Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636462

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636462

Italy Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

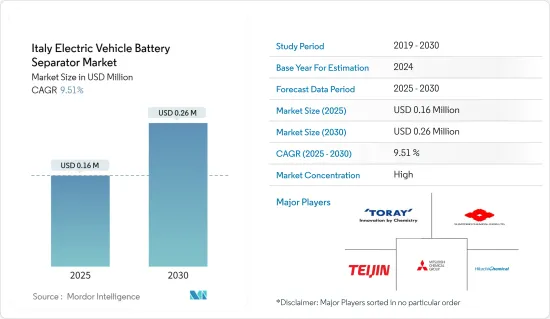

The Italy Electric Vehicle Battery Separator Market size is estimated at USD 0.16 million in 2025, and is expected to reach USD 0.26 million by 2030, at a CAGR of 9.51% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

Italy Electric Vehicle Battery Separator Market Trends

Growing Adoption of Electric Vehicles Drives the Market

- In Italy, the surging demand for electric vehicles (EVs) is propelling the growth of the EV battery separator market. As the country pivots towards clean energy, the spotlight is firmly on electric vehicles, a segment drawing heightened attention from companies. This escalating consumer interest is fueled by heightened environmental consciousness, the economic benefits of owning an EV, and technological strides in the EV domain.

- Recently, Italy has seen a notable uptick in electric vehicle (EV) sales. The International Energy Agency (IEA) highlighted that in 2023, EV sales hit 136,000 units, a 19.29% jump from the previous year. This rising consumer inclination not only accelerates EV adoption but also amplifies the demand for batteries and battery separators in the region.

- To bolster electric vehicle adoption, the Italian government has introduced a suite of incentives and subsidies. These encompass tax breaks, financial grants for electric car purchases, and bolstered investments in charging infrastructure. Such initiatives resonate with broader European Union endeavors to mitigate carbon emissions and achieve climate targets.

- Specifically, in 2023, Italy pledged an annual allocation of EUR 650 million (USD 709 million) for both 2023 and 2024. This funding aims to stimulate purchases of electrified and low-emission vehicles. The commitment includes subsidies for plug-in hybrids and hybrids, with potential grants reaching up to EUR 4,000 (USD 4,368) under certain criteria. These incentives, spanning tax rebates and infrastructure investments, are poised to significantly elevate the demand for EV batteries and, consequently, battery separators in the near future.

- Additionally, Italy's automotive landscape is witnessing a surge in investments channeled towards EV production. As Italian companies expand into EV manufacturing, there's a marked increase in the demand for premium battery components, particularly separators. This growth underscores the industry's dedication to both innovation and sustainability.

- For example, in April 2024, Ferrari inaugurated a state-of-the-art laboratory dedicated to lithium battery cell research, aiming to roll out its inaugural full-electric supercar by the close of 2025. Collaborating with the University of Bologna, the facility will delve into solid states, rapid charging, thermal charging, and ensuring cell safety and performance. Such initiatives are not only broadening the electric vehicle lineup in the region but are also pivotal in driving the expansion of the EV battery separator market.

- Given these developments, the trajectory of EV demand and the corresponding surge in the need for EV battery separators during the forecast period appears robust.

Lithium-Ion Battery Type Dominate the Market

- Li-ion batteries, known for their high energy density, long cycle life, and low self-discharge rate, are the preferred choice for electric vehicles (EVs). This dominant preference not only propels the growth of the EV battery separator market but also shapes the broader trajectory of the electric vehicle industry.

- Key market players are boosting their R&D investments and production capabilities, intensifying competition and driving prices down. Bloomberg NEF highlights that, despite a general uptick in average battery pack prices for EVs and battery energy storage systems (BESS), 2023 witnessed a significant drop. Prices fell to USD 139/kWh, marking a 13% decrease. Projections suggest this trend will persist, with prices anticipated to reach USD 113/kWh by 2025 and plummet further to USD 80/kWh by 2030, driven by relentless technological and manufacturing advancements.

- Advancements in lithium-ion battery technology-like increased energy density, enhanced safety, and better charging efficiency-are catalyzing the development of new separator materials. These separators, designed to meet the high energy and thermal demands of Li-ion batteries, prioritize safety and reliability. This demand not only fuels innovation but also amplifies the need in the separator market.

- In June 2023, ProLogium introduced a revolutionary battery architecture, marking a significant leap in 30 years of lithium-ion battery evolution. By replacing the conventional polymer separator film with a ceramic variant, ProLogium has set new benchmarks in the lithium-ion battery domain for EVs. Such breakthroughs are anticipated to surge the demand for advanced lithium battery separators in the coming years.

- Italy's burgeoning gigafactories underscore its ambition to dominate Europe's battery landscape. These expansive facilities, primarily dedicated to Li-ion battery production, are amplifying the demand for specialized separators.

- In February 2024, the Automotive Cells Company secured a whopping USD 4.7 billion in funding to establish three lithium-ion battery gigafactories in France, Germany, and Italy. This initiative, backed by industry giants like Stellantis, Mercedes-Benz, and Saft (a TotalEnergies subsidiary), boasts a gigafactory design that emphasizes not just steady battery production but also scalability. This highlights the critical need for a reliable separator supply in the region's future.

- Given these developments, the production of lithium-ion batteries is set to surge, leading to a significant uptick in the demand for EV battery separators during the forecast period.

Italy Electric Vehicle Battery Separator Industry Overview

Italy's electric vehicle battery separator market is semi-consolidated. Some key players (not in particular order) are Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, and Teijin Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003729

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group Corporation

- 6.3.2 Hitachi Chemical Company Ltd

- 6.3.3 Toray Industries Inc.

- 6.3.4 Sumitomo Chemical Co. Ltd

- 6.3.5 Teijin Ltd

- 6.3.6 Solvay S.A.

- 6.3.7 EniChem

- 6.3.8 Italvolt S.p.A.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.