Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636488

India Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

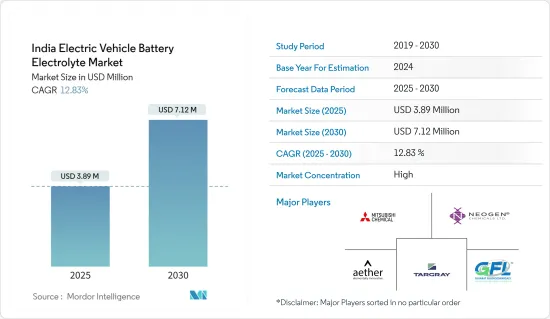

The India Electric Vehicle Battery Electrolyte Market size is estimated at USD 3.89 million in 2025, and is expected to reach USD 7.12 million by 2030, at a CAGR of 12.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles, government policies, and associated investments in them are likely to drive the market.

- On the other hand, challenges associated with raw material availability and supply is expected to have a negative impact on the market.

- Continuous research and development in electrolyte materials is expected to provide future growth opportunities for the market.

- The lithium-ion battery type is expected to be the largest market for the India Electric Vehicle Battery Electrolyte during the study period.

India Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery to Grow Significantly

- Lithium-ion batteries are at the forefront of the electric vehicle (EV) revolution. Their superior energy density and extended life cycle make them pivotal to the automotive industry's shift toward sustainable energy solutions.

- In April 2023, Neogen Chemicals bolstered its manufacturing capabilities through a partnership with Japan's MU Ionic Solutions Corporation. The agreement allows Neogen to leverage MUIS's proprietary manufacturing technology. This strategic move positions Neogen to produce 30,000 MT annually of electrolyte solutions in India, directly addressing the rising demand from domestic lithium-ion cell manufacturers. Such developments are poised to fuel the growth of the electric vehicle battery electrolyte market.

- Similarly, in April 2023, Gujarat Fluorochemicals (GFL) announced a USD 600 million investment plan over three years, targeting battery and electrolyzer production in India. Their facility in Dahej, Gujarat, will commence operations with the production of Lithium hexafluorophosphate (LiPF6), a crucial electrolyte salt for lithium-ion batteries. Starting with a production capacity of 1800 tonnes per annum (tpa), GFL plans to scale up in response to the burgeoning demand for lithium-ion batteries, underscoring the expanding electric vehicle battery electrolyte market in India.

- In December 2023, Ami Organics entered into a Memorandum of Understanding with a prominent global electrolyte firm, paving the way for battery cell and electrolyte production in Gujarat. Demonstrating its commitment to India's "Make in India" initiative, Ami Organics is investing USD 35.8 million in a dedicated electrolyte production facility.

- Over the years, lithium-ion battery prices have plummeted, driving up demand for related components. Bloomberg NEF reports that the average lithium-ion battery price in 2023 was USD 139 USD/KWh, marking a staggering fivefold reduction since 2014. This price drop has accelerated the adoption of lithium-ion batteries, suggesting a bright future for the electrolyte market.

- Given the aforementioned trends in lithium-ion batteries and electrolyte production, the electric vehicle battery electrolyte market in India is poised for significant growth in the coming years.

Government Incentives to Raise Adoption of Electric Vehicles

- Electric vehicles (EVs) play a pivotal role in curbing carbon emissions from the transportation sector. The Indian government's FAME India scheme actively promotes the adoption of electric and hybrid vehicles, targeting a transition of 30% of total transportation to electric vehicles by 2030. This anticipated surge in electric vehicle adoption is poised to benefit India's electric vehicle battery electrolyte market.

- In a parallel effort, India's Production Linked Incentive (PLI) scheme, with an approved budget of USD 3.09 billion, has bolstered domestic electric vehicle manufacturing. The PLI scheme offers automakers a government grant ranging from 13-15% of their annual electric vehicle sales value. This incentive not only aims to amplify EV sales but also assists manufacturers in mitigating the costs associated with new technology investments. Consequently, this initiative has spurred demand for electrolytes in electric vehicle batteries across India.

- Furthermore, the Electric Mobility Promotion Scheme (EMPS) champions the use of electric two-wheelers and three-wheelers while simultaneously nurturing India's electric vehicle manufacturing ecosystem. Under the EMPS, a subsidy of approximately USD 60 is granted for each kilowatt hour of battery capacity. However, this subsidy is limited to 15% of the ex-factory cost (the vehicle's price at the factory gate before taxes) or specific caps: around USD 120 for two-wheelers, USD 300 for e-rickshaws and e-carts, and USD 600 for e-autos, whichever is lower for each category. Such initiatives are anticipated to elevate the demand for components like electrolytes in India's electric vehicle batteries.

- Additionally, India's electric vehicle market has shown a consistent upward trajectory in recent years. Data from the International Energy Agency reveals that electric car sales in India reached 82,000 units in 2023, marking a staggering 70% surge from the prior year. Given this momentum, the demand for electric vehicles in India is poised for further growth, which in turn is set to invigorate the electrolyte market.

- In light of these trends and developments, the outlook for India's Electric Vehicle Battery electrolyte Market appears promising.

India Electric Vehicle Battery Electrolyte Industry Overview

The India electric vehicle battery electrolyte market is semi-consolidated. Some of the major players (not in particular order) include Neogen Chemicals, Gujarat Fluorochemicals, Mitsubishi Chemical Group, Targray Technology International Inc, and Aether Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003757

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Limited avalibility and supply of raw materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ami Organics Electrolytes Private Ltd.

- 6.3.2 Neogen Chemicals

- 6.3.3 Gujarat Fluorochemicals

- 6.3.4 3M India

- 6.3.5 BASF Shanshan Battery Materials Co.

- 6.3.6 Targray Technology International Inc

- 6.3.7 Aether Industries Limited

- 6.3.8 Tatva Chintan Pharma Chem Limited

- 6.3.9 Mitsubishi Chemical Group

- 6.3.10 S K Industries

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in electrolyte material

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.