Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636434

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636434

Global Hermetic Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 240 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

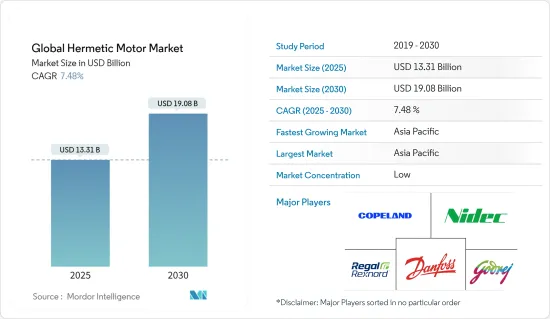

The Global Hermetic Motor Market size is estimated at USD 13.31 billion in 2025, and is expected to reach USD 19.08 billion by 2030, at a CAGR of 7.48% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the expansion of the global cold chain industry and the increasing demand in the HVAC industry are going to drive the global hermetic market.

- On the other hand, the market faces challenges due to high initial costs, limited repairability, and application-specific dependency.

- Nevertheless, due to ongoing technological advancements, the global hermetic motor market is poised for significant opportunities. Innovations, such as high-efficiency designs, smart technologies, advanced materials, and eco-friendly systems, are expected to drive demand and open new avenues for growth, despite existing challenges.

- Asia-Pacific recently held a significant market share, and it is expected to be the largest and fastest market during the forecast period.

Global Hermetic Motor Market Trends

Less than 1HP Power Rated Hermetic Motor is Expectected to be a Significant Segment

- Household appliances such as refrigerators and water coolers, along with commercial refrigeration operations, frequently utilize hermetic compressors rated at less than 1 horsepower. These compressors are crucial for food storage, as they maintain low temperatures that slow down bacterial reproduction and reduce spoilage.

- Hermetic compressors are classified based on horsepower ratings and back pressure levels. For instance, compressors rated at 1/5-1/4 HP, which produce low back pressure, are commonly found in freezers and refrigerators. In contrast, those rated at 1/10-1/5 HP, which provide medium back pressure, are ideal for beverage displays. Lastly, compressors rated at 1/16-1/2 HP, designed for high back pressure, are used in coolers and dehumidifiers.

- From 2017 to 2021, the refrigerated storage capacity in the United States grew from 3.6 billion cubic feet to 3.73 billion cubic feet. However, after peaking in 2021, it saw a slight dip to 3.69 billion cubic feet in 2023.

- Even with the 2023 dip in refrigerated storage capacity, the demand for hermetic compressors rated under 1 horsepower remains robust. This demand is fueled by their essential role in pharmaceutical refrigeration, biopharmaceutical manufacturing, and the food and beverage sector, all bolstered by rising healthcare expenditures and significant investments in efficient refrigeration systems.

- As of January 2024, the North American food and beverage industry is gearing up for substantial growth, with plans for around 66 new projects. This includes nearly 24 new plants and 16 expansion initiatives, underscoring the sector's vigorous investment and development.

- Given these trends, hermetic motors rated at less than 1HP (Horse Power) are poised to dominate the market.

Asia-Pacific Region is Expected to Dominate the Market

- Rapid industrial growth in the Asia-Pacific region, fueled by its expanding population, is driving a heightened demand for efficient refrigeration systems. These systems are crucial across various sectors, including food and beverage, pharmaceuticals, and manufacturing, subsequently propelling the market for hermetic motors.

- Economic advancements in nations such as China and India are translating to increased disposable incomes. With this boost in spending power, there's a notable uptick in demand for both household and commercial refrigeration appliances, which predominantly depend on hermetic motors.

- Furthermore, government initiatives, technological strides in refrigeration, and a wave of new projects in the food, beverage, and semiconductor sectors are amplifying this demand. Collectively, these elements paint a bright future for the hermetic motor market in the Asia-Pacific.

- Take, for example, the Semicon India 2024 event. Here, the Modi government showcased its commitment to India's semiconductor industry, offering 50% financial backing and fostering international partnerships. Such initiatives underscore the rising need for precise environmental controls and efficient cooling solutions, hinting at a surge in hermetic motor demand within semiconductor manufacturing.

- In another instance, May 2024 saw China launching its third state-backed investment fund, with a hefty USD 47.5 billion capital, all aimed at fortifying its semiconductor landscape, as reported by a government-run companies registry.

- In May 2024, Shin-Etsu Chemical Co. Ltd unveiled its new venture, Shin-Etsu Silicone (Pinghu) Co. Ltd, in Zhejiang Province, China. This initiative, featuring a fresh plant for silicone products, underscores a major leap in its silicone business. With this manufacturing expansion, the appetite for hermetic motors continues to rise.

- Given these dynamics, the Asia-Pacific is poised to lead the hermetic motor market.

Global Hermetic Motor Industry Overview

The Global hermetic motor market is semi-fragmented. Some of the key players in this market (in no particular order) include Copeland Corporation LLC, Nidec Corp, Danfoss A/S, Godrej Industries Limited, and Regal Rexnord Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003664

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD Billion, Till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Expansion of the Global Cold Chain Industry

- 4.5.1.2 Increasing Demand in HVAC Industry

- 4.5.2 Restraints

- 4.5.2.1 High Initial Costs, Limited Repairability and Application Specific Dependency

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 AC Hermetic Motors

- 5.1.2 DC Hermetic Motors

- 5.2 Power Rating

- 5.2.1 Less than 1 HP

- 5.2.2 1 - 5 HP

- 5.2.3 Above 5 HP

- 5.3 Application

- 5.3.1 Refrigeration Compressors

- 5.3.2 Air Conditioning Units

- 5.3.3 Industrial Refrigeration

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Turkey

- 5.4.2.7 Russia

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Australia

- 5.4.3.4 Malaysia

- 5.4.3.5 Thailand

- 5.4.3.6 Indonesia

- 5.4.3.7 Vietnam

- 5.4.3.8 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Qatar

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-east and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Copeland LP

- 6.3.2 Nidec Corporation

- 6.3.3 Man Energy Solutions SE

- 6.3.4 Danfoss A/S

- 6.3.5 Tecumseh Products Company LLC

- 6.3.6 Huayi Compressor Co. Ltd

- 6.3.7 Godrej Lawkim Motors

- 6.3.8 Regal Rexnord Corporation

- 6.3.9 Frascold SPA

- 6.3.10 ABB LTD

- 6.4 List of Other Prominent Companies

- 6.5 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.