Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636445

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636445

South America Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 300 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

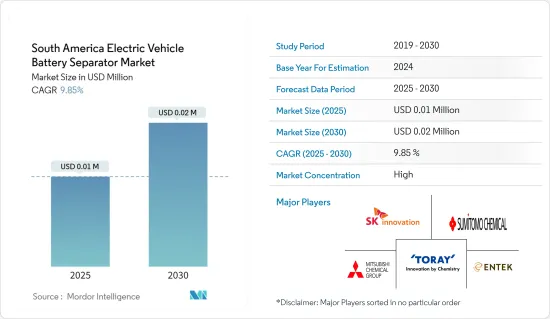

The South America Electric Vehicle Battery Separator Market size is estimated at USD 0.01 million in 2025, and is expected to reach USD 0.02 million by 2030, at a CAGR of 9.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- Brazil is expected to have significant growth in the market during the forecast period, with most of the demand coming from cities like Sao Paulo, Rio de Janeiro and Salvador.

South America Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass through. Due to advantages like high energy density, a relatively long cycle life, and efficiency, lithium-ion batteries have become the predominant choice for electric vehicles.

- In recent years, South America has emerged as a hub, boasting over 60% of the world's lithium reserves. This has attracted investments from various countries and multinational corporations, all keen on harnessing lithium for batteries in electronics, mobile devices, and electric vehicles.

- Data from the United States Geological Survey highlights that Chile, Argentina, and Bolivia together hold about 58% of global lithium reserves. Countries like Brazil, Chile, and Argentina have seen a surge in renewable energy installations, particularly solar. These renewable sources necessitate energy storage systems, prominently featuring lithium-ion batteries, where separators play a crucial role.

- In 2023, lithium production in Argentina hit a record 9,600 metric tons, marking a 46% increase from the previous year. As a leading global lithium producer, Argentina stands at the forefront. With the region's electric vehicles (EVs) poised for growth, there's a significant opportunity to ramp up lithium-ion battery and separator production.

- Moreover, as lithium-ion battery prices decline, their adoption in electric vehicles is set to rise, subsequently amplifying the demand for lithium-ion battery separators. In 2023, lithium-ion battery pack prices dropped 14% from the prior year, settling at USD139/kWh.

- With ongoing research and development focused on creating more stable and efficient battery separators for electric vehicles, the demand for lithium-ion battery separators is on an upward trajectory.

- Given these dynamics, the lithium-ion battery segment is poised to lead the South American Electric Vehicle Battery Separator Market in the coming years.

Brazil is expected to Dominate the Market

- Brazil stands as one of South America's largest economies and ranks as the 13th-largest globally. Historically, the nation leaned heavily on oil and hydroelectricity for its energy needs, but this reliance has evolved in recent years.

- Recently, the Brazilian government exempted hybrid and electric vehicles from the Imposto Sobre Produtos Industrializados (IPI) tax, a levy on domestically produced or imported industrial products. This initiative is poised to invigorate the EV market, subsequently boosting demand for separators, a crucial component of lithium-ion batteries (LIB).

- The Rota 2030 program, spearheaded by the Brazilian government, seeks to enhance energy efficiency in the transportation sector, further energizing the nation's electric vehicle market. As electric vehicle adoption surges, it's set to significantly bolster Brazil's LIB market, given the rising need for LIBs in manufacturing during the forecast period.

- Moreover, 2023 witnessed a remarkable surge in electric and hybrid vehicle sales in Brazil. The nation recorded sales of over 94,000 units, marking an impressive 88.7 percent increase from the previous year. Cumulatively, since 2006, Brazil has seen sales touch 222,608 units. This trend is anticipated to drive demand for electric vehicle battery separators, fueling further growth.

- In April 2024, Sigma Lithium made headlines by finalizing its decision to double the production of its distinctive Quintuple Zero Green Lithium. The production will leap from the current 270,000 tons per year to a staggering 520,000 tons per year. The company has commenced on-site construction activities this month, focusing on earth civil works, foundation, and infrastructure installation, with mobilization of equipment and around 200 workers. Sigma Lithium aims to have its Phase 2 Industrial Plant operational by the end of 2024, with the inaugural production slated for the first quarter of 2025.

- Given these developments, Brazil is poised to lead the Electric Vehicle Battery Separator Market in South America.

South America Electric Vehicle Battery Separator Industry Overview

The electric vehicle battery separator market is semi-consolidated. Some of the major players in the market (in no particular order) include Entek Manufacturing LLC, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sumitomo Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003712

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Material

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek Manufacturing LLC

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Toray Industries Inc.

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 UBE Corp

- 6.3.8 Teijin Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.