PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636214

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636214

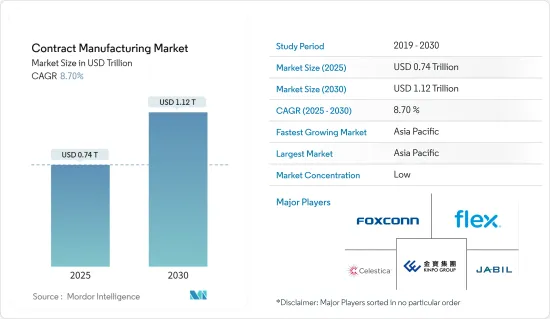

Contract Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Contract Manufacturing Market size is estimated at USD 0.74 trillion in 2025, and is expected to reach USD 1.12 trillion by 2030, at a CAGR of 8.7% during the forecast period (2025-2030).

Key Highlights

- Companies are increasingly outsourcing manufacturing to concentrate on core competencies, minimize capital expenditure, and leverage advanced technologies. The infusion of cutting-edge automation technologies, notably artificial intelligence and robotics, revolutionizes contract manufacturing. These advancements boost efficiency, cut costs, and elevate quality control standards. AI-driven systems empower manufacturers to swiftly adapt to changing production demands, while robotics ensure heightened precision and speed.

- There is a pronounced shift toward sustainability in the contract manufacturing realm. Companies embrace eco-friendly initiatives, from harnessing renewable energy to effective waste management. This pivot is largely fueled by consumer appetite for green products and mounting regulatory pressures.

- As consumers increasingly seek personalized products, a notable shift toward customizable manufacturing processes exists. Contract manufacturers fine-tune their production lines for enhanced flexibility, enabling swift changeovers and scalability to cater to diverse client demands. This evolution underscores a growing consensus: the era of one-size-fits-all solutions is waning.

- The Russia-Ukraine War underscored vulnerabilities in global supply chains, leading to an intensified focus on resilience. Contract manufacturers diversify their supplier bases, leverage digital tools for real-time visibility, and craft contingency plans to mitigate disruptions. This proactive stance is vital for ensuring consistent production and delivery. In a similar vein, design giants like Apple are channeling investments to shift and broaden their manufacturing footprint beyond China.

- Global supply chain disruptions, from geopolitical tensions or natural disasters, can throw production timelines and costs off balance. A report from TD Cowen highlights that Apple's suppliers are moving their manufacturing bases away from China, driven by production delays, among other factors. Apple, alongside its 188 key suppliers, is ramping up investments to accelerate this relocation strategy. The report further notes that if even a single critical component remains tied to the original region, the relocation will be deemed only partial.

Contract Manufacturing Market Trends

Electronics Sector is Driving the Market

- The electronics industry is in charge of rapid technological advancements, embracing trends like miniaturization and the integration of cutting-edge technologies such as IoT, AI, and 5G. Within this dynamic landscape, contract manufacturers play a pivotal role, offering specialized manufacturing processes and advanced technologies tailored to meet the industry's rigorous standards.

- From smartphones to a myriad of consumer electronics, the demand for high-volume production is paramount. Contract manufacturers provide the essential scalability, ensuring these products are produced in large quantities with efficiency and cost-effectiveness. This agility allows electronics companies to swiftly adapt to market fluctuations and evolving consumer trends. With established production facilities and deep expertise, contract manufacturers adeptly navigate complex assembly processes, upholding stringent quality standards even during extensive production runs.

- Leading tech giants, including Apple, Microsoft, Sony, and HP, turn to contract manufacturers like Foxconn and Pegatron for their production needs. By outsourcing the manufacturing of key products, from Apple's smartphones to MacBook laptops, these companies rake in revenues exceeding hundreds of billions. This partnership is not just beneficial for the tech giants; it is a significant revenue stream for contract manufacturers. Notably, Foxconn, one of the globe's largest electronics contract manufacturers, reported a staggering revenue of over USD 190 billion in 2023.

- Driven by global supply chain disruptions and escalating labor costs in traditional offshore locations, companies are increasingly reshoring their manufacturing operations. By partnering with local manufacturers, these companies aim to boost agility and gain greater control over their production processes.

- In response to rising demand and the need for large-scale production, contract manufacturers are not only expanding existing facilities but also setting up new plants in strategic regions. Notably, countries like India and Southeast Asia are witnessing a surge, with major contract manufacturers establishing their presence. As the industry forges ahead with innovations and expansions, contract manufacturers are poised to be pivotal in providing high-quality, efficient, and scalable production solutions.

