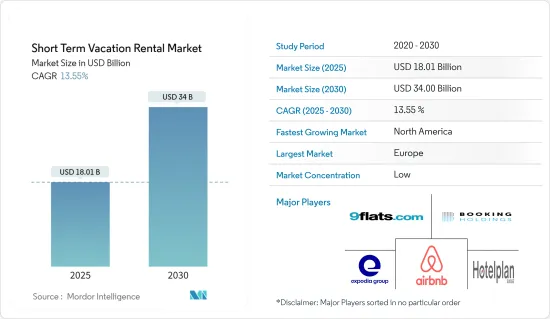

The Short Term Vacation Rental Market size is estimated at USD 18.01 billion in 2025, and is expected to reach USD 34.00 billion by 2030, at a CAGR of 13.55% during the forecast period (2025-2030).

In recent years, the short-term vacation rental market has seen significant expansion, driven by a rising demand for flexible and personalized lodging. These rentals provide travelers with a homier atmosphere, often boasting more space, privacy, and amenities than traditional hotels. The sector attracts a diverse clientele, from tourists and business travelers to remote workers, all seeking both short and extended stays.

Key drivers of this growth include a surge in global travel, a consumer shift towards unique and immersive experiences, and the emergence of digital platforms that streamline the booking and management of rentals. With the rising demand for alternative accommodations, property management has become increasingly professionalized, ensuring guests enjoy reliable, high-quality service.

However, the market grapples with challenges, notably regulatory restrictions in numerous cities. These regulations often aim to tackle concerns about housing availability and the influence of short-term rentals on local neighborhoods. Additionally, economic fluctuations and changing travel trends can sway demand, rendering the market sensitive to broader financial shifts.

Yet, despite these hurdles, the short-term vacation rental market is set for continued growth, buoyed by evolving traveler preferences, technological advancements, and an increasing allure for flexible, experience-centric travel options.

Short Term Vacation Rental Market Trends

Rising Demand for Personalized Stays Fuels Growth in Vacation Rentals Market

The vacation rentals market has seen steady growth in recent years, largely driven by changing traveler preferences and advancements in technology. The shift toward online booking platforms has made it easier for consumers to find and book a broad variety of accommodations, from budget-friendly options to luxury properties. This convenience, mixed with the flexibility of choosing short-term or extended stays, has attracted more travelers to vacation rentals over traditional hotel options.

Another key driver has been the increasing demand for private, comfortable, and personalized lodging experiences. In the wake of the pandemic, many travelers sought safer alternatives to crowded hotels, leading to a steady rise in demand for vacation rentals that offer more privacy and home-like environments. This preference has persisted, even as global travel resumed.

As more people prioritize unique and flexible travel experiences, the vacation rental market continues to expand. Its growing popularity reflects the changing dynamics of the travel industry, where consumers seek accommodations that offer more freedom, comfort, and individuality. This trend is expected to fuel further growth in the coming years, solidifying vacation rentals as a major segment in the lodging market.

Global Trends and Regional Growth in the Short-Term Vacation Rental Market

The short-term vacation rental market shows varying levels of growth and market share across different regions. North America and Europe lead with a high market share, driven by the popularity of flexible, short-term stays and widespread use of online booking platforms. In these regions, travelers prefer private accommodations for both leisure and business trips, making short-term vacation rentals a strong alternative to hotels.

Oceania, Asia, and Western Asia hold a medium market share in the short-term vacation rental market. In Oceania, outdoor tourism, particularly in Australia and New Zealand, drives demand for short-term rentals. Asia is witnessing moderate growth, with destinations like Japan and Thailand gaining traction, though cultural preferences for hotels limit the market's expansion. Western Asia, including countries like the UAE and Turkey, is also seeing an increase in short-term vacation rentals, particularly in urban centers and tourist hotspots.

South America, Africa, Russia, and Greenland maintain a low market share in the short-term vacation rental market. South America's growth is slow due to economic and infrastructure challenges, although demand is rising in countries like Brazil. Africa's market is still emerging, with limited adoption outside of tourist-heavy regions. Russia and Greenland have minimal short-term rental activity, as traditional accommodations remain the preferred option.

Short Term Vacation Rental Industry Overview

The short-term vacation rental market is highly fragmented, with many players competing for market share.

Leading this competitive landscape is 9flats.com PTE Ltd., which offers a wide range of unique rental properties across various destinations. Following closely is Airbnb, Inc., which dominates the market with its extensive listings and strong brand recognition. Booking Holdings Inc. utilizes its broad hotel network to provide a diverse range of selection of vacation rentals, appealing to various traveler preferences. Expedia Group, Inc. integrates vacation rentals into its wider travel offerings, attracting a broad audience. Lastly, Hotelplan Management AG is known for its curated varieties of vacation rentals that cater to family and group travelers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements in Online booking platforms

- 4.2.2 Increased Disposable Income Is Leading to More Travel, Driving Demand

- 4.3 Market Restraints/ Challenges

- 4.3.1 Potential Hosts May Be Deterred From Entering the Market Due to Concerns Over Guest Safety and Property Damage

- 4.3.2 Local Communities Raise Concerns Over Noise, Disruptions, and Housing Shortages

- 4.4 Market Opportunities And Future Trends

- 4.4.1 Travel agencies and online platforms boost Listing Visibility, leading to Increased Bookings and a Broader Market Reach

- 4.4.2 Exploring Niche Markets, such as Pet-friendly Rentals and Accessible Accommodations

- 4.5 Value Chain/ Supply Chain Analysis

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of new Entrants

- 4.6.2 Bargaining Power of Buyers/ Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Consumer Buying Behaviour

- 4.8 Insights on Governmental Regulations

- 4.9 Insights on Technological Disruption

- 4.10 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Accommodation Type

- 5.1.1 Apartments

- 5.1.2 Villas

- 5.1.3 Cottages

- 5.1.4 Houses

- 5.1.5 Cabins

- 5.1.6 Condos

- 5.2 By Price Range

- 5.2.1 Budget

- 5.2.2 Mid-Range

- 5.2.3 Luxury

- 5.3 By Booking Channel

- 5.3.1 Online Travel Agencies

- 5.3.2 Direct Bookings ( Via Host Websites)

- 5.3.3 Offline Channels

- 5.4 By Region

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 9flats.com PTE Ltd

- 6.2.2 Airbnb, Inc

- 6.2.3 Booking Holdings Inc

- 6.2.4 Expedia Group, Inc

- 6.2.5 Hotelplan Management AG

- 6.2.6 MakeMyTrip Pvt. Ltd.

- 6.2.7 NOVASOL A/S

- 6.2.8 Tripadvisor Rentals

- 6.2.9 Wyndham Destinations, Inc.

- 6.2.10 Oravel Stays Private Limited

7 FUTURE OF THE MARKET

8 DISCLAIMER

9 ABOUT US