Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636492

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636492

France Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

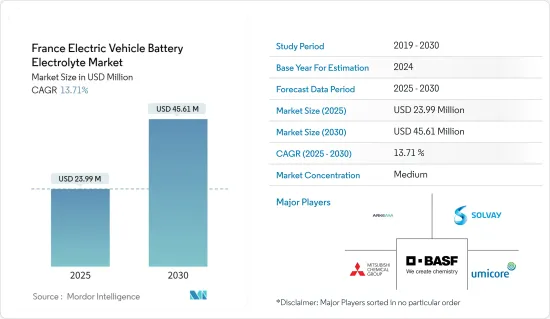

The France Electric Vehicle Battery Electrolyte Market size is estimated at USD 23.99 million in 2025, and is expected to reach USD 45.61 million by 2030, at a CAGR of 13.71% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles, government support, and the decreasing price of lithium-ion batteries are expected to drive the market in the forecast period.

- On the other hand, the lack of domestic manufacturing for battery components is expected to restrain market growth in the future.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs, creates significant growth opportunities in the France electric vehicle battery electrolyte market in the near future.

France Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In recent years, lithium-ion batteries have become the preferred choice for electric vehicles due to their high energy density, long cycle life, and overall efficiency.

- Moreover, as the cost of lithium-ion batteries continues to decline, it's set to have a pronounced effect on France's market for electric vehicle lithium-ion battery electrolytes. In 2023, the price of lithium-ion battery packs dropped by 14% from the previous year, settling at USD 139/kWh. This decrease in battery prices translates to more affordable EVs, leading to heightened adoption and an expanded market share for electric vehicles. Consequently, this rising demand will not only boost the consumption of battery components, such as electrolytes but also spur technological advancements aimed at enhancing battery performance.

- Furthermore, France has seen a surge in investments directed towards EV lithium-ion battery manufacturing, further amplifying the demand for lithium-ion battery electrolyte materials.

- For example, in February 2024, Automotive Cells Company secured a substantial USD 4.7 billion to fund the creation of three lithium-ion battery gigafactories for EVs, strategically located in France, Germany, and Italy. Such initiatives underscore the growing demand for lithium-ion battery materials, particularly electrolytes.

- Looking ahead, as France ramps up its investments in expanding EV lithium-ion battery manufacturing facilities, the market for EV lithium-ion battery electrolytes is poised for significant growth.

- As a case in point, AESC is set to inaugurate a battery gigafactory in Douai, Hauts-de-France, by 2025. The inaugural phase of this facility will churn out advanced lithium-ion batteries tailored for Renault's ECHO 5 and 4Ever crossover utility vehicles. With a capacity of 9 Gigawatt-hours, this phase is primed to power 200,000 electric cars each year. Such investments are anticipated to bolster the lithium-ion battery electrolyte market in the coming years.

- In conclusion, driven by the rising adoption of lithium-ion batteries in electric vehicles and their plummeting prices, the lithium-ion battery electrolyte segment is set for substantial growth in the forecast period.

The Growing Adoption of Electric Vehicles and Government's Support is Expected to Drive the Market

- France's policy initiatives and investments play a pivotal role in shaping the EV battery electrolyte market. Through programs like the National Low-Carbon Strategy and active participation in the European Green Deal, France is at the forefront of significant carbon reduction efforts. This dedication not only boosts the demand for electric vehicles but also intensifies the need for their batteries, subsequently driving up the demand for battery electrolytes.

- Moreover, France's engagement in the European Battery Alliance and IPCEI projects, aimed at establishing a sustainable and competitive battery supply chain in Europe, bolsters investments in battery manufacturing. Coupled with government incentives for EV adoption, these initiatives ensure a robust market for advanced battery components, including electrolytes.

- For example, in August 2023, the European Commission approved a EUR 1.5 billion initiative from France, under EU State aid rules, to support ProLogium Technologies ('ProLogium') in researching and developing next-gen electric vehicle batteries. Such backing from the government is poised to amplify EV battery manufacturing, subsequently increasing the demand for battery electrolytes.

- Significant investments in gigafactories and R&D are escalating the demand for high-performance electrolyte materials, essential for meeting the surging needs of the nation's electric vehicle sector. The International Energy Agency reported that in 2023, France's EV car sales reached 0.47 million units, up from 0.34 million in 2022.

- Looking ahead, as research and development efforts intensify for more efficient EV batteries, there's a growing opportunity for the advancement of battery electrolytes, which are vital for enhancing battery efficiency. A case in point: in July 2024, Stellantis and CEA, a prominent global research institution, unveiled a five-year partnership to craft next-generation battery cells for electric vehicles.

- Given these dynamics, it's evident that France's bolstered policies and investments in battery manufacturing are set to propel the market in the coming years.

France Electric Vehicle Battery Electrolyte Industry Overview

The France electric vehicle battery electrolyte market is moderate. Some of the major players in the market (in no particular order) include Arkema Global, BASF SE, Solvay SA, Umicore SA, and Mitsubishi Chemical Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003761

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles and Government's Support

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Lack of Domestic Manufacturing for Battery Components

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Arkema Global

- 6.3.2 BASF SE

- 6.3.3 Solvay SA

- 6.3.4 Mitsubishi Chemical Group.

- 6.3.5 Umicore SA

- 6.3.6 Targray Industries Inc.

- 6.3.7 3M Company

- 6.3.8 NEI Corporation

- 6.3.9 Cabot Corporation

- 6.3.10 Samsung SDI

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Innovation in Electrolyte Formulations

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.