Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636444

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636444

China Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

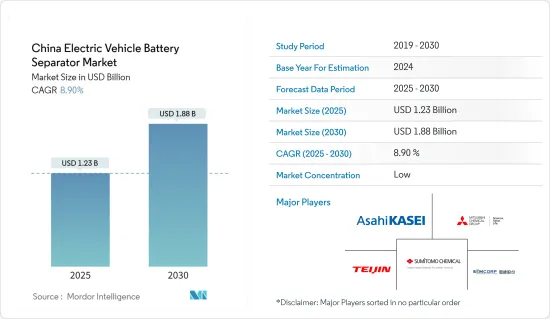

The China Electric Vehicle Battery Separator Market size is estimated at USD 1.23 billion in 2025, and is expected to reach USD 1.88 billion by 2030, at a CAGR of 8.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and suppotive government initiatives are expected to drive the market during the forecast period.

- On the other hand, supply chain challanges are likely to hinder the market growth during the forecast period.

- Nevertheless, technological innovations and development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

China Electric Vehicle Battery Separator Market Trends

Increasing Demand for Electric Vehicles

- China stands as the world's largest electric vehicle (EV) market, with the surging demand for EV batteries propelling the growth of the battery separator market. The International Energy Agency reported that in 2023, China sold 8.1 million electric vehicles, encompassing both Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV).

- With the rising demand for EVs comes an increased need for sophisticated separators that enhance battery performance. These separators play a crucial role in preventing short circuits and ensuring battery stability, especially as automakers focus on improving vehicle range, efficiency, and safety.

- China dominates the global EV landscape, boasting over half of the world's electric automobiles and surpassing its 2025 sales target for new energy vehicles (NEVs). This surge is bolstered by government incentives and supportive policies.

- For example, in June 2023, aiming to further stimulate domestic EV sales, a coalition of the Ministry of Finance (MOF), State Taxation Administration (STA), and Ministry of Industry and Information Technology (MIIT) announced an extension of the "Vehicle Purchase Tax Reduction and Exemption Policy for New Energy Vehicles." This tax exemption, effective from January 1, 2024, is set to continue until December 31, 2027.

- Furthermore, China's ambitious EV adoption targets, underpinned by robust government backing, have catalyzed the growth of its battery manufacturing sector. This surge is evident in substantial investments directed towards expanding production capacities, pioneering research & development, and pushing the boundaries of battery technologies.

- In a notable move, in August 2024, Xiaomi, the renowned Chinese tech titan, broke ground on its second EV plant in Beijing. Documents from the Beijing city authorities reveal that Xiaomi, already a dominant player in the smartphone arena, secured the land on July 25 and promptly initiated construction the very next day. Strategically, this new facility is rising right next to Xiaomi's inaugural EV plant. As manufacturers ramp up to cater to the escalating EV demand, the significance of battery separators becomes increasingly evident.

- Thus, as the EV industry evolves with a keen focus on innovation and performance, battery separators emerge as pivotal players, fueling market growth in China. With the EV market on an upward trajectory, the demand for these critical battery components is set to soar.

Lithium-Ion Batteries Segment to Dominate the Market

- In China, the lithium-ion battery segment plays a crucial role in the burgeoning electric vehicle (EV) ecosystem. In 2023, China accounted for 60% of all new electric car registrations. As a leading global producer and consumer of electric vehicles, China's influence is paramount in the evolution and acceptance of lithium-ion batteries, which are indispensable for energizing these vehicles.

- Lithium-ion batteries, known for their energy density and efficiency, depend on high-performance separators for safety and reliability. These separators not only prevent short circuits between the anode and cathode but also facilitate efficient ion transfer during charging and discharging.

- In China, advancements in separator materials like polyethylene (PE) and polypropylene (PP) have enhanced the performance, durability, and thermal stability of lithium-ion batteries.

- For example, in January 2024, a team from the Institute of Modern Physics (IMP) at the Chinese Academy of Sciences (CAS) and the Advanced Energy Science and Technology Guangdong Laboratory unveiled new polyethylene terephthalate (PET) separators. These separators, designed for lithium-ion batteries, can endure high temperatures, directly boosting electric vehicle performance and consumer appeal.

- Notably, the average price of lithium-ion batteries has consistently fallen, hitting approximately USD 139 per kWh in 2023. This marks an over 82% drop since 2013. Projections suggest this trend will persist, with prices potentially dipping below USD 113/kWh by 2025 and reaching USD 80/kWh by 2030. As lithium-ion battery prices decline, making electric vehicles more accessible, there's a corresponding surge in demand for battery separators. Manufacturers, keen on optimizing costs and boosting performance, are driving this demand.

- Moreover, China's ambition to have 40% of all vehicle sales be electric further underscores the rising demand for EV batteries and their components, including separators.

- Thus, with technological strides, a burgeoning EV market, and plummeting battery prices, China's battery separator landscape is set for significant expansion.

China Electric Vehicle Battery Separator Industry Overview

The Chinese electric vehicle battery separator market is semi-fragmented. Some of the major players (not in particular order) include Shanghai Energy New Materials Technology Co., Ltd. (SEMCORP), Teijin Limited, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, and Asahi Kasei Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003711

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Challanges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shanghai Energy New Materials Technology Co., Ltd. (SEMCORP)

- 6.3.2 Teijin Limited

- 6.3.3 Sumitomo Chemical Co., Ltd.

- 6.3.4 Mitsubishi Chemical Group Corporation

- 6.3.5 Asahi Kasei Corporation

- 6.3.6 Entek International

- 6.3.7 Shanghai PTL New Energy Technology Co., Ltd.

- 6.3.8 Toray Industries Inc.

- 6.3.9 UBE Corp

- 6.3.10 SK Innovation Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Battery Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.