Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636447

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636447

Asia Pacific Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

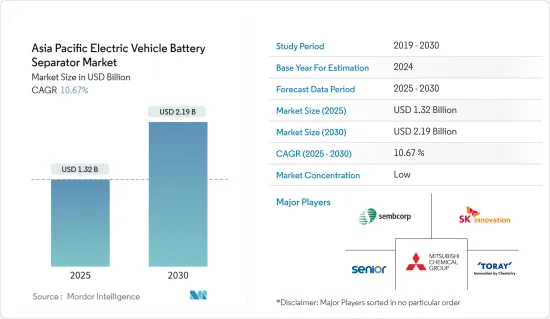

The Asia Pacific Electric Vehicle Battery Separator Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 2.19 billion by 2030, at a CAGR of 10.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, high production cost, especially for advanced separators with higher thermal stability and mechanical strength, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- China is poised to command a substantial market share, primarily due to its dominance in electric vehicle battery manufacturing capacity.

Asia Pacific Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass through.

- Recently, lithium-ion batteries have become the dominant technology in electric vehicles (EVs), thanks to their high energy density, long cycle life, and efficiency.

- Moreover, as countries like China, Japan, and South Korea lead the way, the push for greener transportation has spurred a rise in EV production across the Asia-Pacific (APAC) region.

- As lithium-ion battery prices continue to decline, their adoption in EVs is set to rise, subsequently increasing the demand for lithium-ion battery separators. Notably, in 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh.

- Ongoing R&D efforts are enhancing battery performance, cost efficiency, and safety, spotlighting advancements in battery separators that boost lithium-ion battery efficacy.

- For example, in May 2023, SKIET and Sunwoda inked a memorandum of understanding, with SKIET set to supply battery separators. The collaboration also includes a technology-sharing agreement, aiming to enhance separator supply in terms of technological prowess, quality, and competitive pricing.

- Given the rising demand for lithium-ion batteries and advancements in battery separators for EVs, this segment is poised to capture a substantial market share.

China is Expected to have a Significant Share

- China stands as the leading producer and consumer of electric vehicles in the Asia-Pacific region. The nation's vigorous push towards electrification has spurred a significant demand for electric vehicle batteries, subsequently propelling the market for battery separators.

- To promote the adoption of EVs, the Chinese government has rolled out a series of policies and subsidies. These measures encompass tax incentives, direct financial support to EV manufacturers, and substantial investments in charging infrastructure, all of which fortify the battery separator market.

- Moreover, with a heightened emphasis on curbing air pollution and a commitment to achieving carbon neutrality by 2060, China's embrace of EVs is rapidly escalating. This surge is directly amplifying the demand for high-performance lithium-ion batteries and, consequently, battery separators.

- Data from the International Energy Agency reveals that China's EV car sales reached 8.1 million units in 2023, a notable rise from 5.9 million units in 2022. Looking ahead, as the nation continues to innovate in electric vehicle battery technology, the appetite for EV battery separators is set to grow. Domestic firms are pouring resources into R&D, aiming to craft advanced separators that promise enhanced safety, superior efficiency, and cost-effectiveness.

- As an illustration, in September 2023, Shenzhen Senior Technology Material Co., Ltd., in collaboration with Bruckner Maschinenbau, launched a 5th generation BSF production line for battery separators, boasting an impressive annual capacity of 250 million square meters. Such strategic investments are poised to amplify the demand for battery separators in the coming years.

- Given the surging adoption of EVs and ongoing technological advancements, China is poised to maintain its market dominance in the foreseeable future.

Asia Pacific Electric Vehicle Battery Separator Industry Overview

The Asia Pacific electric vehicle battery separator market is semi-fragmented. Some of the major players in the market (in no particular order) include Senior plc, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sembcorp Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003714

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High Production Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Japan

- 5.3.5 Malaysia

- 5.3.6 Thailand

- 5.3.7 Indonesia

- 5.3.8 Vietnam

- 5.3.9 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Senior plc

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Toray Industries Inc.

- 6.3.5 Sembcorp Industries Ltd

- 6.3.6 UBE Corporation

- 6.3.7 Teijin Ltd

- 6.3.8 Hitachi Chemical Company Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.