Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636267

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636267

South America Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

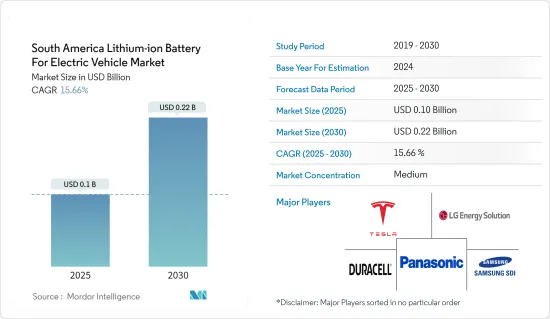

The South America Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 0.10 billion in 2025, and is expected to reach USD 0.22 billion by 2030, at a CAGR of 15.66% during the forecast period (2025-2030).

Key Highlights

- Over the long term, declining lithium-ion battery prices and the growing adoption of electric vehicles in Brazil, Colombia, Argentina, and Chile are expected to drive the growth of the market.

- On the other hand, the higher capital cost of electric vehicles compared to traditional internal combustion vehicles and the lack of robust charging infrastructure and networks in developed countries such as Brazil and Colombia are expected to restrain the market's growth.

- Nevertheless, the adoption of solid-state lithium-ion batteries for electric vehicles in South American countries is expected to create lucrative opportunities for the growth of the market.

- Brazil is expected to dominate the market, with favorable government policies and increasing adoption of electric vehicles.

South America Lithium-ion Battery For Electric Vehicle Market Trends

The Battery Electric Vehicle (BEV) Segment is expected to Dominate the Market

- Battery electric vehicles (BEVs), also commonly referred to as Electric Vehicles, use a large traction battery pack to power the electric motor. These types of EVs must be plugged into a wall outlet or charging equipment called electric vehicle supply equipment (EVSE).

- Factors like increasing demand for automotive vehicles across South America, growing innovation and advanced technology, rising consumer awareness about the use of fuel-efficient cars, and growing awareness to reduce greenhouse gasses and emissions are driving the demand for battery electric vehicles (BEV) across the region.

- BEVs are fully electric vehicles and typically do not have an internal combustion engine (ICE), fuel tank, or exhaust pipe; they rely only on stored electricity for propulsion. The energy to run the vehicle comes from the battery pack, which is recharged from the grid. BEVs are zero-emissions vehicles, as they do not generate any harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The South American vehicle industry has witnessed notable growth in recent years. The region has seen increased demand for battery electric vehicles (EVs), especially in the passenger car segment. This surge can be attributed to factors like heightened awareness, growing environmental concerns, and governmental initiatives promoting EV adoption. EV sales in the region saw a notable increase of more than 18% in 2023 compared to 2022.

- Brazil imported USD 735 million worth of Chinese BEVs in 2023. The growth in Chinese exports of BEVs to Brazil far exceeded the overall rate of increase in exports across China's "new three" industries: electric vehicles, lithium-ion batteries, and solar photovoltaic cells.

- Owing to the above points, the battery electric vehicle segment is expected to dominate the market due to the increasing utilization of electric vehicles in Brazil, Colombia, and Peru.

Brazil is Expected to Dominate the Market

- Brazil is one of the largest markets for lithium-ion batteries, mainly due to the high demand for electric vehicles. The demand for lithium-ion batteries in Brazil is increasing, which may offer a significant boost to the market's growth.

- The Rota 2030 program aims to improve energy efficiency in the transportation sector, which would be a major boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to significantly boost market growth during the forecast period.

- As per the International Energy Agency (IEA), the battery electric vehicle (BEV) cars sales were around 19,000 units (BEV cars) in 2023, an increase of over 123.5% from around 8,500 units in 2022. As the sales of BEVs continue to rise, the demand for EV batteries, such as lithium-ion batteries, has become increasingly vital.

- In May 2024, Miner and lithium supplier AMG Critical Materials announced the expansion of its mining operations in Brazil. In Brazil, the expansion of AMG's lithium concentrate has been progressing as planned, with the plant expected to reach a full nameplate capacity of 130,000 mt/year during Q4 2024, up from a previous capacity of 90,000 mt/year.

- In May 2024, the Brazilian government announced significant changes to the import tariffs for electric and hybrid vehicles. This long-awaited policy shift aims to stimulate national production of electrified vehicles and reduce the dependency on imported cars. By implementing a quota system, the government intends to balance the entry of imported vehicles while fostering local manufacturing.

- In February 2024, Sigma Lithium, a Brazilian mining company, announced its plans to invest USD 99.4 million in Brazil, backed by financing from the National Development Bank. The new plant, Sigma's second one in the Brazilian state of Minas Gerais, is expected to almost double its output to 510,000 metric tons annually.

- Thus, Brazil is expected to dominate the market during the forecast period.

South America Lithium-ion Battery For Electric Vehicle Industry Overview

The South American market for lithium-ion batteries for electric vehicles is semi-fragmented. Some of the key players in the market (in no particular order) include Tesla Inc., LG Energy Solution Ltd, Panasonic Holdings Corporation, Duracell Inc., and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003549

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-Ion Battery Prices

- 4.5.1.2 Growing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Colombia

- 5.3.3 Peru

- 5.3.4 Argentina

- 5.3.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 EnerSys

- 6.3.4 Duracell Inc.

- 6.3.5 Clarios (Formerly Johnson Controls International PLC)

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 LG Energy Solutions Ltd

- 6.3.8 VARTA AG

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-State Lithium-Ion Batteries for Electric Vehicles

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.