Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636221

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636221

France Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

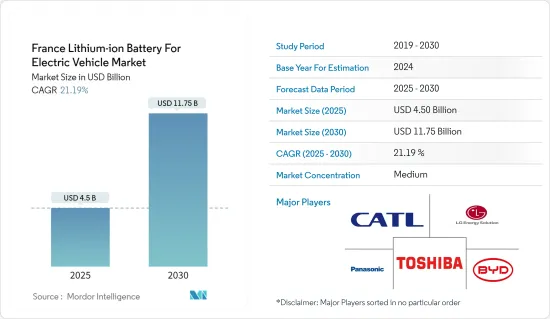

The France Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 4.50 billion in 2025, and is expected to reach USD 11.75 billion by 2030, at a CAGR of 21.19% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing adoption of electric vehicles, declining lithium-ion battery prices, and supportive government policies and initiatives for electric vehicles across France are expected to drive the demand for lithium-ion batteries for electric vehicles during the forecast period.

- On the other hand, the lack of raw material reserves and emerging alternative battery technologies can significantly restrain the growth of the lithium-ion battery for electric vehicles market.

- Nevertheless, the adoption of solid-state lithium-ion batteries for electric vehicles is anticipated to create vast opportunities for the French lithium-ion battery in electric vehicles market.

France Lithium-ion Battery for Electric Vehicle Market Trends

Declining Lithium-ion Battery Prices Driving the Market

- The declining prices of lithium-ion batteries are significantly driving the growth of the lithium-ion battery market for electric vehicles (EVs) in France. As the production of lithium-ion batteries increases globally, manufacturers benefit from economies of scale, leading to lower production costs. This cost reduction is passed down to consumers and businesses, making EVs more affordable.

- The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and in R&D activities to enhance their performance, increasing the competition and, in turn, reducing lithium-ion battery prices.

- Owing to the increasing average battery pack prices of electric vehicles (EV) and battery energy storage systems (BESS), battery prices declined in 2023 to 139 USD/kWh, a decrease of over 13%. The trajectory of technological innovation and manufacturing enhancements is anticipated to decrease the battery pack prices further, with prices projected to reach USD 113/kWh in 2025 and USD 80/kWh in 2030.

- Furthermore, the price of lithium-ion batteries has been steadily decreasing due to technological advancements, increased production scale, and improved supply chain efficiencies. This trend is significantly impacting the global energy market, making electric vehicles (EVs) and renewable energy storage systems more affordable and accessible. Leading companies in the market have made significant technological advances in the past few years.

- In July 2024, Stellantis and CEA announced a new five-year collaboration to design next-generation battery cells, including lithium-ion batteries for electric vehicles, in-house. The joint research program aims to develop advanced technology cells with enhanced performance, longer lifespan, and lower carbon footprint at competitive costs. Such advancements are expected to boost the demand for advanced lithium-ion batteries in the coming years and positively reduce the battery price across France.

- Moreover, the decreasing price of lithium-ion batteries, rising demand, and the establishment of new lithium-ion production plants across France are interlinked phenomena driving significant shifts in the energy and automotive industries. Investments in enhancing lithium-ion battery production have increased exponentially across the country in recent years.

- For instance, in February 2024, the country announced a total investment of EUR 10 billion (USD 10.84 billion) from public and private funds to open four gigafactories of electric vehicle batteries, including lithium-ion batteries, around the national territory in the near future. Such investments and incentives are likely to accelerate battery production across the country over the coming years and boost the demand for lithium-ion batteries in the future.

- Hence, such advancements and initiatives are expected to reduce lithium-ion battery prices further, making them much more cost-competitive than other battery types and resulting in their increasing adoption for numerous applications across France.

Battery Electric Vehicle (BEV) Segment to Witness Significant Growth Over the Forecast Period

- The battery electric vehicle (BEV) segment has experienced significant growth in recent years, a trend closely tied to the advancements and increased adoption of lithium-ion batteries in electric vehicles (EVs).

- France is experiencing a significant surge in the adoption of electric vehicles (EVs), which is driving the expansion of the EV charging equipment market. The country is the leading EV producer worldwide. The country is shifting toward clean energy and transitioning to electric vehicles, which is an essential segment on which companies are currently focusing more.

- EV sales have been rising exponentially in the country over the last few years. For instance, according to the International Energy Agency (IEA), in 2023, the number of electric vehicles sold in France was 0.47 million, up by 38.2% from 2022. The number of electric vehicle sales is expected to increase significantly in the coming years, raising the demand for BEVs across France.

- The country has implemented several policies to promote electric vehicles (EVs) and support the transition to a low-carbon transportation industry. These policies aim to reduce consumers' overall cost of ownership and encourage the switch from internal combustion engine vehicles to BEVs.

- For instance, in May 2024, the government signed an agreement with leading car manufacturers to agree to an interim goal of 800,000 electric vehicle sales by 2027 under a new medium-term planning agreement with the government, up from 200,000 in 2022. The government also earmarked EUR 1.5 billion (USD 1.6 billion) to support the production and purchase of electric vehicles through various programs. Such initiatives and targets are likely to accelerate the production and demand for BEVs across the country in the coming years.

- Furthermore, the rising shift toward electric vehicles is a significant factor. Leading companies across the country have launched numerous projects and investments to raise the production of battery electric vehicles over the coming years.

- For instance, in June 2024, BYD, a Chinese electric vehicle giant, announced it would open an EV production factory in France. The facility is expected to be operational by the end of the next year. Such types of projects are expected to boost BEV production across the country during the forecast period.

- Hence, such initiatives and plans are likely to enhance BEV sales across the country and hike the demand for lithium-ion batteries during the forecast period.

France Lithium-ion Battery for Electric Vehicle Industry Overview

The French lithium-ion battery for electric vehicles market is semi-fragmented. Some of the key players (not in any particular order) are LG Energy Solution Ltd, Toshiba Corporation, Panasonic Holdings Corporation, BYD Company Limited, and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003484

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles (EV)

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.1.3 Supportive Government Policies and Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.2.2 Emerging Alternative Battery Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Other Vehicles (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution Ltd

- 6.3.2 BYD Company Limited

- 6.3.3 Toshiba Corporation

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Contemporary Amperex Technology Co. Limited

- 6.3.6 Automotive Cells Company

- 6.3.7 Automotive Energy Supply Corporation (AESC)

- 6.3.8 Verkor

- 6.3.9 Saft Groupe SA

- 6.3.10 EnerSys

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-state Lithium-ion Batteries for Electric Vehicles

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.