Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636509

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636509

Italy Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

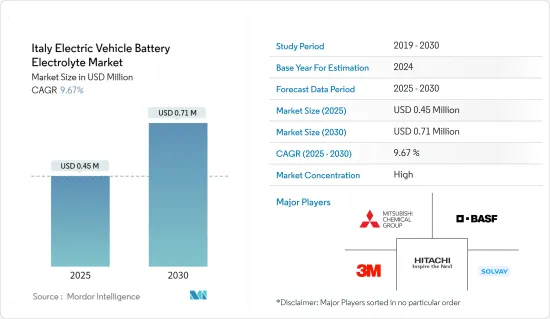

The Italy Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.45 million in 2025, and is expected to reach USD 0.71 million by 2030, at a CAGR of 9.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand for electric vehicle (EVs) and suppotive government initiatives are expected to drive the market during the forecast period.

- On the other hand, supply chain challanges are likely to hinder the market growth during the forecast period.

- Nevertheless, innovations in electrolyte materials are expected to provide significant opportunities for the market in the coming years.

Italy Electric Vehicle Battery Electrolyte Market Trends

Growing Demand for Electric Vehicles (EVs) to Drive the Market

- Italy's electric vehicle (EV) market is booming, driving up the demand for battery electrolytes. This trend is underscored by a significant uptick in EV registrations over recent years. Registrations for Battery Electric Vehicles (BEVs) surged from a mere 2,000 units in 2017 to an impressive 66,000 units in 2023. Likewise, Plug-in Hybrid Electric Vehicles (PHEVs) saw their demand leap from 29,000 units in 2017 to 70,000 units in 2023, underscoring the growing acceptance of EVs among Italian consumers.

- In June 2024, Italy experienced a notable spike in EV registrations, primarily due to the rollout of the new Ecobonus incentive, which has effectively piqued consumer interest. June alone witnessed the registration of 13,285 new fully electric vehicles, marking a staggering 115.8% jump from the same month in 2023. This upswing elevated the market share of electric vehicles to 8.3%, a significant leap from the previous year's 4.4%. In the first half of 2024, electric vehicle registrations totaled 34,709, reflecting a 6.2% growth from the same timeframe in 2023, and sustaining a market share of 3.9%.

- The Italian government's dedication to promoting EV adoption is evident through various initiatives. For example, in January 2024, the government earmarked 930 million euros to bolster the sales of locally produced electric vehicles (EVs). A primary objective of this initiative is to champion electromobility among lower-income households. By incentivizing the purchase of domestically produced EVs, especially for these families, the government anticipates a boost in overall EV sales. Such an uptick in sales is poised to drive up the demand for battery components, notably electrolytes.

- Beyond financial incentives, Italy is ambitiously aiming to set up 110,000 public electric vehicle charging points by 2030. As of August 2023, 45,210 charging points were already operational, with nearly 75% being fast chargers, predominantly situated in urban locales and shopping centers.

- While many major European markets, including Germany and France, saw stagnation in their EV markets, Italy's upward trajectory signals a pronounced shift towards electric mobility. This trend bodes well for the battery electrolyte market as EV sales continue their ascent.

- In summary, the confluence of government incentives, surging registrations, and an expanding charging infrastructure is cultivating a robust environment for the growth of Italy's EV battery electrolyte market, all fueled by the nation's escalating appetite for electric vehicles.

Lithium-Ion Batteries Segment to Dominate the Market

- Driven by the rising adoption of electric vehicles (EVs), government pushes for sustainable transportation, and technological strides in battery development, the lithium-ion battery segment is pivotal. Valued for their high energy density, lightweight nature, and extended cycle life, lithium-ion batteries are the preferred choice for EVs. As the EV market expands, there's a growing demand for high-performance electrolytes that boost battery efficiency, safety, and lifespan.

- Italy's robust automotive sector, now pivoting towards electric mobility, bolsters the lithium-ion battery segment. With major automakers pouring investments into EV production, lithium-ion battery manufacturing is witnessing a notable uptick. A testament to this momentum, Statevolt announced in January 2023 its plans to set up a 45 GWh lithium-ion battery facility in Italy, specifically for EVs. This automotive shift aligns seamlessly with Italy's dedication to curbing carbon emissions and championing clean energy, echoing the broader ambitions of the European Union.

- The electric vehicle battery electrolyte market is significantly swayed by the plummeting prices of lithium-ion batteries. In 2023, the average price of lithium-ion batteries dipped to approximately USD 139 per kilowatt-hour (kWh), showcasing a remarkable decline of over 82% since 2013. Forecasts suggest a further drop to below USD 113/kWh by 2025, with a potential target of USD 80/kWh by 2030.

- As battery costs decrease, the overall price of electric vehicles follows suit, enhancing their affordability and accessibility for consumers. This anticipated rise in EV demand, spurred by lower prices, underscores the growing need for top-tier battery electrolytes.

- Furthermore, as prices decline, manufacturers are more inclined to invest in cutting-edge electrolyte formulations that bolster battery performance and safety. Highlighting this trend, Feon Energy, a Stanford University offshoot specializing in advanced battery electrolytes, clinched USD 6.1 million in seed funding in June 2024 for its innovative electrolytes and achieved UN 38.3 certification for its lithium-metal batteries. Such advancements catalyze innovation in the electrolyte domain, paving the way for products that amplify battery efficiency, lighten weight, and boost energy density.

- Given these dynamics, Italy's lithium-ion battery segment, especially in the realm of electric vehicle battery electrolytes, is on an upward trajectory, buoyed by technological innovations and falling battery prices that facilitate the broader embrace of electric vehicles.

Italy Electric Vehicle Battery Electrolyte Industry Overview

The Italy electric vehicle battery electrolyte market is semi-consolidated. Some of the major players include (not in particular order) Mitsubishi Chemical Group, 3M, Hitachi Ltd., Solvay SA, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003839

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles (EVs)

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Challanges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 3M

- 6.3.3 Arkema

- 6.3.4 Daikin Industries

- 6.3.5 Dow Chemical Company

- 6.3.6 BASF SE

- 6.3.7 Solvay SA

- 6.3.8 Asahi Kasei Corporation

- 6.3.9 Hitachi, Ltd.

- 6.3.10 Cabot Corporation

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Electrolyte Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.