PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636512

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636512

India Kitchen Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

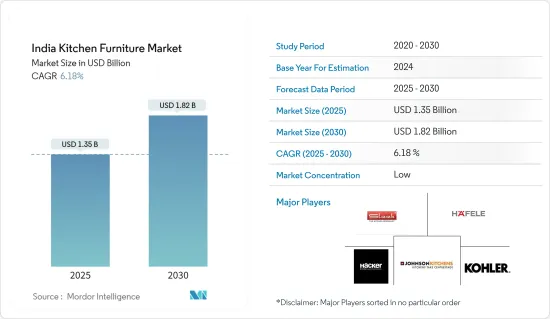

The India Kitchen Furniture Market size is estimated at USD 1.35 billion in 2025, and is expected to reach USD 1.82 billion by 2030, at a CAGR of 6.18% during the forecast period (2025-2030).

Rising disposable incomes, urbanization, and a shift towards nuclear families are critical drivers of growth in the kitchen furniture market. A rising interest in modular kitchens further fuels this growth. The market segments include modular kitchens, kitchen cabinets, and kitchen islands, with modular kitchens emerging as the most prominent and fastest-growing segment. Established players ramp up their manufacturing and retail capacities to meet the escalating demand, while startups introduce tech-driven solutions. Consumers are increasingly gravitating towards modern, customizable kitchen designs. They also seek ergonomic and space-saving furniture solutions. A surge in residential construction bolsters this trend, as do real estate activities and the pervasive influence of international design trends, often amplified through social media.

The market's expansion is also supported by advancements in technology and materials, which enable the production of more durable and aesthetically pleasing kitchen furniture. Additionally, government initiatives promoting urban housing projects contribute to the market's growth. The increasing number of dual-income households further drives the demand for high-quality, functional kitchen spaces. Integrating intelligent kitchen appliances and IoT (Internet of Things) technology is another emerging trend, enhancing the functionality and convenience of modern kitchens.

India Kitchen Furniture Market Trends

Increasing Construction Activities in India is Fuelling the Market

In recent years, India's kitchen furniture market has seen steady growth, primarily propelled by a surge in the country's construction activities. India's residential construction has notably risen, fueled by population growth, urbanization, and increasing disposable incomes. With the rise in new home constructions, there's a parallel uptick in the demand for kitchen furniture, spanning cabinets, countertops, and storage solutions. Concurrently, India's real estate sector is expanding by constructing new commercial and mixed-use spaces. These modern structures often feature bespoke, high-end kitchens, further bolstering the demand for kitchen furniture. India's market is experiencing a significant trend towards modular kitchens, driven by a rising preference for international design aesthetics, often inspired by global travel and media influences. Consequently, there's a heightened appetite among Indian consumers for kitchen furniture that embodies contemporary and innovative design principles.

Rise in E-Commerce is Fuelling the Market

The surge in e-commerce is propelling India's kitchen furniture market. E-commerce platforms have democratized access to kitchen furniture, reaching consumers in major cities and Tier-2 and Tier-3 regions. This accessibility means customers can now peruse and purchase a diverse array of kitchen furniture from the convenience of their homes. To bolster this trend, e-commerce entities bolstered their logistics and supply chains, ensuring swift and efficient deliveries, even in remote areas. Moreover, many platforms now offer customization options, allowing customers to tailor dimensions, materials, and finishes to their preferences, heightening the allure of kitchen furniture.

India Kitchen Furniture Industry Overview

The kitchen furniture market in India is characterized by fragmentation and intense competition, featuring a mix of international and domestic players. This landscape not only offers growth opportunities during the forecast period but also intensifies the competitive dynamics. Notably, key market players such as Sleek, Johnson Kitchens, Hafele, Haecker, and Kohler hold substantial market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Urbanization is Driving the Market

- 4.2.2 Increasing Modular Kitchens is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Fluctuation in Raw Material Costs is Impacting the Market

- 4.4 Market Opportunities

- 4.4.1 Partnerships with Interior Designers, Architects, and Home Improvement Stores Present Lucrative Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porters 5 Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Market

- 4.8 Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Kitchen Cabinets

- 5.1.2 Kitchen Chairs

- 5.1.3 Kitchen Tables

- 5.1.4 Others

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets and Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 E-Commerce

- 5.2.4 Other Distribution Channels

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Sleek

- 6.2.2 Johnson Kitchens

- 6.2.3 Hafele

- 6.2.4 Haecker

- 6.2.5 Kohler

- 6.2.6 Zuari Furnitures

- 6.2.7 EBCO

- 6.2.8 Godrej Interio

- 6.2.9 Style Spa

- 6.2.10 Arttdinnox*

7 Future Of The Market

8 Disclaimer