PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636556

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636556

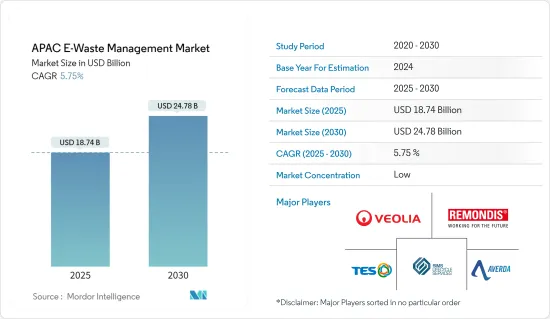

APAC E-Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The APAC E-Waste Management Market size is estimated at USD 18.74 billion in 2025, and is expected to reach USD 24.78 billion by 2030, at a CAGR of 5.75% during the forecast period (2025-2030).

Asia-Pacific region is experiencing a significant rise in electronic waste due to rapid technological advancements, increased adoption of consumer electronics, and strong economic growth. China, India, and Japan are major contributors.

In August 2023, Japan announced a partnership with ASEAN countries to address e-waste challenges. This collaboration, established during an environment ministers' meeting, focuses on developing regulations for e-waste disposal. Japan will assist in creating registration and certification systems for waste management businesses, funded through its fiscal year 2024 budget.

This initiative aims to improve e-waste handling in Southeast Asia, which has struggled with environmental contamination and health risks due to lax waste import regulations. Japan also seeks to recover valuable metals from e-waste, supporting its electric vehicle industry and mitigating its limited domestic metal resources.

Meanwhile, in May 2024, South Korea's private equity and environmental firms increasingly invested in the landfill sector. Affirma Capital acquired Jentec, a major landfill operator, for KRW 500 billion (USD 368 million). Jentec operates a large landfill in Dangjin, South Chungcheong Province. This growing interest reflects increased confidence in waste management and suggests potential advancements in e-waste treatment technologies.

APAC E-Waste Management Market Trends

India's Upcoming EPR Certificate Platform to Boost E-Waste Recycling Efficiency

In the financial year 2022, India produced over 1.6 million metric tons of e-waste, with 527 thousand metric tons being collected and processed. As of March 2024, the government plans to roll out an online platform for trading Extended Producer Responsibility (EPR) certificates to combat this escalating challenge. EPR mandates hold producers accountable for recycling their products post-disposal, thereby promoting the creation of more recyclable and reusable goods.

The Central Pollution Control Board (CPCB) oversees this platform to boost transparency and efficiency in the EPR certificate market. Companies can fulfill recycling obligations by managing waste internally or procuring EPR certificates from entities surpassing their recycling benchmarks. The CPCB will set the guidelines and pricing for these certificates, pegged to a percentage of the environmental compensation for unmet EPR targets.

Since the inception of EPR directives in the E-Waste (Management) Rules of 2022, the government has processed 5,615 EPR applications, approving 4,865, and has received 285 applications from recyclers, granting 196. Notably, the government has already surpassed its recycling goal of 1.05 billion metric tons for Waste Electrical and Electronic Equipment (WEEE). It is now looking to bolster these efforts with the upcoming platform.

China Highlights E-Waste Innovations and Sustainability Initiatives at Beijing Event

Industry experts note that in 2022, China, the world's largest producer of electronic waste, churned out over 12 million metric tons. Fast-forward to April 2024, when the Qijiayuan Diplomatic Residence Compound (DRC) in Beijing set the stage for an event spotlighting China's waste sorting and recycling strides. The exhibition featured cutting-edge AI-driven waste-sorting machinery and showcased products crafted from recycled materials. Notably, the event included interactive activities for children, emphasizing the importance of recycling.

Hosted by the Beijing Municipal Center for Foreign-related Environment Sanitation Services, the event underscored China's resolve to combat e-waste, leveraging advancements in AI, IoT, big data, and cloud computing. The China International Press Communication Center (CIPCC), under the China Public Diplomacy Association (CPDA), facilitated this visit as part of a media exchange initiative reignited after a pause during the COVID-19 pandemic. The program hosted 100+ journalists from 90+ nations, focusing on media exchange and offering insights into China's ongoing developments.

Through such showcases and initiatives, China is crafting a narrative of being a frontrunner in sustainable e-waste management technology. This strategic move aims to bolster China's global standing, amplifying its soft power and influence in international environmental dialogues.

APAC E-Waste Management Industry Overview

The e-waste management market in Asia-Pacific sees intense competition, with major firms like Veolia Group, Remondis, and Averda, alongside Sims Recycling Solutions and TES-AMM, leading the charge. Veolia Group and Remondis, in particular, stand out for their emphasis on advanced recycling technologies and broadening service portfolios to handle diverse electronic waste streams.

These market leaders prioritize sustainability, forging partnerships with local governments to bolster e-waste collection and recycling infrastructure. Attero, a prominent player in India's e-waste landscape, has a widespread collection network and cutting-edge recycling methods. Collectively, these firms are propelling the APAC e-waste market forward through a strategic focus on technology, regulatory adherence, and sustainable initiatives, paving the way for a more efficient and eco-conscious e-waste management landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Technological Advancements Drive Increasing E-Waste Volumes

- 5.1.2 Urbanization and Industrialization

- 5.2 Market Restraints

- 5.2.1 High Cost of Recycling

- 5.2.2 Complexity of E-Waste

- 5.3 Market Opportunities

- 5.3.1 Advancements in Recycling Technologies

- 5.3.2 Public-Private Partnerships

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.1.3 Glass

- 6.1.4 Other Materials

- 6.2 By Source Type

- 6.2.1 Consumer Electronics

- 6.2.2 Industrial Electronics

- 6.2.3 Household Appliances

- 6.2.4 Other Sources

- 6.3 By Application

- 6.3.1 Landfill

- 6.3.2 Recycled

- 6.3.3 Other Applications

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Veolia Group

- 7.2.2 Remondis

- 7.2.3 Averda

- 7.2.4 Sims Recycling Solutions

- 7.2.5 TES-AMM

- 7.2.6 Enviro-Hub Holdings Ltd

- 7.2.7 Blue Planet Environmental Solutions Pte Ltd

- 7.2.8 ECO Recycling Ltd (Ecoreco)

- 7.2.9 Attero

- 7.2.10 JOMAR Life Research Laboratory*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX