Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636264

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636264

India Stationary Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

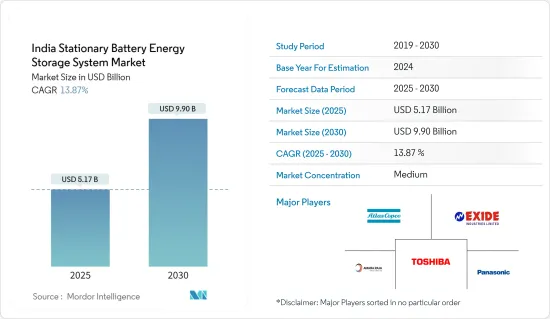

The India Stationary Battery Energy Storage System Market size is estimated at USD 5.17 billion in 2025, and is expected to reach USD 9.90 billion by 2030, at a CAGR of 13.87% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increasing adoption of solar energy and the declining cost of lithium-ion batteries are expected to drive the market.

- On the other hand, the presence of alternative energy storage systems is expected to hamper the market during the forecast period.

- Nevertheless, advancements in lithium battery technology are expected to create significant market opportunities in the future.

India Stationary Battery Energy Storage System Market Trends

Lithium-ion Battery Expected to Grow Significantly

- In India, lithium-ion batteries for stationary industries have gained prominence during the last decade compared to other countries. In comparison to different battery types, these batteries provide more advantages. Lithium-ion (Li-ion) batteries are nearly 100% efficient in charge and discharge, allowing the same ampere-hours in and out. These batteries offer various technical advantages over other technologies, such as lead-acid batteries. Rechargeable Li-ion batteries, on average, offer cycles more than 5,000 times, compared to lead-acid batteries that last around 400 to 500 times.

- Lithium-ion batteries can be recharged numerous times and are more stable. Furthermore, they tend to have a higher energy density, voltage capacity, and lower self-discharge rate than other rechargeable batteries. This improves power efficiency as a single cell has longer charge retention than different battery types.

- Further, the decreasing price of lithium-ion batteries has shifted the battery manufacturers' attention toward this battery type. In 2023, the price of lithium-ion battery packs decreased by 14% compared to the previous year to USD139/kWh. In addition to these advantages, research and development are being conducted to manufacture more effective and efficient lithium battery materials for stationary battery energy storage systems.

- For instance, in August 2024, Best Power Equipments (BPE), a prominent player in stationary power solutions, launched a 20,000-square-foot factory in Greater Noida, Uttar Pradesh, India. The fully operational facility boasts advanced automated systems tailored for large-scale manufacturing of lithium-ion batteries and stationary BESS. Such initiatives further boost the market's growth.

- In the future, the domestic manufacturing of more efficient lithium-ion battery technology is expected to drive the segment further. For instance, many regional companies are investing in lithium-ion battery technology. In May 2024, DAEWOO unveiled its latest innovation: the Maintenance-Free Lithium Inverter for Indian markets. This lithium-ion battery technology redefines reliability and emphasizes convenience, ensuring seamless operation alongside eco-friendly advantages.

- Thus, owing to the decreasing prices and technological development, the segment is expected to grow significantly during the forecast period.

On-grid Connection Expected to Record Major Share

- An on-grid stationary battery energy storage system is designed to store and manage energy connected to the electrical grid. It can draw power from the grid and supply stored energy back to it. These systems are used to store excess energy (often from renewable sources like solar or wind) when production exceeds demand. They release energy back to the grid during peak demand periods or when renewable generation is low.

- India has witnessed consistent growth in its solar energy capacity. According to the Ministry of Power, solar power contributed the highest share in the renewable energy mix, accounting for 38.9% as of May 2023. This growth was driven by government initiatives, favorable policies, decreasing solar equipment costs, and a commitment to renewable energy sources.

- The Indian government has implemented various policies to promote energy storage. For instance, in September 2023, the Union Cabinet approved a viability gap funding (VGF) scheme to establish a robust storage system for managing excess wind and solar power. Under this scheme, 4,000 MWh of battery energy storage system (BESS) projects are set to be developed by FY2031. The scheme has an initial allocation of INR 94 billion, which includes INR 37.60 billion in budgetary support.

- These incentives encourage investments in on-grid BESS, making it more attractive for developers and consumers. For instance, in April 2023, India Grid Trust announced the commissioning of its first battery energy storage system (BESS) project, integrated with solar panels at the Dhule substation in Maharashtra. According to a company statement, this project is designed to fulfill the substation's auxiliary consumption needs.

- Further, several tenders have been issued in India for solar battery energy storage system (BESS) projects, reflecting the growing interest and investment in energy storage solutions to support the country's renewable energy goals.

- Additionally, collaborations between government entities, private companies, and international organizations are facilitating the development of on-grid BESS projects. These partnerships enhance funding opportunities and technological expertise in the market.

- For instance, in March 2024, JSW Renew Energy Five, a fully owned subsidiary of JSW Neo Energy, entered a power purchase agreement (PPA) with Solar Energy Corporation of India Limited (SECI) for the initial phase of two 250 MW/500 MWh battery energy storage system (BESS) projects. Under this agreement, JSW Energy Limited, the parent company of JSW Renew Five, will receive payment for 60% of the project's total capacity (150 MW/300 MWh) over 12 years, with a fixed monthly capacity charge of INR 108,400 (approximately USD 1,310) per MW.

- Together, these factors create a favorable environment for the growth of the on-grid segment of the Indian stationary battery energy storage system market during the forecast period.

India Stationary Battery Energy Storage System Industry Overview

The Indian stationary battery energy storage system market is semi-fragmented. Some of the major players in the market (in no particular order) include Toshiba Corporation, Amara Raja Energy & Mobility Limited, Exide Industries Ltd, Atlas Copco AB, and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003546

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Solar Energy

- 4.5.1.2 Declining Cost of Lithium-Ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Presence of Alternative Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Battery Technology

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Other Battery Technologies

- 5.2 By Connection Type

- 5.2.1 On-grid

- 5.2.2 Off-grid

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utility

- 5.4 By Application

- 5.4.1 Inverter

- 5.4.2 Uninterruptible Power Supply (UPS)

- 5.4.3 Solar Energy Storage Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies and SWOT Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fluence Energy Inc.

- 6.3.2 Exide Industries Limited

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Toshiba Corporation

- 6.3.5 Amara Raja Energy and Mobility Ltd

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 HBL Power Systems Limited

- 6.3.8 Tata Power Solar Systems Limited

- 6.3.9 Inverted Energy Pvt. Ltd

- 6.3.10 Atlas Copco AB

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Lithium Battery Technology

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.