PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636260

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636260

Latin America Inland Waterway Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

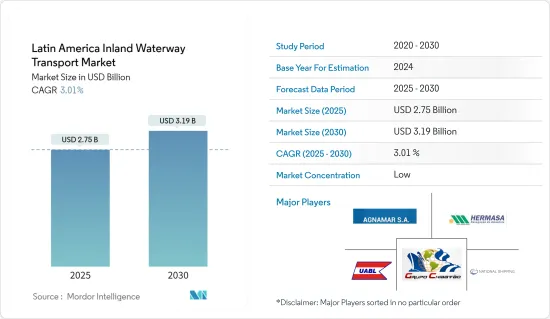

The Latin America Inland Waterway Transport Market size is estimated at USD 2.75 billion in 2025, and is expected to reach USD 3.19 billion by 2030, at a CAGR of 3.01% during the forecast period (2025-2030).

Key Highlights

- Latin America's inland waterway transport market is diverse, with each country having its unique characteristics and challenges. Factors such as cost-effectiveness and economic advantage are bolstering market growth.

- The river network in Latin America is extensive and consists of some of the largest river basins in the world. However, despite these natural features, inland navigation is underutilized and plays a marginal role in the transport of commercial goods in the region.

- Latin America has not yet taken full advantage of its extensive system of navigable waterways. There are many opportunities to integrate inland navigation better into the region's transport network to cater to the ever-increasing demand for cargo and passenger transport. Although the international shipments of cargo utilizing inland waterways have increased over the previous decade, this transportation mode contributes to less than 1% of the total value and volume of goods that are shipped internationally.

- Latin American countries utilize their inland waterways for domestic transport and as a crucial link in international trade. For instance, commodities like soybean products, aluminum, and petroleum, sourced from river basins such as Paraguay-Parana, Amazonas, Plata, Orinoco, and Magdalena, find their way to global markets in Europe, the United States, and Asia through ships that set sail directly from ports situated along the river systems.

- Between July and September 2023, Brazil's inland waterways witnessed a historic milestone, with waterborne cargo transportation hitting 33.79 million tonnes. These figures, sourced from the Waterborne Statistics of Brazil's National Agency for Waterway Transportation (ANTAQ), underscored a significant achievement for the nation.

- In the third quarter of 2023, inland waterway throughput saw a notable 6.1% increase compared to the previous record set in 2022. Additionally, compared to 2019, a benchmark year for its inland cargo movements, the figures were 7.6% higher.

- Key drivers behind this record-breaking quarter were the transportation of soybeans, containers, and iron ore. Notably, agricultural commodities alone accounted for 4.1 million tonnes, marking a staggering 79.3% increase from the previous year.

- In Brazil, Inland waterways saw a surge in container transportation, hitting 2.6 million tonnes, marking a 13.23% rise from the previous year's third quarter. Notably, iron ore shipments alone totaled 1.7 million tonnes, showcasing a substantial 45.4% uptick from the same period in 2022.

Latin America Inland Waterway Transport Market Trends

Rise in container throughput driving the market

In 2023, Latin American ports recorded varied performance in their throughputs. These shifts were primarily tied to the economic and trade activities of the ports' respective countries. However, operational specifics, supply chain management, carrier strategies, and investments also played pivotal roles in shaping these outcomes. Standout performers in 2023 included Callao in Peru, with a 9.8% growth, Paranagua in Brazil, with a 7.9% increase, Balboa in Panama, with a 6.1% increase, and Cartagena in Colombia.

Callao's throughput surged by 9.8% in 2023, surpassing 2.7 million TEUs. Notably, both DP World and APM Terminal, managing South and North Ports, respectively, made significant investments in equipment and terminal systems. These investments not only boosted the port's handling capacity but also significantly improved its operational efficiency.

The transshipment business at Callao saw a robust uptick in 2023, accounting for an estimated 25-30% of the port's total box traffic. Paranagua Container Terminal (PCT) set a new record, processing over 1.25 million TEUs. The terminal witnessed a notable surge in the export of perishable goods, especially frozen chicken; this trend is expected to continue.

