Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636446

Europe Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

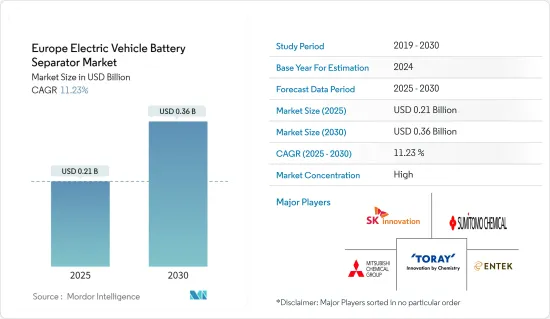

The Europe Electric Vehicle Battery Separator Market size is estimated at USD 0.21 billion in 2025, and is expected to reach USD 0.36 billion by 2030, at a CAGR of 11.23% during the forecast period (2025-2030).

Key Highlights

- The growing adoption of electric vehicles and the decreasing price of lithium-ion batteries are expected to drive the market over the medium term.

- Conversely, the European battery sector grapples with rising raw material costs. Key materials, especially polyethylene (PE) and polypropylene (PP) - crucial for separator manufacturing - are seeing significant price hikes. This trend poses a potential challenge to the market's expansion.

- However, heightened research and development into alternative battery chemistries, including solid-state batteries, advanced lithium-ion variants, and sodium-ion batteries, present promising opportunities for future market growth.

- Germany is set to play a pivotal role in the market's expansion during the forecast period, with cities like Berlin, Hamburg, and Munich leading the demand surge.

Europe Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- In recent years, the European nation has seen a notable surge in its lithium-ion battery market. Sales of lithium-ion batteries in the country have been significantly bolstered by promising investments from public-private partnership projects, particularly in civil infrastructure and public transit.

- In addition to the continent's growing adoption of electric vehicles, battery separators are reaping benefits from various government initiatives aimed at curbing carbon emissions. These initiatives serve as a catalyst for growth. Furthermore, the introduction of lithium-ion batteries enhanced with polyolefins and ceramic oxides-known for their stability, safety, and ability to reduce shrinkage and particle penetration-adds further momentum to the market.

- Globally, vehicles are increasingly adopting hybridization and electrification. The spectrum includes hybrid electric vehicles (HEVs), plug-in hybrids, and fully electric vehicles (EVs). Europe, being the initiator of the Paris Climate Pact, has actively championed the transition from internal combustion vehicles to EVs, witnessing substantial growth in the process.

- As per the European Transport & Environment Report 2023, the UK's lithium mining capacity is projected to reach 7,000 tonnes by 2030. Additionally, in November 2023, the UK government unveiled a USD 2.5 billion Advanced Manufacturing Plan. This plan encompasses a new Battery Strategy, backed by approximately USD 54 million in government funding, aimed at fostering a competitive battery supply chain by 2030. This initiative seeks to bolster supply chain resilience as automakers pivot towards localized battery production, aligning with the broader transition to battery electric vehicles (BEVs). The Battery Strategy is set to extend focused support for zero-emission vehicles, batteries, and their supply chains, with dedicated capital and R&D funding spanning five years, up to 2030.

- In 2023, global separator production leader Alteo, in collaboration with W-Scope, inked a deal to establish Europe's largest separator production facility. This venture is integral to nurturing both French and European value chains, especially in light of multiple gigafactory projects. Notably, this facility will be Europe's sole site powered entirely by electric energy, and the separators produced will feature SEPal's high-performance aluminas.

- Given these developments, the lithium-ion battery segment is poised to lead the European electric vehicle battery separator market in the coming years.

Germany is Expected to Dominate the Market

- Germany stands as a prominent hub for electric vehicles (EVs), with the government actively promoting their adoption to curb emissions. Boasting one of the world's most advanced charging infrastructures, Germany leads Europe as its largest EV market. Echoing global trends, Germany has witnessed a surge in EV demand, driven by a collective shift towards sustainable transportation solutions, subsequently bolstering the battery separator market.

- With the rising adoption of EVs by consumers and businesses alike, the demand for battery separators has surged in tandem. This momentum is fueled by environmental concerns, government incentives championing EV adoption, and breakthroughs in battery technology, rendering EVs more accessible and practical.

- By 2023, sales of plug-in hybrid electric vehicles in Germany surpassed 180,000 units. Setting its sights on the future, Germany aims to have 15 million EVs gracing its roads by 2030. Central to this ambitious goal are the government's supportive policies and incentives. For instance, both the government and EV manufacturers in Germany contribute EUR 2,000 each, totaling EUR 4,000 for electric cars valued up to EUR 60,000. Additionally, EVs enjoy a decade-long exemption from vehicle tax, complemented by a special tax bonus based on battery size.

- Germany's allure extends beyond its borders, drawing global investments to establish lithium-ion battery manufacturing hubs. A testament to this trend, in 2023, Contemporary Amperex Technology Co. Limited (CATL) inaugurated its new lithium-ion battery cell plant in Germany, starting with an 8 GWh annual capacity, with plans to scale up to 14 GWh.

- In another significant move, Northvolt AB, backed by a EUR 1 billion commitment from the German government, unveiled plans for its second battery manufacturing facility in northern Germany in May 2023.

- Looking ahead, European Industrial Policy forecasts Europe's battery production capacity to surpass 1,000 GWh by 2030, boasting a robust annual growth rate exceeding 20%. The newly introduced EU Battery Regulation emphasizes bolstering localized supply chains. Given these projections, the demand for wet process separators in Germany is poised for substantial growth.

- Given these dynamics, as Germany's electric vehicle landscape continues to expand, the demand for electric vehicle battery separators is set to rise correspondingly during the forecast period.

Europe Electric Vehicle Battery Separator Industry Overview

The Europe Electric Vehicle Battery Separator Market is semi-consolidated. Some of the major players in the market (in no particular order) include Entek Manufacturing LLC, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sumitomo Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003713

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Escalating Raw Material Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Material

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Spain

- 5.3.5 France

- 5.3.6 Netherlands

- 5.3.7 Belgium

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek Manufacturing LLC

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Toray Industries Inc.

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 UBE Corp

- 6.3.8 Teijin Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.3.11 Senior Europe

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.