Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636229

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636229

Oil & Gas Static And Rotating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

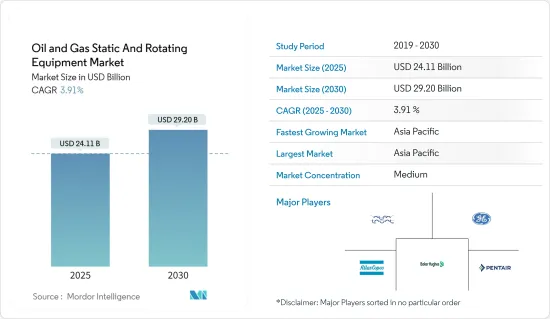

The Oil & Gas Static And Rotating Equipment Market size is estimated at USD 24.11 billion in 2025, and is expected to reach USD 29.20 billion by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

Key Highlights

- The oil and gas static and rotating equipment market is expected to grow during the forecast period due to increasing global energy demand and the need for static rotating equipment from increased offshore exploration activities.

- On the other hand, the rising adoption of renewable and cleaner energy sources is expected to hamper the market growth in the future.

- However, there is an opportunity for significant market growth through technological advancements to improve equipment efficiency during the forecast period.

- Asia-Pacific is expected to witness significant growth in the market during the forecast period.

Oil & Gas Static And Rotating Equipment Market Trends

The Rotating Equipment Segment is Expected to Have a Significant Demand

- Rotating equipment plays a significant role in the oil and gas industry. The rotating components of this equipment may consist of engines, compressors, turbines, and industrial valves. Most of the rotating equipment is used to transport substances from one area to another, or it may be used to force materials to rotate, such as by making a propeller turn.

- Rotating equipment is used in industries, including upstream, downstream, and downstream. Pumps and compressors are examples of rotating equipment that have several uses in the production and storage of oil and gas.

- In several oil and gas projects, agreements and contracts are made with other companies to install rotating equipment. For example, in May 2024, Larsen & Toubro (L&T), L&T Energy Hydrocarbon (LTEH), got a contract from ONGC for the engineering, procurement, construction, installation, and commissioning of new process gas compressor (PGC) modules at ONGC's Mumbai High and Tapti offshore locations.

- Further, increasing gas production is expected to create demand for rotating equipment like compressors and pumps. According to the Statistical Review of World Energy Data, in 2023, global gas production accounted for 4059.2 billion cubic meters. Gas production has increased continuously since 2010, with a slight drop in 2020.

- Moreover, companies are making efforts to improve the efficiency of rotating equipment by investing more and more in research and development, which, in turn, will create opportunities for these equipment in the future.

- For instance, in May 2024, John Crane, a global leader in rotating equipment solutions and energy transition technologies, secured a five-year contract in Alberta, Canada. The contract involves providing industrial seal support services for a major complex. As part of this agreement, John Crane is implementing a managed reliability program (MRP) to enhance the longevity of critical site assets. This includes rotating equipment like centrifugal pumps and industrial seals. Such programs are expected to improve rotating equipment efficiency, driving future demand.

- Thus, owing to the use and demand for rotating equipment in the oil and gas industry, the segment is expected to have a significant demand during the forecast period.

Asia-Pacific is Expected to Have a Significant Growth in the Market

- Asia-Pacific is home to over half of the world's population, giving it the potential to influence the future of global energy significantly. The region includes developing countries like India, China, and Japan, which are experiencing rapid urbanization and industrialization.

- Thus, the region's energy demand is increasing continuously, which, in turn, demands production and exploration activities in the oil and gas industry. With the upcoming oil and gas projects, the demand for static and rotating equipment is expected to grow in the region.

- For example, in October 2022, SENEX Energy announced the construction of a new gas compression facility adjacent to its Atlas project in southwest Queensland. The gas plant will be constructed using production license PL209. With increasing oil and gas production, demand for this equipment is expected to grow during the forecast period.

- According to Statistical Review of World Energy Data, in 2023, Asia-Pacific total gas production accounted for 691.8 billion cubic meters, an annual growth rate of 0.6% compared to the previous year.

- Further, the development of downstream projects is expected to drive the market in the region. In the petrochemical industry, static and rotating equipment are used in refining. In March 2023, Indian Oil Corporation Ltd announced it would invest USD 742 million in building a petrochemical complex at Paradip in Odisha. Such new projects are expected to increase the demand for equipment, thereby driving the market.

- The increasing demand for natural gas production in the region is expected to surge the need for oil and gas starting and rotating equipment. For instance, according to the Gas Exporting Countries Forum, natural gas is projected to account for 36% of Southeast Asia's total generation mix by 2050. In summary, Asia-Pacific's demand for natural gas is expected to grow significantly, with estimates reaching 710 bcm by 2050.

- Due to the development of the oil and gas industry and the increasing energy demand, Asia-Pacific is expected to grow significantly.

Oil & Gas Static And Rotating Equipment Industry Overview

The oil and gas static and rotating equipment market is semi-fragmented. The key players in the market (in no particular order) include Alfa Laval AB, Atlas Copco AB, General Electric Co, Baker Hughes Co., and Pentair PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003497

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Energy Demand

- 4.5.1.2 More Offshore Exploration Activities

- 4.5.2 Restraints

- 4.5.2.1 Rising Adoption of Renewable and Cleaner Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Type

- 5.2.1 Static

- 5.2.2 Rotating

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Russia

- 5.3.2.6 NORDIC

- 5.3.2.7 Italy

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Egypt

- 5.3.4.4 Qatar

- 5.3.4.5 Nigeria

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Atlas Copco AB

- 6.3.3 General Electric Co

- 6.3.4 Baker Hughes Co.

- 6.3.5 Pentair PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer Limited

- 6.3.8 FMC Technologies Inc.

- 6.3.9 Flowserve Corporation

- 6.3.10 Mitsubishi heavy Industries Ltd

- 6.3.11 Doosan Group

- 6.4 List of Other Prominent Companies

- 6.5 Market RankingAnalysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement to Increase the Efficiency

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.