PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636429

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636429

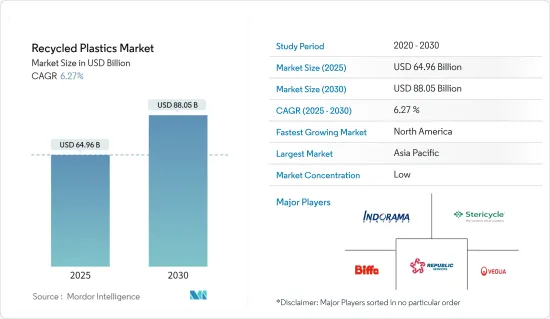

Recycled Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Recycled Plastics Market size is estimated at USD 64.96 billion in 2025, and is expected to reach USD 88.05 billion by 2030, at a CAGR of 6.27% during the forecast period (2025-2030).

Recycled plastics are the result of repurposing waste plastic into valuable items. The process involves sorting, cleaning, extruding, reprocessing, and identifying the plastic. With the prevalent global issue of non-biodegradable plastics, recycling stands out as a crucial solution to combat the environmental accumulation of polymers.

Technological advancements in recycling are pivotal in driving the recycled plastics market. Innovations like chemical recycling and improved sorting methods have significantly boosted the efficiency and quality of recycled plastics. Moreover, as consumers increasingly prioritize sustainability, manufacturers across industries, from automotive to consumer goods, are adopting recycled materials. This shift is evident in the production of various items, including car parts, packaging, and household goods. With these advancements and the growing demand for sustainable solutions, the market is poised for substantial growth in the coming years.

Recycled Plastics Market Trends

Increasing Adoption of Recycled Plastic in Packaging Industries

Key players in the automotive, electrical and electronics, and packaging sectors are increasingly turning to recycled plastics, driving the demand for these materials. These sectors collectively consume close to 6 million tons of plastic packaging each year. The food and beverage industry is at the forefront of the push for food-safe packaging, propelling the use of recyclable polymers. These polymers, when employed as packaging barriers, not only ensure food safety but also present a sustainable option to traditional plastics, thereby expanding their market reach.

Recycled polyethylene terephthalate (PET) stands out as the preferred choice for crafting water and beverage bottles. Beyond edibles, recycled polymers are finding applications in packaging for toys, fashion accessories, and sports equipment, enhancing the durability of these items. Their inert characteristics are also driving the demand for packaging personal care products like shampoos, soaps, and surfactants. With their increasing adoption in consumer goods packaging, the market for recycled polymers is poised for further growth.

Rise in Recycled Plastics Market in Asia Pacific

During the review period, Asia-Pacific led the recycled plastics market, propelled by urbanization, industrialization, and economic growth. The region's industrial sector saw a notable uptick in plastic usage, supported by a growing automotive sector and an expanding role in construction. Significant investments in infrastructure, coupled with a surge in residential and commercial constructions, further bolstered this trend.

Additionally, stringent government regulations, rising environmental concerns, and a global push for sustainability have spurred innovative solutions in recycled plastic adoption. For instance, the Indian government introduced the 'India Plastics Pact,' a collaboration between WWF India and the Confederation of Indian Industry, and it was supported by UK Research and Innovation (UKRI) and WRAP. This pact aims for ambitious targets, including transitioning to 100% reusable or recyclable plastic packaging and effectively recycling 50% of plastic packaging during the forecast period.

Recycled Plastics Industry Overview

The recycled plastics market is fragmented, with the presence of several local and global players. Major players in the market are focusing on their growth strategies, such as investing in R&D centers, expansion of plastic recycling operations, and infrastructure development to strengthen their presence. Some of the major players include Biffa, Stericycle, Republic Services, Veolia, and Indorama Ventures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness Regarding Sustainable Plastic Waste Management

- 4.2.2 Implementation of Restrictions on Landfills

- 4.3 Market Restraints

- 4.3.1 Preference for Virgin Plastics Over Their Recycled Alternatives

- 4.3.2 Ineffective Plastic Waste Segregation and Disposal

- 4.4 Market Opportunities

- 4.4.1 Regulations Imposed by Authorities Promote the Adoption of Recycled Plastics

- 4.4.2 Advancements in Plastic Recycling Technologies

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Polyethylene

- 5.1.2 Polyvinyl Chloride

- 5.1.3 Polyethylene Terephthalate

- 5.1.4 Polypropylene

- 5.1.5 Polystyrene

- 5.1.6 Other Types

- 5.2 By Source

- 5.2.1 Foams

- 5.2.2 Films

- 5.2.3 Bottles

- 5.2.4 Fibers

- 5.2.5 Other Sources

- 5.3 By End User

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Electrical and Electronics

- 5.3.4 Automotive

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Biffa

- 6.2.2 Stericycle

- 6.2.3 Republic Services

- 6.2.4 Veolia

- 6.2.5 Indorama Ventures

- 6.2.6 Loop Industries

- 6.2.7 Plastipak Holdings

- 6.2.8 KW Plastics

- 6.2.9 B&B Plastics

- 6.2.10 Green Line Polymers*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US