PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636217

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636217

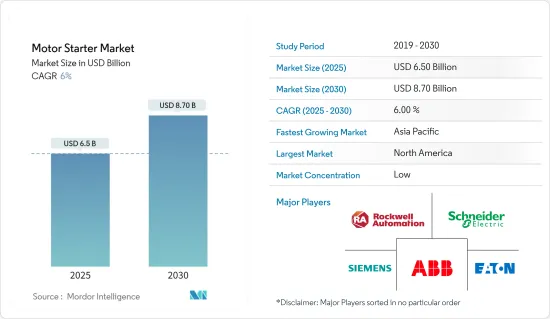

Motor Starter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Motor Starter Market size is estimated at USD 6.50 billion in 2025, and is expected to reach USD 8.70 billion by 2030, at a CAGR of 6% during the forecast period (2025-2030).

Key Highlights

- In response to growing environmental concerns, industries are increasingly adopting energy-efficient motor starters, like soft starters, to reduce energy consumption and extend motor lifespan. Concurrently, the rise of the Internet of Things (IoT) has spurred the creation of intelligent motor starters, enabling remote monitoring and control, thus evolving the market.

- The global shift toward electric vehicles (EVs) has heightened the demand for sophisticated motor control solutions, including motor starters in automotive applications. In EVs, motor starters collaborate with battery management systems to optimize performance and ensure safety. As countries pivot from internal combustion engines to EVs across the world, the demand for motor starters is projected to surge.

- Recent innovations in the motor starter market have introduced products with advanced features like overload protection, thermal monitoring, and programmable settings, boosting reliability and performance. Manufacturers are broadening their product lines to encompass motor starters tailored to various voltage levels, power ratings, and industry-specific needs.

- The motor starter market is fiercely competitive, with many manufacturers competing for a market share. This intense competition often results in pricing pressures and challenges in product differentiation.

- Macroeconomic trends, particularly robust economic growth in emerging markets, fuel the demand for motor starters in the manufacturing and construction sectors. Additionally, tightening regulations on energy efficiency and environmental sustainability are influencing market dynamics. Nevertheless, the market is poised for continued growth.

Motor Starter Market Trends

The Manufacturing Sector is Expected to Drive the Market's Growth

- The transition to Industry 4.0 has spurred the widespread adoption of automation technologies in manufacturing. Factories are deploying advanced robotics and automated systems, necessitating efficient motor control. This evolution fuels the demand for sophisticated motor starters capable of managing diverse loads and enhancing overall performance.

- The infusion of IoT and smart technologies into manufacturing is revolutionizing facility operations. Smart motor starters, equipped with real-time monitoring, diagnostics, and remote control features, are gaining traction. These advancements bolster operational efficiency and predictive maintenance, propelling the market.

- Manufacturers are increasingly seeking customized motor starters specifically designed for distinct applications and operating conditions. This demand has fostered collaborative initiatives between motor starter producers and end users, aiming to craft solutions that align with unique performance standards.

- With manufacturers modernizing their facilities, there has been a notable uptick in capital expenditure on automation equipment, including motor starters. Data from FRED highlights this trend: total construction investment in new manufacturing facilities in the United States soared to a record USD 193 billion in 2023, a significant leap from USD 124.3 billion in 2022.

- Legislative measures like the Inflation Reduction Act (IRA), Bipartisan Infrastructure Law (BIL), and CHIPS and Science Act (CHIPS Act) are catalyzing investments in domestic manufacturing sectors, notably semiconductors, electric vehicle (EV) batteries, and wind turbines in the United States. This investment momentum is not confined to the United States, with emerging economies witnessing rapid industrialization, contributing to the surging demand for motor starters.

Asia-Pacific is Expected to Witness a High Growth Rate

- Countries like China and India are witnessing rapid industrialization and urban expansion, leading to a heightened demand for motor starters across multiple sectors. As these industries scale operations to cater to urban needs, the importance of efficient motor control systems becomes increasingly evident.

- Asia-Pacific is a global manufacturing hub, especially in the electronics, automotive, and machinery sectors. With key players like India, China, Japan, and several Southeast Asian nations, the region's growth propels the demand for motor starters, which are vital for controlling electric motors during manufacturing processes.

- The Indian manufacturing sector is witnessing a significant surge in investments, marking a pivotal moment in the country's economic journey. A report by Colliers highlights that the Indian manufacturing market is on track to hit the USD 1 trillion mark by 2025-26. Gujarat is emerging as the frontrunner, establishing itself as India's manufacturing powerhouse, closely trailed by Maharashtra and Tamil Nadu, which are expected to make substantial contributions to the market.

- The automotive industry, particularly booming in China and Japan, with India making significant strides, is fueling the demand for motor starters in electric vehicles. Furthermore, as urbanization and population grow, there is a rising need for water treatment facilities, underscoring the demand for dependable motor starters in pumps and control systems.

- According to the PRC's National Development and Reform Commission, China's sludge volume could hit 90 million tons by 2025. Experts project an investment of around USD 8 billion in new sludge processing facilities in China from 2021 to 2025. Given the escalating pollution levels, India is anticipated to follow suit. With such trends, the motor starter market in the region is poised for significant growth.

Motor Starter Industry Overview

The market is fiercely competitive, featuring a blend of large multinational corporations and regional players. This landscape is marked by rapid technological advancements, strategic collaborations, and a pressing need for companies to stand out through product customization, enhanced energy efficiency, and the integration of smart technologies.

Prominent players in the arena include Schneider Electric, Siemens AG, ABB Ltd, and Eaton Corporation. These companies are channeling investments into R&D, focusing on pioneering and refining motor starter technologies. Features like overload protection, thermal monitoring, smart connectivity, and real-time diagnostics have emerged as pivotal differentiators in this competitive market.

As Industry 4.0 gains momentum, companies that seamlessly weave in IoT capabilities, real-time monitoring, and predictive maintenance into their offerings are poised to attract a clientele eager for automated and digital solutions. Furthermore, companies can foster deeper relationships with their clients by providing tailored motor starters that address the distinct requirements of specific industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation

- 5.1.2 Energy Efficiency Regulation

- 5.2 Market Restraints

- 5.2.1 Competition From Variable Frequency Drives (VFDs)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Direct-on-Line Starter

- 6.1.2 Stator Resistance Starter

- 6.1.3 Slip Ring Starter

- 6.1.4 Auto Transformer Starter

- 6.1.5 Star Delta Starter

- 6.1.6 Soft Starter

- 6.2 By Power Rating

- 6.2.1 Up to 5 kW

- 6.2.2 5 - 50 kW

- 6.2.3 Above 50 kW

- 6.3 By End-user Vertical

- 6.3.1 Manufacturing

- 6.3.2 Oil and Gas

- 6.3.3 Mining

- 6.3.4 Water and Wastewater Treatment

- 6.3.5 Automotive

- 6.3.6 Food and Beverage

- 6.3.7 Building and Construction

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Seimens AG

- 7.1.3 ABB Group

- 7.1.4 Eaton Corporation

- 7.1.5 Rockwell Automation

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Fuji Electric FA Components & Systems Co. Ltd

- 7.1.8 Toshiba Corporation

- 7.1.9 Larsen & Toubro Limited

- 7.1.10 WEG SA

- 7.1.11 W.W. Grainger Inc.

- 7.1.12 Danfoss

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET