PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636215

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636215

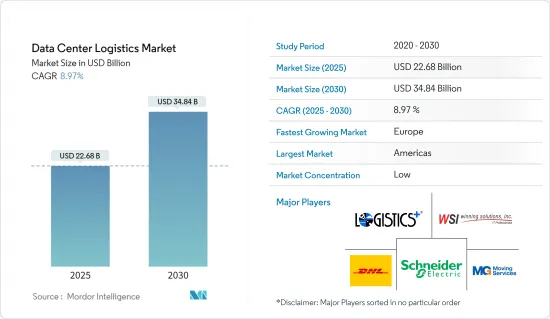

Data Center Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data Center Logistics Market size is estimated at USD 22.68 billion in 2025, and is expected to reach USD 34.84 billion by 2030, at a CAGR of 8.97% during the forecast period (2025-2030).

The data center logistics market is poised for substantial growth, driven by escalating global demand for robust data management infrastructure and services. Several vital factors underpin this growth. The increasing reliance on cloud computing, big data analytics, and digital services across industries fuels the need for advanced data centers capable of handling large volumes of data securely and efficiently.

Additionally, the surge in internet traffic, driven by expanding digitalization and IoT (Internet of Things), further propels the demand for data center facilities. Companies increasingly adopt hybrid cloud solutions and edge computing to optimize data processing and reduce latency, necessitating agile and scalable logistics solutions to support these complex infrastructures.

Opportunities are surplus in the data center logistics market, particularly in specialized services such as secure transportation of sensitive equipment, temperature-controlled storage solutions, and efficient supply chain management for rapid deployment and expansion of data center facilities. As data centers become larger and more dispersed to ensure geographic redundancy, logistics providers can capitalize on offering tailored solutions that ensure resilience and reliability in data management.

Moreover, innovations in green data centers and sustainable practices present new avenues for growth. With increasing emphasis on environmental sustainability, logistics providers can differentiate themselves by offering eco-friendly solutions that reduce carbon footprints and optimize energy efficiency in data center operations.

In conclusion, the data center logistics market is evolving rapidly, driven by technological advancements and the expanding digital economy. Logistics providers poised to meet data center operators' diverse and demanding needs will find ample opportunities for growth and innovation in this dynamic market.

Data Center Logistics Market Trends

The Surge in IT Spending and GenAI Integration Augmenting Market Growth

Data center systems are expected to witness significant growth in demand in the future. In 2023, global expenditure on these systems saw a 4% uptick, and experts are eyeing a substantial 10% leap in 2024, propelled mainly by the rise of generative AI. Technology providers are proactively integrating GenAI features into their offerings, aligning with fresh use cases identified by their corporate clientele.

Industry experts underscore a remarkable upswing in the data center logistics industry, mirroring the global IT spending trends. For instance, from a modest USD 140 billion in 2012, this spending ballooned to a significant USD 236.18 billion by 2023. Such a trajectory vividly illustrates the mounting appetite for data storage, advanced processing, and the ever-expanding realm of cloud services.

With this sector's spending on a steep incline, the spotlight intensifies on efficient logistics for data center construction, expansion, and upkeep. It accentuates the demand for state-of-the-art solutions, encompassing temperature-controlled transit, secure storage, and punctual infrastructure deliveries. As investments in data centers surge, logistics providers must not only scale up but also deftly navigate heightened complexities, all while championing innovation and sustainability to cater to the market's evolving needs.

The Dominance of the United States in Hyperscale Data Centers is Driving Growth in Data Center Logistics

Industry reports indicate that the United States accommodates more than 500 of the 1,000 hyperscale data centers globally, a milestone reached in the first half of 2024. By the end of 2023, 992 large data centers were operated by leading hyperscale providers like Amazon, Microsoft, and Google.

As per experts, the concentration of data centers in the United States, totaling 5,381 units in 2024, highlights the country's dominant position in the global data infrastructure landscape. This substantial number reflects the robust demand for advanced data management and processing capabilities, driven by the increasing reliance on cloud computing, big data analytics, and digital services. Consequently, the US data center logistics market is experiencing significant growth and evolution. This growth necessitates sophisticated logistics solutions to manage the complex supply chains associated with data center construction, maintenance, and expansion, including secure transportation of sensitive equipment, temperature-controlled storage, and just-in-time delivery of critical components.

The high concentration of data centers in the United States also indicates a growing emphasis on geographic redundancy and localized data storage solutions to ensure resilience and reliability in data management. As a result, logistics providers in the United States are innovating and expanding their service offerings to meet the dynamic and critical needs of data center operations. The trend toward more data centers underscores a robust demand for specialized logistics services, positioning the country as a pivotal market for advancements in data center logistics.

Data Center Logistics Industry Overview

The data center logistics market features a diverse competitive landscape, encompassing specialized logistics firms and major providers offering end-to-end supply chain solutions. Notable market players, including Iron Mountain, Schneider Electric, and Digital Realty, leverage their expertise to deliver customized logistics services tailored to the unique needs of data center operations.

Expansion strategies in this market commonly revolve around geographic diversification, the introduction of specialized services like temperature-controlled transportation and secure storage, and the adoption of cutting-edge technologies such as AI and IoT for real-time tracking and optimization. With global data center construction on the rise, propelled by the surging demand for cloud computing and data storage, logistics provider are prioritizing scalability and sustainability and broadening their service offerings to secure a larger market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Government Regulations in the Industry

- 4.5 Insights into Tier Classifications of Data Center

- 4.6 Insights into Technological Advancements in the Industry

- 4.7 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Data Storage and Processing

- 5.1.2 Increasing Emphasis On Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Infrastructure Limitations

- 5.2.2 Risk of Equipment Damage

- 5.3 Market Opportunities

- 5.3.1 Forming Strategic Partnerships With IT Companies

- 5.3.2 Developing Tailored Logistics Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Devices

- 6.1.1 Electrical Devices (UPS Systems, Other Electrical Infrastructure)

- 6.1.2 Mechanical Devices (Cooling Systems, Racks, Other Mechanical Infrastructure)

- 6.2 By Size of Data Center

- 6.2.1 Small and Medium-scale Data Center

- 6.2.2 Large-scale Data Center

- 6.3 By Service

- 6.3.1 Transport

- 6.3.2 Installation

- 6.3.3 Warehousing

- 6.3.4 Value-added Services

- 6.4 By End User

- 6.4.1 Banking, Financial Services, and Insurance

- 6.4.2 IT and Telecommunications

- 6.4.3 Government and Defense

- 6.4.4 Healthcare

- 6.4.5 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Australia

- 6.5.3.5 South Korea

- 6.5.3.6 Rest of Asia-Pacific

- 6.5.4 Middle East and Africa

- 6.5.4.1 GCC

- 6.5.4.2 South Africa

- 6.5.4.3 Rest of Middle East and Africa

- 6.5.5 South America

- 6.5.5.1 Brazil

- 6.5.5.2 Argentina

- 6.5.5.3 Rest of South America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Winning Solutions lnc

- 7.2.2 Schneider Electric

- 7.2.3 DHL

- 7.2.4 Logistics Plus Inc.

- 7.2.5 MG Moving Services

- 7.2.6 Iron Mountain Inc.

- 7.2.7 JK Moving

- 7.2.8 Flexential

- 7.2.9 Equinix

- 7.2.10 CyrusOne*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators

- 9.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 9.3 External Trade Statistics