PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636432

Shipbroking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

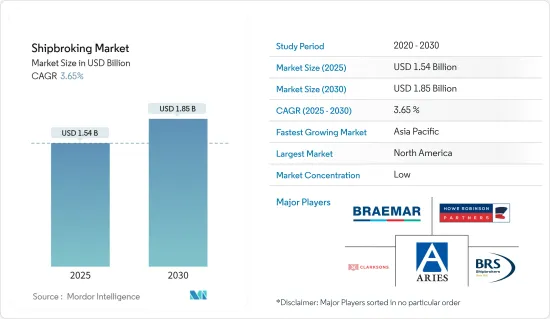

The Shipbroking Market size is estimated at USD 1.54 billion in 2025, and is expected to reach USD 1.85 billion by 2030, at a CAGR of 3.65% during the forecast period (2025-2030).

Global trade trends, the shipping industry's health, and geopolitical shifts significantly shape the shipbroking market. Shipbrokers typically specialize in specific types of vessels, such as dry bulk carriers, tankers, container ships, or offshore support vessels. Each vessel type has its market dynamics and requires specialized knowledge. Freight rates significantly shape the shipbroking landscape, responding to supply and demand, vessel availability, cargo volumes, and trade routes. These rate fluctuations directly influence the profitability of shipbroking activities, be it chartering or vessel transactions.

The shipbroking sector is notably sensitive to various influences, including economic downturns, geopolitical tensions, regulatory shifts, and alterations in global trade patterns. These factors collectively sway vessel demand, supply, and overall market conditions. Moreover, the shipbroking industry is witnessing a digital metamorphosis. Online platforms and digital tools are now pivotal, streamlining processes, bolstering market transparency, and fostering more efficient connections among buyers, sellers, owners, and charterers.

Shipbroking Market Trends

Rise in Oil and Gas Industry is Driving the Shipbroking Market

The rise in the oil and gas industry has had a significant impact on the shipbroking market. The rising demand for oil and gas underscores the critical importance of efficient transportation and logistics. Shipbrokers play a crucial role in connecting buyers and sellers, negotiating contracts, and arranging the shipment of these valuable resources. They help ensure that oil and gas are transported safely and efficiently, meeting the demands of the industry. The growth of the oil and gas industry directly drives the demand for shipbroking services.

The oil and gas industry depends significantly on maritime transportation for moving crude oil, refined petroleum products, LNG, and other related commodities. Tankers, including crude oil tankers and LNG carriers, are essential for transporting these energy resources across oceans and between continents. As the oil and gas industry expands or experiences increased production, there is a corresponding need for more vessels to transport these commodities.

Growing Shipbroking Market in Asia

Asia-Pacific remains a pivotal center for global shipping, commanding a substantial share of the world's seaborne trade. Significant shifts have been witnessed in the shipbroking market across Asia in recent years. Notably, China has solidified its position as a leading force in the regional shipbroking landscape, with many prominent domestic firms expanding operations throughout Asia. Chinese brokers now wield considerable influence in critical shipping lanes and commodity exchanges.

Moreover, Asian shipbrokers are diversifying their offerings, moving beyond traditional chartering and sales to include services like freight derivatives, consultancy, and data analytics, aligning with their clients' changing demands. By embracing digitalization, Asian shipbrokers increasingly turn to online trading platforms and data analytics tools. This tech adoption is enhancing industry efficiency and bolstering transparency and decision-making processes.

Shipbroking Industry Overview

The shipbroking market is fragmented and consists of many players. The market is expected to grow during the forecast period due to factors such as e-commerce, technology integration, and growing economies. Major regional companies have embraced modern technologies like warehousing management systems, automation, and transportation management systems. These adoptions have enhanced their planning and tracking capabilities, leading to heightened productivity and a more compelling value proposition. Some major players include Aries Shipbroking (Asia) Pte Ltd, BRS Group, Braemar Shipping Services PLC, Clarkson PLC, and Howe Robinson Partners.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Maritime Transport is Driving the Market

- 4.2.2 The Increasing Interconnectedness of Global Markets

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Shipping Rates is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Rise in Digital Technologies has Opened up New Avenues for Shipbrokers

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Dry Cargo Broking

- 5.1.2 Tanker Broking

- 5.1.3 Container Vessel Broking

- 5.1.4 Other Types

- 5.2 By Service

- 5.2.1 Charting

- 5.2.2 Sales and Purchases

- 5.2.3 Offshore Services

- 5.2.4 Newbuilding Services

- 5.2.5 Salvage &Towage Services

- 5.3 By Industry

- 5.3.1 Oil and Gas

- 5.3.2 Manufacturing

- 5.3.3 Aerospace and Defense

- 5.3.4 Government

- 5.3.5 Other Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 Aries Shipbroking (Asia) Pte Ltd

- 6.2.2 BRS Group

- 6.2.3 Braemar Shipping Services PLC

- 6.2.4 Clarkson PLC

- 6.2.5 Howe Robinson Partners

- 6.2.6 Simpson Spense Young

- 6.2.7 Fearnleys A/S

- 6.2.8 ACM Shipping Group PLC

- 6.2.9 Chowgule Brothers Pvt. Ltd

- 6.2.10 Affinity (Shipping) LLP*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US