PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636262

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636262

ASEAN Inland Waterway Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

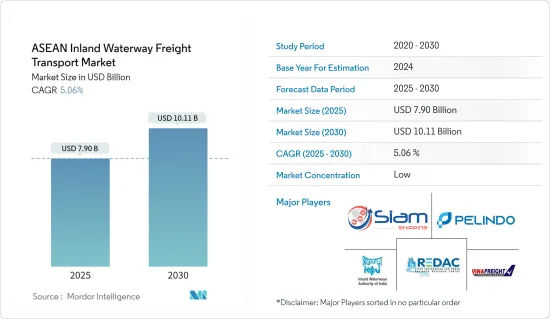

The ASEAN Inland Waterway Freight Transport Market size is estimated at USD 7.90 billion in 2025, and is expected to reach USD 10.11 billion by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

Key Highlights

- The ASEAN market for inland waterway freight transport is mainly driven by the increasing demand for sustainable logistics and expanding trade.

- With its extensive network of rivers and waterways, ASEAN relies heavily on inland waterway transport. This mode of transportation not only facilitates trade but also fuels economic growth and fosters connectivity among ASEAN's diverse regions.

- ASEAN is home to a robust network of rivers, canals, and lakes, which play a pivotal role in transportation. Prominent rivers like the Mekong, Chao Phraya, Irrawaddy, and Red River have been harnessed and preserved to enhance navigability and bolster cross-border trade.

- ASEAN member states have proactively forged agreements and frameworks to bolster inland waterway transport. One such initiative is the ASEAN Framework Agreement for the Facilitation of Goods in Transit (AFAFGIT). Its primary objective is to streamline customs procedures, fostering smoother cross-border trade facilitation. Simultaneously, the ASEAN Maritime Transport Working Group (MTWG) concentrates on bolstering both maritime and inland waterway transport connectivity across the region.

- Inland waterway transport, despite its advantages, grapples with several challenges. These challenges encompass issues like underdeveloped infrastructure, insufficient maintenance, and the necessity for harmonized cross-border regulations. However, the market also holds promising avenues for progress. These include increased infrastructure investments, the potential for public-private collaborations, and the integration of technological advancements to bolster both efficiency and safety.

ASEAN Inland Waterway Freight Transport Market Trends

The Demand For Containerized Shipping is Driving the Market

- The ASEAN inland waterway transport market is mainly driven by the increasing demand for sustainability and expansion of trade activities. The economies of ASEAN countries have experienced remarkable growth, bolstering their participation in global trade. This expansion underscored the importance of seamless and reliable transportation for goods.

- ASEAN nations have actively pursued global trade, forging agreements with diverse partners. Containerized shipping has grown in tandem with this international trade surge. By leveraging containers, businesses streamline cross-border transportation, fostering trade and bolstering economic collaboration.

- Several ASEAN nations have emerged as pivotal manufacturing hubs, churning out a wide array of export-oriented goods. Containerized shipping offers a dependable and secure transport mode for these products. Key sectors like electronics, automotive, textiles, and consumer goods rely heavily on containerized shipping to reach global markets.

- ASEAN's commitment to regional integration is evident through initiatives like the ASEAN Economic Community (AEC). The AEC aims to promote unhindered movement of goods, services, and investments across the region. This drive for cohesion has not only boosted trade within ASEAN but also increased the need for containerized shipping.

- From January to May 2024, Chinese ports processed a container throughput of 132.8 million TEUs, an 8.8% uptick from 2022, according to the Ningbo Zhoushan Port Group. Shanghai Port's container throughput hit 20.9 million TEUs, marking an 8.6% Y-o-Y rise, while Ningbo Zhoushan Port recorded 15.8 million TEUs, an increase of 6.5%.

- ASEAN countries are at the forefront of cargo handling. The Container Port Performance Index (CPPI), produced jointly by the World Bank and S&P Global Market Intelligence, indicates that 18 of the world's top 25 ports are in Asia, with 11 in Eastern Asia and four in Western Asia.

Singapore's Port Sets New Records, Reflecting its Dominance in Global Trade

Despite its limited inland waterways, Singapore boasts a highly advanced and efficient port system that stands at the forefront of global trade. The Port of Singapore, renowned as one of the world's busiest, holds a pivotal position in international commerce.

In 2023, the Port of Singapore achieved a record-breaking container throughput of 39.01 million TEUs, surpassing its previous milestone of 37.57 million TEUs set in 2021. Additionally, the port witnessed a significant uptick in vessel arrival tonnage, with figures crossing the 3 billion GT (gross tonnage) mark for the first time. This marked a notable 9.4% surge from 2022, culminating in a new record of 3.09 billion GT in 2023.

As of 2023, eight berths in the newly operational Tuas Port Phase 1 were functional. Furthermore, Phase 2's reclamation works reached 70% completion. In tandem with the port's strong performance, cargo handling demonstrated consistent growth, with volumes in 2023 hitting 591.70 million tonnes, a rise from 578.22 million tonnes in 2022.

ASEAN Inland Waterway Freight Transport Industry Overview

The ASEAN inland waterway freight transport market is fiercely competitive. The major players in the market include Siam Shipping, PT Pelindo, Vinafreight, River Engineering and Urban Drainage, River Engineering and Urban Drainage Research Center, and Inland Water Transport Corporation (IWTC).

Multiple players in the market strive to secure their market share. Several ASEAN nations have state-owned operators that wield considerable influence over both regulations and infrastructure development in this market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Enhanced connectivity and intermodal integration

- 4.2.1.2 Economic growth and trade driving the market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory compliances affecting the market

- 4.2.2.2 Inefficient custom procedures

- 4.2.3 Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.3.2 Environmental sustainability driving the market

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Advancements in the Market

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type of Transportation

- 5.1.1 Liquid Bulk Transportation

- 5.1.2 Dry Bulk Transportation

- 5.2 By Vessel Type

- 5.2.1 Cargo Ships

- 5.2.2 Container Ships

- 5.2.3 Tankers

- 5.2.4 Other Vessel Types

- 5.3 By Geogrpahy

- 5.3.1 Singapore

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Indonesia

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Siam Shipping

- 6.2.2 PT Pelindo

- 6.2.3 Vinafreight

- 6.2.4 River Engineering and Urban Drainage

- 6.2.5 Inland Water Transport Corporation(IWTC)

- 6.2.6 Port of Singapore Authority

- 6.2.7 Port Klang Authority

- 6.2.8 Port of Bangkok

- 6.2.9 Port of Manila

- 6.2.10 Port of Yangon*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity and Region

- 8.2 Insights on Capital Flows

- 8.3 Key Data related to E-Commerce and Cross-Border E-Commerce

- 8.4 E-Commerce Sales by Product category

- 8.5 External Trade Statistics Export and Import, by Product