PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636419

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636419

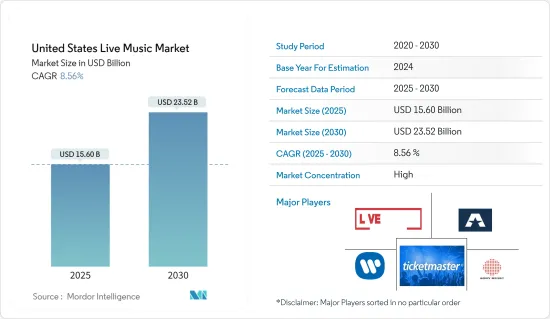

United States Live Music - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Live Music Market size is estimated at USD 15.60 billion in 2025, and is expected to reach USD 23.52 billion by 2030, at a CAGR of 8.56% during the forecast period (2025-2030).

The live music industry in the United States is thriving and dynamic, with diverse musical genres and events. It provides audiences all around the country with various experiences, making it an essential part of the cultural and entertainment landscape. The live music industry showcases musicians from multiple genres, including rock, pop, hip-hop, country, electronic, and more, through concerts, festivals, tours, and other live performances.

Live music venues in the United States come in various shapes and sizes, from cozy bars and theaters to spacious arenas and outdoor amphitheaters. Like all creative industries, the music industry was significantly impacted by the COVID-19 pandemic. Many music-related events, such as award presentations, concert tours, and festivals, were canceled or rescheduled. There were consequences for the numerous supporting individuals who depended on performers for their livelihood, even though some musicians and composers were able to utilize the opportunity to produce new works. There have also been some album release delays.

United States Live Music Market Trends

The Live Music Ticket Sales Type is Thriving in the US Market

The live music industry in the United States has experienced notable fluctuations in recent years, particularly in ticket sales and sponsorship revenues. Initially, the industry thrived with strong figures in both areas. However, a significant downturn caused a sharp decline in ticket sales and sponsorship revenues, reflecting the industry's struggles during this challenging period.

Despite these setbacks, the industry demonstrated remarkable resilience. Gradually, a recovery began, with ticket sales and sponsorship revenues starting to rise. This upward trend continued, with both metrics showing significant improvement each year. The industry steadily approached its former levels, reflecting its ability to adapt and recover.

By the latest period, the live music industry had nearly fully rebounded, with both ticket sales and sponsorship revenues surpassing their initial figures. This steady recovery underscores the industry's enduring appeal and adaptability as it successfully navigated through adversity to reclaim its vitality. The industry now stands poised for continued growth and renewed vibrancy, offering optimism for artists, event organizers, and music enthusiasts.

Key Age Groups Driving the Growth of the US Live Music Market

The live music market in the United States is significantly driven by two primary age groups, i.e., those in their late twenties to mid-thirties and those in their late thirties to mid-forties. The first group, typically in their early career stages or mid-career strides, combines financial stability with a high degree of social activity. This demographic prioritizes experiences over material possessions, making them avid concert-goers and festival enthusiasts. Their proficiency with technology and social media further amplifies their influence, as they frequently share their live music experiences online, boosting the visibility and popularity of events.

The second group, generally in their mid to late careers, also plays a crucial role in the live music market. They often have higher disposable incomes and view entertainment and leisure activities as essential for maintaining work-life balance. Their attendance at live music events is often driven by nostalgia for the music they grew up with and a desire to share these experiences with their children. This group is also more inclined to invest in premium experiences, such as VIP passes and exclusive concerts, which significantly contribute to the industry's revenue.

Together, these two age groups form the backbone of the live music market, fueling its growth with their enthusiasm, financial capability, and social influence. Their participation and spending habits are essential for promoters, venues, and artists aiming to thrive in the competitive live music scene in the United States.

United States Live Music Industry Overview

The live music industry in the United States exhibits characteristics of consolidation. In this dynamic market, Live Nation Entertainment leads with a vast network of venues and comprehensive artist management.

AEG Presents competes fiercely and is known for diverse concert lineups and festival curation. Warner Music Group utilizes its artist roster for impactful live performances, while Ticketmaster dominates ticketing services nationwide. Sony Music Entertainment, influential in music production, also contributes to live events. These formidable contenders drive innovation, foster artist growth, and enrich the vibrant live music scene across the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Consumer Preference for Live Music Events and Experiences

- 4.2.2 Diverse Range of Events, Including Concerts, Festivals, and Special Performances

- 4.3 Market Restraints

- 4.3.1 Rising Costs Associated with Venue Rentals, Artist Fees, and Event Production

- 4.3.2 Increasing Competition from Other Entertainment Options and Digital Content

- 4.4 Market Opportunities

- 4.4.1 Collaborating With Brands, Artists, and Technology Firms to Innovate Event Experiences

- 4.4.2 Embracing Eco-friendly Practices and Sustainable Event Management

- 4.5 Insights on Technological Innovations in the Market

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Concerts

- 5.1.2 Festivals

- 5.1.3 Theater

- 5.1.4 Corporate Events

- 5.1.5 Weddings

- 5.2 Revenue

- 5.2.1 Tickets

- 5.2.2 Sponsorship

- 5.2.3 Merchandising

- 5.3 Age Group

- 5.3.1 Children

- 5.3.2 Teenagers

- 5.3.3 Adults

- 5.3.4 Seniors

- 5.4 Venue Size

- 5.4.1 Small

- 5.4.2 Medium

- 5.4.3 Large

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Live Nation Entertainment

- 6.3.2 AEG Presents

- 6.3.3 Warner Music Group

- 6.3.4 Ticketmaster

- 6.3.5 Sony Music Entertainment

- 6.3.6 C3 Presents

- 6.3.7 Wasserman Music

- 6.3.8 Anschutz Entertainment Group (AEG)

- 6.3.9 Goldenvoice

- 6.3.10 Bandsintown*

7 MARKET FUTURE TRENDS

8 DISCLAIMER & ABOUT US