PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636554

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636554

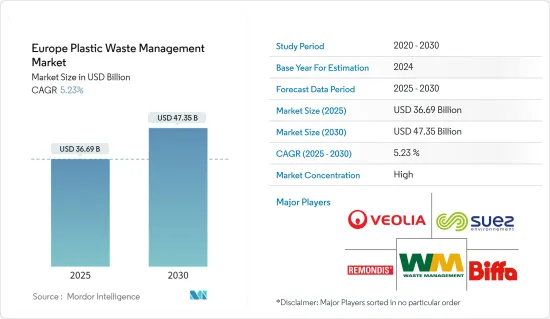

Europe Plastic Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Plastic Waste Management Market size is estimated at USD 36.69 billion in 2025, and is expected to reach USD 47.35 billion by 2030, at a CAGR of 5.23% during the forecast period (2025-2030).

Key Highlights

- The European plastic waste management market is mainly driven by government initiatives to curb rapid waste generation and a growing preference for sustainability.

- Plastic waste pollution is a pressing global concern. As a significant consumer of plastics, Europe plays a pivotal role in exacerbating this issue. The region's annual plastic waste production, notably from single-use items like packaging, is on the rise. However, recycling rates are lagging, underscoring the considerable distance Europe must traverse to achieve a circular economy for plastics.

- In 2023, the European Union produced an estimated 60 million metric tons of plastic waste. Projections suggest this trend will persist, potentially leading to a doubling of plastic waste generation by 2060, exceeding 100 million metric tons annually.

- Within Europe, packaging represents the primary source of plastic waste, with EU Member States collectively producing over 16 million metric tons in 2023. Over the last decade, plastic packaging waste in the European Union surged by approximately 30%.

- In Europe, landfilling and incineration for energy recovery continue to dominate plastic waste management, while recycling lags, making up less than 15% of the continent's waste disposal. Despite some progress, the plastic packaging recycling rate in the European Union has struggled to breach the 50% mark, falling short of the bloc's 2025 recycling goal.

- The plastic waste exported from the European Union to countries outside the bloc intended for treatment is factored into recycling rates. However, these shipments often face mismanagement due to inadequate waste infrastructure in the receiving nations. Despite this, plastic waste exports in the region have been on a downward trend, attributed to an increasing number of countries enforcing bans and restrictions on such imports.

- Plastic pollution is a pressing issue in Europe, prompting the region to enact new policies. For instance, the Single-use Plastics Directive of the European Union includes bans on various disposable plastic items commonly found on European beaches. The momentum for a broader single-use plastics ban in Europe is gaining traction. Notably, in November 2023, the European Union committed to halting plastic waste exports to non-OECD nations by 2026, although calls for a total export ban persist.

Europe Plastic Waste Management Market Trends

The European Union's New Policies Set to Transform the Packaging Industry and Drive Climate Neutrality by 2050

The European Union revised its legislation on packaging and packaging waste, effective 2023. This revision is part of a broader goal to steer the packaging industry toward climate neutrality by 2050.

From 2023, eateries, delivery services, and restaurants were mandated to provide reusable containers as an option for takeout food, moving away from single-use plastics. By 2025, the United Kingdom is projected to require disposable beverage bottles to contain a minimum of 25% recycled plastic content.

These new policies are poised to usher in a wave of business opportunities, particularly benefiting smaller enterprises. They will also reduce the reliance on virgin materials, bolster Europe's recycling capabilities, and lessen the continent's dependence on primary resources and external suppliers. Crucially, these initiatives are set to align the packaging industry with climate neutrality targets by 2050.

While striving for ambitious net-zero and net-positive goals, the plastics industry hinges on three pillars, i.e., speed, workforce, and policy. Achieving these milestones positions Europe competitively and marks a significant stride in combating climate change. The upcoming three to five years will be pivotal in gauging the industry's ability to decarbonize by mid-century.

The United Kingdom Ramps up Efforts to Tackle Plastic Waste Amid Global Shifts

Plastics, lauded for their affordability, durability, and versatility, have entrenched themselves in the global society. However, the limitations in their disposal pose a significant environmental threat. The United Kingdom stands out in its plastic waste production, with its households discarding a monumental 100 billion plastic packaging pieces annually, averaging 66 per week. In 2021, the country generated 2.5 million metric tons of plastic packaging waste.

Despite heightened environmental awareness, the country's recycling rate for plastic packaging waste lingered at 44% in 2021, which remained relatively static for half a decade. This rate encompasses both direct recycling and energy recovery from incineration. Alarmingly, nearly half of the United Kingdom's plastic waste is incinerated for energy, while a mere 12% is recycled domestically, with 25% ending up in landfills and the rest shipped overseas.

With insufficient domestic processing capabilities, the United Kingdom has increasingly turned to exports, notably channeling a significant portion to the Netherlands, which accounted for a quarter of UK plastic waste imports in 2022. However, the global scenario is shifting. Countries like China, a traditional waste importer, have clamped down on such practices, intensifying the pressure on the United Kingdom to revamp its waste management strategies. Calls for bolstered recycling infrastructure and the adoption of advanced recycling technologies have grown louder.

Given the slow decomposition rate of plastic, concerns over pollution are mounting in the United Kingdom. In response, the UK government has initiated various policies, including the single-use carrier bag charge, which has notably curbed supermarket plastic bag issuance. Calls for further bans have emerged, with Scotland leading the way by prohibiting problematic single-use plastics like cutlery, plates, and coffee cups. Following suit, England was set to implement a similar ban starting October 1, 2023. Additionally, a nationwide deposit return scheme (DRS) for beverage containers, initially slated for 2023, has been delayed to 2025, citing economic challenges.

Europe Plastic Waste Management Industry Overview

The European plastic waste management market is fragmented in nature. It boasts a competitive landscape shaped by key players such as Veolia Environnement SA, Suez, Remondis, Biffa, Waste Management Inc., and Renewi. These industry leaders vie for market share through pioneering recycling technologies, streamlined collection and sorting, and eco-conscious waste disposal methods. Their strategies pivot on adhering to regulations, championing circular economy tenets, and curbing the environmental toll of plastic waste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Demand for Sustainability Driving the Market

- 4.2.1.2 Environmental Concerns Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Developments in the Plastic Waste Management Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Polyethylene Terephthalate (PET)

- 5.1.5 Other Polymers

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Other Sources (Construction and Healthcare)

- 5.3 By Treatment

- 5.3.1 Recycling

- 5.3.2 Chemical Treatment

- 5.3.3 Landfill

- 5.3.4 Other Treatments

- 5.4 By Region

- 5.4.1 The United Kingdom

- 5.4.2 Germany

- 5.4.3 Spain

- 5.4.4 France

- 5.4.5 Italy

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Veolia Environment

- 6.2.2 Suez Environment

- 6.2.3 Biffa Group

- 6.2.4 Waste Management Inc.

- 6.2.5 REMONDIS

- 6.2.6 Renewi

- 6.2.7 FCC Environment

- 6.2.8 Viridor

- 6.2.9 DS Smith

- 6.2.10 TOMRA*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX