Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636475

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636475

South America Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

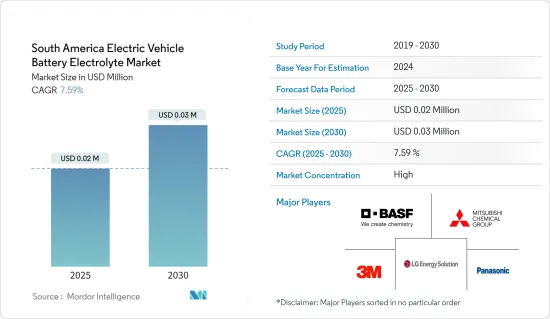

The South America Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.02 million in 2025, and is expected to reach USD 0.03 million by 2030, at a CAGR of 7.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and advancements in battery technology across the region are expected to drive the demand for the electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the technological challenges in Solid-State electrolytes can significantly restrain the growth of the electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs creates significant growth opportunities in the electric vehicle battery electrolyte market in the near future.

- Brazil is anticipated to be the fastest-growing country in the South American electric vehicle battery electrolyte market during the forecast period due to rising EV adoption.

South America Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Type to Witness Significant Growth

- As electric vehicles (EVs) gain traction in South America, the market for EV battery electrolytes, particularly those used in lithium-ion batteries, is experiencing rapid growth. This surge is largely fueled by increasing consumer demand and stringent government regulations aimed at curbing greenhouse gas emissions.

- Due to their high energy density, extended cycle life, and minimal self-discharge rate, lithium-ion batteries play a pivotal role in the EV market. Recently, the cost of lithium-ion batteries has had a pronounced impact on EV pricing. Given their significance, electrolytes play a crucial role in determining the overall costs of these batteries in the region.

- For instance, a Bloomberg NEF report highlighted that in 2023, battery prices fell to USD 139/kWh, marking a 13% drop from the previous year. With ongoing technological innovations and manufacturing improvements, projections suggest battery pack prices will further decline, hitting USD 113/kWh in 2025 and USD 80/kWh by 2030. As lithium-ion battery production ramps up-thanks to enhanced manufacturing efficiencies, bulk raw material procurement, and optimized supply chains-the cost per unit of battery electrolytes is also expected to decrease during the forecast period.

- South America, traditionally recognized for its upstream supply of raw lithium, is witnessing a burgeoning interest in establishing local industries tied to battery production, including electrolytes. This trend hints at the potential emergence of localized production facilities, which would not only curtail import dependencies but also bolster regional supply chains.

- In a notable move, in April 2023, BYD Co Ltd, the world's leading electric vehicle manufacturer, unveiled plans for a USD 290 million lithium factory in Chile's northern Antofagasta region. Such initiatives are poised to boost lithium production in the region and subsequently elevate the demand for electrolytes in lithium-ion batteries.

- Moreover, South America boasts some of the globe's largest lithium reserves, accounting for an estimated 54% of the world's lithium resources. This lithium abundance is vital for producing lithium-ion batteries that power the region's electric vehicles. In a strategic move, Argentina's government, in June 2023, pledged a hefty USD 1.7 billion investment in lithium production, underscoring its ambition to be a dominant global supplier. Such commitments are set to meet the surging lithium demand and, in turn, amplify the need for battery electrolytes.

- In summary, these developments signal a robust growth trajectory for both lithium-ion battery production and the demand for EV battery electrolytes in South America.

Brazil to Witness Significant Growth

- Brazil is solidifying its position as a key player in the South American EV battery electrolyte market. With a robust industrial foundation, a surge in regional EV adoption, and strategic initiatives, Brazil is emerging as a pivotal hub for the development and utilization of EV battery components, notably electrolytes.

- In recent years, Brazil has seen a notable uptick in EV sales, driven by heightened consumer demand, growing environmental consciousness, and government-backed incentives like tax credits and rebates. As EV adoption rises, so does the demand for lithium-ion batteries and premium battery electrolytes.

- According to the International Energy Agency, electric vehicle sales in Brazil reached 152,000 units in 2023, marking a 1.81-fold increase from 2022 and a staggering 25.8-fold jump from 2019. With the government rolling out supportive policies, sales are projected to climb further.

- Brazil's established automotive sector has laid a robust groundwork for the burgeoning EV supply chain. Numerous Brazilian companies are heavily investing in EV production, signaling a pronounced pivot towards sustainable transportation.

- In January 2024, General Motors Co. announced a USD 1.4 billion investment in Brazil over the next five years, aiming to bolster the country's EV production. This move is set to amplify the demand for EV battery electrolytes in the near future.

- In tandem, the Brazilian government is actively championing electric vehicle adoption and the requisite infrastructure development. Collaborating with both local and global leaders, the government aims to elevate EV production in the coming years.

- In May 2024, a consortium comprising Raizen, car rental giant Movida, and Chinese automaker BYD, upped its electric vehicle target to 20,000. This partnership, dedicated to advancing urban transportation in Brazil, originally set a goal of integrating 10,000 electric cars with the 99 app by the end of 2025. Such endeavors are poised to boost the demand for EV batteries and, by extension, battery electrolytes.

- Given these developments, it's evident that Brazil's initiatives and projects are set to bolster EV production and elevate the demand for EV battery electrolytes in the foreseeable future.

South America Electric Vehicle Battery Electrolyte Industry Overview

The South American electric vehicle battery electrolyte market is semi-consolidated. Some of the key players (not in particular order) are 3M Company, BASF Corporation, LG Chem Ltd, Mitsubishi Chemical Group, Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003742

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Battery Technology

- 4.5.2 Restraints

- 4.5.2.1 Technological Challenges in Solid-State Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Company

- 6.3.2 BASF Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 Mitsubishi Chemical Group

- 6.3.5 Panasonic Holdings Corporation

- 6.3.6 Solvay SA

- 6.3.7 Asahi Kasei Inc.

- 6.3.8 Albemarle Corporation

- 6.3.9 Ganfeng Lithium

- 6.3.10 Samsung SDI

- 6.3.11 Soulbrain Co.Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Electrolyte Formulations

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.