Asia Pacific Holds Significant Share

- Lower labor costs and favorable economic conditions create a cost-competitive environment in Asia-Pacific. This financial advantage attracts global companies to outsource manufacturing, reinforcing the region's reputation as a hub for cost-effective production solutions.

- With a robust manufacturing infrastructure, the region has extensive production facilities, cutting-edge technologies, and streamlined logistics networks. Countries like China and India have cemented their positions as major hubs, boasting large-scale facilities adept at high-volume production.

- India is making significant strides in manufacturing for major international players. In the Indian state of Tamil Nadu, contract manufacturers like Foxconn, Pegatron, and Wistron have set up various iPhone manufacturing facilities. As a result, iPhone exports from India have seen substantial growth. According to the Wall Street Journal, Apple is looking to expand its production footprint in India, with a target of producing 25% of its global iPhone output by 2028.

- Apple's immediate plan is to ramp up manufacturing in India to exceed 50 million devices in the coming years, with aspirations to increase that number by several million units. This ambitious expansion is being championed not just by Apple but also by its key suppliers, notably Taiwan's Foxconn. India is emerging as a favored hub for global biopharmaceutical companies seeking to outsource biotechnology services. Similar trends are also being witnessed in Southeast Asian nations, particularly Vietnam.

- This region stands at the forefront of global manufacturing. Prioritizing technological innovation and mass production reinforces its dominant position in the sector. Despite facing challenges such as quality control issues and supply chain disruptions, the market thrives on strategic partnerships and significant investments. As dynamics evolve, this region cements its reputation as a crucial global manufacturing center.

Contract Manufacturing Industry Overview

The contract manufacturing market is fragmented and characterized by numerous players vying for business across diverse industries. Competition is driven by factors such as cost efficiency, technological capabilities, and service offerings. Major players like Hon Hai Precision Co. Ltd (Foxconn), Flextronics International LTD, Jabil Inc., Kinpo Group, etc., leverage advanced technologies and global networks to attract clients. At the same time, smaller, specialized firms focus on niche markets or tailored solutions. Price competition is intense, with companies continually optimizing processes to reduce costs. Additionally, firms compete on factors like quality, speed, and compliance with regulatory standards.

July 2024: Cosmos Health Inc., a globally integrated healthcare group, will be involved in innovative R&D, own proprietary pharmaceutical and nutraceutical brands, manufacture and distribute healthcare products, and operate a telehealth platform. The company announced that its wholly-owned subsidiary, Cana Laboratories, has entered into additional contract manufacturing agreements with Provident Pharmaceuticals. Established in 2012, Provident is a specialty pharmaceutical company focusing on commercializing and marketing niche and legacy pharmaceutical products, along with medical devices targeting specific therapeutic areas.

January 2024: Hon Hai Precision Co. Ltd (Foxconn) launched a new electric vehicle company in Zhengzhou, the capital of China's Henan province and the site of the world's largest Apple iPhone manufacturing plant. This move comes as the Taiwanese electronics contract manufacturer intensifies its EV initiatives in response to a worldwide downturn in smartphone manufacturing contracts. The newly established entity, Foxconn New Energy Automobile Industry Development (Henan), was officially registered on January 4, boasting a capital of USD 70.4 million, as per Chinese public records.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Efficiency

- 5.1.2 Globalization and Market Expansion

- 5.2 Market Restraints

- 5.2.1 Quality Control Issues

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Manufacturing Services

- 6.1.2 Design Services

- 6.1.3 Post Manufacturing Services

- 6.2 By End-user Vertical

- 6.2.1 Electronics

- 6.2.2 Pharmaceuticals and Healthcare

- 6.2.3 Automotive

- 6.2.4 Consumer Goods

- 6.2.5 Other End-user Verticals

- 6.3 By Contract Type

- 6.3.1 Long-term Contract

- 6.3.2 Short-term Contract

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hon Hai Precision Industry Co. Ltd

- 7.1.2 Flextronics International Ltd

- 7.1.3 Jabil Inc.

- 7.1.4 Celestica Inc.

- 7.1.5 Kinpo Group

- 7.1.6 Shenzhen Kaifa Technology Co. Ltd

- 7.1.7 Benchmark Electronics Inc.

- 7.1.8 Universal Scientific Industrial Co. Ltd

- 7.1.9 Venture Corporation Limited

- 7.1.10 Wistron Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET