PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636255

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636255

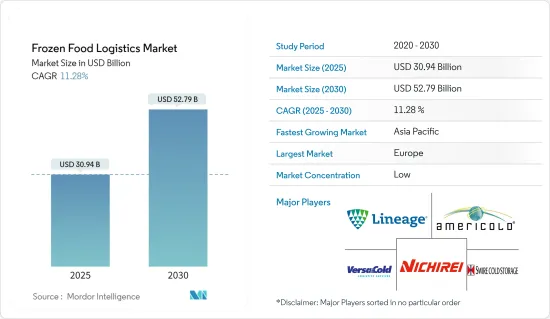

Frozen Food Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Frozen Food Logistics Market size is estimated at USD 30.94 billion in 2025, and is expected to reach USD 52.79 billion by 2030, at a CAGR of 11.28% during the forecast period (2025-2030).

Key Highlights

- A surge in demand for frozen food products and growing urbanization mainly drive the frozen food logistics market.

- Over the past few years, the premium frozen food industry has witnessed remarkable growth. A heightened consumer appetite for top-tier, convenient, and nutritious food choices predominantly propels this upsurge. This trend is especially pronounced among health-conscious individuals seeking balanced diets and the swiftness of ready-to-eat meals.

- Moreover, consumers increasingly acknowledge the superior quality of products made possible by modern freezing technologies, which effectively retain taste and nutritional value.

- Notably, affluent urban households are spearheading the sales of these premium frozen offerings. These products often boast gourmet recipes, responsibly sourced ingredients, and cutting-edge flavors.

- This surge in demand mirrors a broader consumer shift toward home cooking, culinary experimentation, and a desire for restaurant-grade meals-all enjoyed from the comfort of their homes. It is a trend tailored for discerning food enthusiasts unwilling to compromise on quality, taste, or nutrition.

- In 2023, retail sales of frozen foods surged by 7.9%, hitting USD 74.2 billion. This marked a notable USD 10 billion increase over the last three years, as highlighted in a recent report. Like many grocery segments, the growth of frozen food's value in dollars was primarily fueled by inflation-driven price hikes.

- Consequently, consumer behavior toward frozen food is changing. The Power of Frozen in Retail 2023 report, a collaboration between the American Frozen Food Institute (AFFI) and the Food Industry Association (FMI), revealed that consumers shelled out an average of USD 4.99 per unit for frozen items. This represented a 13.5% uptick from 2023 and a substantial 29.6% leap in the last three years.

- Frozen meals and desserts are leading the pack in frozen food sales, raking in USD 26.6 billion and USD 15.4 billion, respectively, in 2023. These are followed by fruits/vegetables, seafood, and meat/poultry, each boasting sales figures of USD 8.1 billion, USD 7 billion, and USD 5.7 billion, respectively, in the same year.

Frozen Food Logistics Market Trends

Demand for Frozen Food Products Gaining Traction in the Industry

The ready-to-eat market has witnessed a significant evolution in recent years, driven by a surge in product innovation tailored to changing consumer preferences. This transformation is especially pronounced in India, where convenience and taste preferences are paramount.

Consumers are increasingly gravitating toward healthier, natural options in the ready-to-eat industry. This has increased demand for products with clean labels, minimal additives, and organic ingredients. Furthermore, there is a growing appetite for plant-based and vegan choices. As more individuals adopt plant-based diets or reduce meat consumption, the demand for plant-based or vegan-friendly ready-to-eat options is rising.

Key to the industry's growth is the unwavering commitment to innovation by both established players and startups. Recent research from Nielsen underscores a significant consumer pivot toward healthier ready-to-eat choices, particularly in India. The study indicates that 72% of Indian consumers actively seek nutritious, well-balanced, ready-to-eat meals, showcasing a heightened health consciousness.

In response, companies are harnessing technology and culinary skills to craft products that meet nutritional needs and cater to the diverse Indian palate. This includes the introduction of gluten-free, organic, and locally-inspired options.

Partnerships between ready-to-eat brands and nutrition institutes or experts are broadening product offerings and reshaping consumer perceptions, positioning ready-to-eat foods as a healthier meal choice.

Europe is Holding a Prominent Position in the Market

In 2023, Germany's total frozen food sales reached 4.043 million tonnes, marking a 3.4% increase from 3.909 million tonnes in 2022. This surge pushed sales past the 4-million-tonne milestone for the first time.

The out-of-home market saw a notable 6.5% uptick in sales, hitting 2.061 million tonnes in 2023, up from 1.935 million tonnes in 2022. This growth propelled the market past the 2-million-tonne threshold.

Within the food retail and home services industry, frozen food sales in 2023 reached 1.982 million tonnes, reflecting a modest 0.4% increase from 1.974 million tonnes in 2022. Notably, this figure stood 6.5% higher than the pre-COVID-19-pandemic levels in 2019, which were at 1.861 million tonnes.

Individually, per capita consumption of frozen food hit a record high of 49.4 kg in 2023, up from 47.7 kg in 2022. At the household level, consumption saw a 3 kg increase, reaching 99.4 kg in 2023, compared to 96.4 kg in 2022.

Frozen Food Logistics Industry Overview

The frozen food logistics market is fragmented in nature. Giants like Lineage Logistics, Americold Logistics, Swire Cold Storage, Nichirei Logistics, and VersaCold Logistics Services are leading the pack in the cold chain logistics industry.

These key players provide a suite of services, including temperature-controlled storage, transportation, and distribution, tailored to the specific needs of the frozen food industry. These companies have solidified their competitive edge in the market by leveraging expansive networks, cutting-edge technologies, and specialized know-how in frozen goods management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rise in E-Commerce Driving The Market

- 4.2.1.2 Changing Consumer Lifestyles Driving The Market

- 4.2.2 Restraints

- 4.2.2.1 High Operating Costs Associated With Maintaining Cold Chain Logistics

- 4.2.2.2 Regulatory Compliances Affecting The Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving The Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ready-to-eat

- 5.1.2 Ready-to-cook

- 5.2 By Product Type

- 5.2.1 Frozen Fruits and Vegetables

- 5.2.2 Frozen Meat and Fish

- 5.2.3 Frozen-Cooked Ready Meals

- 5.2.4 Frozen Desserts

- 5.2.5 Frozen Snacks

- 5.2.6 Other Product Types

- 5.3 By Transportation

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Seaways

- 5.3.4 Airways

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lineage Logistics

- 6.2.2 Americold Logistics

- 6.2.3 Swire Cold Storage

- 6.2.4 Nichirei Logistics

- 6.2.5 VersaCold Logistics Services

- 6.2.6 Burris Logistics

- 6.2.7 Kloosterboer

- 6.2.8 NewCold

- 6.2.9 Interstate Cold Storage

- 6.2.10 Preferred Freezer Services*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 8.3 E-commerce and Consumer Spending-related Statistics

- 8.4 External Trade Statistics