TCP, owned by China Merchants Port Holdings Company, invested BRL 370 million (USD 72.05 million) in 2023 in acquiring new equipment, including 11 RTGs and 10 terminal tractors, and enhancing its facility. The port is expected to introduce at least seven more terminal tractors in 2024.

On the Pacific coast, Balboa in Panama was the sole port among the three listed to witness a traffic increase in 2023. This was largely attributed to its swift adaptation to the country's ongoing drought crisis and the draught restrictions imposed by the Panama Canal Authority.

Balboa saw a significant rise in its throughput, especially in the last five months of 2023, largely unaffected by the Panama Canal restrictions. Containers from vessels on Asia/US East Coast routes were swiftly unloaded onto the Panama Canal Railway and trucks for pickup on the Atlantic side.

Brazil Bolstered Port Infrastructure to Meet Global Trade Demand

Brazil boasts an 8,500-kilometer coastline, making it the world's fifth-largest country by area. Notably, it shares borders with all South American nations except Ecuador and Chile. This unique geography underscores the pivotal role of Brazilian ports, which handle over 90% of the nation's trade volume.

Brazil boasts 47 public ports and 129 private ports, alongside a multitude of smaller ports and terminals. Leading the pack is the Port of Santos, situated in Sao Paulo, reigning as Brazil's largest and a key player in Latin America's bustling port scene.

The Port of Paranagua, the Port of Rio de Janeiro, and the Port of Itajai stand as significant counterparts to Santos in Brazil. These ports operate under a governance structure that involves federal, state, and municipal authorities, with the federal government taking the lead in overseeing and harmonizing their operations.

Brazil is ramping up its investments in port infrastructure to keep pace with the surging demands of international trade. A prime example is the Port of Santos Expansion Project, a strategic move to boost the port's capacity and modernize its facilities, making it capable of handling larger vessels. This expansion is a pivotal step in elevating the port's global competitiveness, and it is expected to increase the throughput.

Another significant endeavor is the Itajai Port Development Program, which focuses on revamping infrastructure to streamline operations and cater to the needs of larger vessels. By deepening berths and enhancing access channels, the project is set to boost the port's efficiency and draw in more shipping traffic, cementing its status as a vital maritime hub in Brazil.

Key initiatives like the Rio de Janeiro Port Modernization Program and the Suape Port Complex Expansion underscore Brazil's dedication to enhancing its port infrastructure, aligning it with the dynamic demands of international trade.

Latin America Inland Waterway Transport Industry Overview

Latin America's inland waterway transport market is highly competitive. Some of the prominent players in the market include Agnamar SA, Hermasa Navegacao Da Amazonia Ltda, National Shipping SA, Chibatao Navega Cao E Comercio Ltda, and UABL Paraguay SA.

The major players in the market have strong competitive advantages, such as extensive networks, established customer relationships, and efficient operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Enhanced connectivity and intermodal integration

- 4.2.1.2 Economic growth and trade driving the market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory compliances affecting the market

- 4.2.2.2 Inefficient custom procedures

- 4.2.3 Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.3.2 Environmental sustainability driving the market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Attractiveness - Porters Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Advancements in the Market

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Type of Carrgo

- 5.1.1 Bulk

- 5.1.1.1 Liquid Bulk Transportation

- 5.1.1.2 Dry Bulk Transportation

- 5.1.2 Container

- 5.1.1 Bulk

- 5.2 By Geography

- 5.2.1 Mexico

- 5.2.2 Brazil

- 5.2.3 Chile

- 5.2.4 Colombia

- 5.2.5 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Agnamar SA

- 6.2.2 Hermasa Navegacao Da Amazonia Ltda

- 6.2.3 National Shipping SA

- 6.2.4 Chibatao Navega Cao E Comercio Ltda

- 6.2.5 UABL Paraguay SA

- 6.2.6 Hamburg Sud

- 6.2.7 CMA CGM

- 6.2.8 Maersk Line

- 6.2.9 MSC Mediterranean Shipping Company

- 6.2.10 Grimaldi Group*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity and Region

- 8.2 Insights on Capital Flows

- 8.3 Key Data related to E-Commerce and Cross-Border E-Commerce

- 8.4 E-Commerce Sales by Product category

- 8.5 External Trade Statistics Export and Import, by Product