Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636490

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636490

United States Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

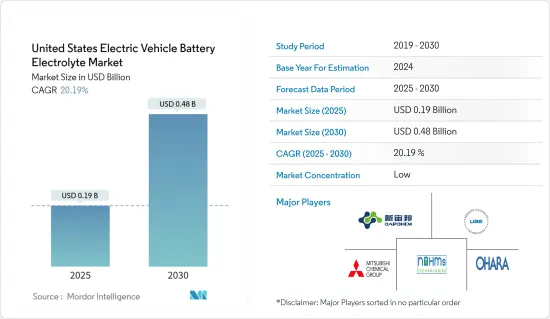

The United States Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.19 billion in 2025, and is expected to reach USD 0.48 billion by 2030, at a CAGR of 20.19% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing usage of electric vehicles, including BEVs, PHEVs, and HEVs, and favorable government policies to promote the usage of electric vehicles in the United States are expected to drive the market's growth.

- On the other hand, the supply chain gap in battery materials created by the monopoly of some countries like China is expected to restrain market growth in the future.

- Nevertheless, the ongoing research and advancement in electrolyte material and efficient electrolytes may offer opportunities for market growth.

United States Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery is Expected to Dominate the Market

- Lithium-ion batteries, pivotal for powering electric vehicles (EVs), extend the lifespan of these vehicles, thereby minimizing the frequency of battery replacements. Unlike some other battery types, lithium-ion batteries are deemed environmentally friendly, as they lack toxic materials such as lead or cadmium, making them a cleaner and safer option. Furthermore, their high power output is essential for EVs, which demand swift acceleration and elevated speeds.

- As of 2023, the United States boasts a lithium-ion battery manufacturing capacity of 114 GWh, according to the Business Council for Sustainable Energy (BCSE). With rising electric vehicle sales, the automotive sector's demand for lithium-ion batteries is poised for significant growth in the coming years. For example, the International Energy Agency reports that electric vehicle sales in the United States and Canada surged over 54% from 2021 to 2023. This uptick in lithium-ion battery usage will subsequently boost the demand for penetration electrolyte solutions, vital for transporting positive lithium ions between the cathode and anode.

- In 2023, Huntsman Corporation, a leading American chemical manufacturer, unveiled plans to boost production of the electrolyte solvent ethylene carbonate in Texas. Additionally, in collaboration with Capchem, they are establishing a plant in the United States, further bolstering the country's electric vehicle battery electrolyte solution market.

- Moreover, in March 2023, the White House unveiled the "National Blueprint for Lithium Batteries," charting the industry's course from 2021 to 2030. The blueprint emphasizes enhancing raw material sourcing and bolstering domestic lithium processing, underscoring the anticipated surge in lithium-ion battery demand in the United States driven by the electric vehicle boom.

- Given the rising adoption of lithium-ion batteries in electric vehicles and their declining prices, the segment is set for substantial growth in the coming years.

Increasing Adoption of Electric Vehicles is expected to Drive the Market

- Driven by rising consumer interest and supportive government policies, the United States is witnessing a rapid expansion in its electric vehicle (EV) battery electrolyte market.

- Technological advancements, particularly in high-nickel and electrolyte solutions, are boosting battery performance and cost-effectiveness. Concurrently, the U.S. is bolstering its domestic supply chain for critical materials such as lithium, nickel, and cobalt, aiming to reduce import reliance and ensure stability.

- In January 2024, MIT researchers unveiled a groundbreaking battery material set to transform electric vehicle power sources. This lithium-ion battery, featuring an innovative organic material-based cathode and electrolyte solution, marks a shift from the traditional cobalt or nickel usage. Such advancements are poised to amplify the nation's demand for battery electrolyte materials.

- As electric vehicle adoption surges, the United States is prioritizing the fortification of its battery manufacturing supply chain. This momentum is likely to spur domestic production of electric vehicle battery components, including electrolytes.

- In June 2023, Capchem, a China-based R&D-centric company, unveiled plans for a USD 120 million electrolyte plant in southern Ohio. Simultaneously, Dongwha Electrolyte commenced a USD 70 million facility in Tennessee, targeting an annual production of over 70,000 metric tons of electrolytes. Additionally, Soulbrain is establishing a USD 75 million electrolyte plant in Indiana, strategically located to cater to a nearby battery factory.

- Looking ahead, as EV adoption continues its upward trajectory, the United States's R&D focus on battery technology-aimed at boosting energy density, cutting costs, and extending EV range-will likely invigorate the battery cathode market.

- Data from the International Energy Agency highlights a significant jump in United States EV car sales, soaring to 1.39 million units in 2023 from 0.99 million in 2022.

- With projections of 26 million electric vehicles by 2030, the United States anticipates a need for 12.9 million charging ports, paving the way for a burgeoning electric vehicle battery cathode market.

- Given the accelerating adoption of EVs and technological strides, the United States is poised to lead the market during the forecast period.

United States Electric Vehicle Battery Electrolyte Industry Overview

The United States Electric Vehicle Battery Electrolyte Market is semi-fragmented. Some of the major companies operating in the market (in no particular order) include Advanced Electrolyte Technologies LLC, Mitsubishi Chemical Holdings, Shenzhen Capchem Technology Co., Ltd, Nohms Technologies Inc., and Ohara Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003759

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Usage of Electric Vehicles, including BEVs, PHEVs, and HEVs

- 4.5.1.2 Favorable government policies to promote the usage of electric vehicles

- 4.5.2 Restraints

- 4.5.2.1 The Supply chain gap in battery materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Advanced Electrolyte Technologies LLC

- 6.3.2 Mitsubishi Chemical Holdings

- 6.3.3 Shenzhen Capchem Technology Co., Ltd

- 6.3.4 Nohms Technologies Inc

- 6.3.5 Ohara Corporation

- 6.3.6 BASF SE

- 6.3.7 LG Chem Ltd

- 6.3.8 Targray Industries Inc.

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Ongoing Research and Advancement in Electrolyte Material

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.