Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636230

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636230

Wind Turbine Pitch And Yaw Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

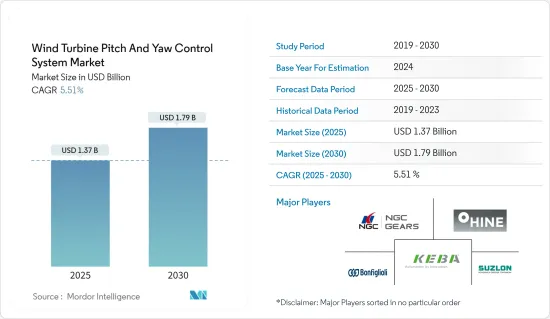

The Wind Turbine Pitch And Yaw Control System Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 1.79 billion by 2030, at a CAGR of 5.51% during the forecast period (2025-2030).

Key Highlights

- Over the long term, rising investments in wind power projects and supportive government policies and incentives are the major factors expected to drive the wind turbine pitch and yaw control system market during the forecast period.

- On the other hand, the control systems' high costs and high competition from other renewable energy technologies will restrain the market during the forecast period.

- However, hybrid systems integration with improved technological systems and offshore wind energy development will provide ample opportunities to the wind turbine pitch and yaw control system market players during the forecast period.

- Due to greater wind energy infrastructure development activity, Europe is expected to dominate the wind turbine pitch and yaw control system market.

Wind Turbine Pitch and Yaw Control System Market Trends

The Offshore Segment to Dominate the Market

- As the demand for clean, green electricity rises, major companies and countries are adopting renewable energy sources, especially wind energy and offshore wind energy, which can lead to tapping into huge unused potential. Adopting offshore wind energy with advanced technologies attracted many countries and companies with high investments.

- The installation of wind farms in offshore areas is becoming a lucrative market because of the higher wind speed compared to onshore wind speed. In the future, deploying offshore wind energy is at the core of delivering the European Green Deal. Europe has vast offshore sea areas, with some regions supporting speeds of more than 10 miles per hour.

- Offshore wind energy power generation technology evolved over the last five years to maximize the electricity produced per megawatt capacity installed to cover more sites with lower wind speeds. In recent years, wind turbines have become more extensive with broader diameters, larger wind turbine blades, and taller hub heights.

- According to the International Renewable Energy Agency RE Capacity 2024, the offshore wind capacity increased by 10,696 MW in 2023. It reached 72,663 MW, compared to 2022 installed capacity, thus citing a major increase in the offshore wind industry.

- During the forecast period, the offshore capacity is expected to increase due to rising investment in the industry due to factors like government initiatives and high wind energy potential in the offshore segment.

- Countries like Japan plan to install 10GW of offshore wind projects by 2030 and 30-40 GW capacity by 2035 and 2040. Additionally, in July 2024, the American Clean Power Association announced an investment of approximately USD 65 billion by 2030 in the offshore wind energy industry in the United States.

- Thus, with such plans, the offshore segment is expected to dominate the wind turbine pitch and yaw control system market during the forecast period.

Europe to Witness Significant Growth

- Europe is a leader in offshore wind energy and is home to one of the biggest operational wind farms worldwide. The region's offshore and onshore capacity is large enough to meet the electricity needs of major European countries.

- The region has seen the earliest and most expansive research and development in wind turbine components and control systems. A significant number of companies in the wind turbine pitch and yaw control system market are based in Europe.

- According to the International Renewable Energy Agency RE Capacity 2024, wind energy capacity in Europe increased by 16,833 MW in 2023. It reached 257,111 MW compared to the 2022 installed capacity, indicating a significant increase in wind turbine installed capacity and a major boost to the wind turbine pitch and yaw control system market players.

- Favorable government policies have also contributed to the wind energy market and related components, making it the second-largest wind energy market globally. Adopted in 2023, the revised Renewable Energy Directive raised the European Union's binding renewable energy target for 2030 to a minimum of 42.5%, earlier set at 32% in 2018.

- In September 2023, construction officially commenced at RWE's Sofia Offshore Wind Farm, a monumental renewable energy project set to contribute significantly to the UK's net-zero targets. The Sofia Offshore Wind Farm represents an impressive investment of over USD 3.2 billion in the UK's energy infrastructure by RWE, marking a substantial commitment to renewable energy.

- In January 2024, Total Energies SE, the French Supermajor Energy company, announced its new agreement with European Energy to develop offshore wind projects in three Nordic countries: Sweden, Denmark, and Finland.

- Thus, based on the aforementioned points, Europe will dominate the wind turbine pitch and yaw control system market during the forecast period.

Wind Turbine Pitch and Yaw Control System Industry Overview

The wind turbine pitch and yaw control system market is semi-consolidated. Some major players operating in the market (in no particular order) include Bonfiglioli Transmissions Private Limited, SUZLON Energy Ltd, Nanjing High-Speed Gear Manufacturing Co. Ltd, Dana SAC UK Ltd, and Hine Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003498

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition and

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Investments in Wind Power Projects

- 4.5.1.2 Supportive Government Policies and incentives

- 4.5.2 Restraints

- 4.5.2.1 High Competition from Other Renewable Energy Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Yaw Control System

- 5.1.1 Active

- 5.1.2 Passive

- 5.2 By Application

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Colombia

- 5.3.2.4 Rest of South America

- 5.3.3 Middle East and Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 United Arab Emirates

- 5.3.3.3 Qatar

- 5.3.3.4 Egypt

- 5.3.3.5 South Africa

- 5.3.3.6 Nigeria

- 5.3.3.7 Rest of Middle East and Africa

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Indonesia

- 5.3.4.5 Vietnam

- 5.3.4.6 Thailand

- 5.3.4.7 Malaysia

- 5.3.4.8 Rest of Asia-Pacific

- 5.3.5 Europe

- 5.3.5.1 United Kingdom

- 5.3.5.2 Germany

- 5.3.5.3 France

- 5.3.5.4 Spain

- 5.3.5.5 Russia

- 5.3.5.6 Turkey

- 5.3.5.7 NORDIC

- 5.3.5.8 Rest of Europe

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Bonfiglioli Transmissions Private Limited

- 6.3.1.2 SUZLON Energy Ltd

- 6.3.1.3 Nanjing High-Speed Gear Manufacturing Co.

- 6.3.1.4 Dana SAC UK Ltd

- 6.3.1.5 Hine Group

- 6.3.1.6 OAT GmbH

- 6.3.1.7 ABM Greiffenberger Gmbh

- 6.3.1.8 Siemens AG

- 6.3.1 Market Players

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Hybrid systems integration with improved technological systems and offshore Wind Energy development

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.