PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636209

North America Municipal Solid Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

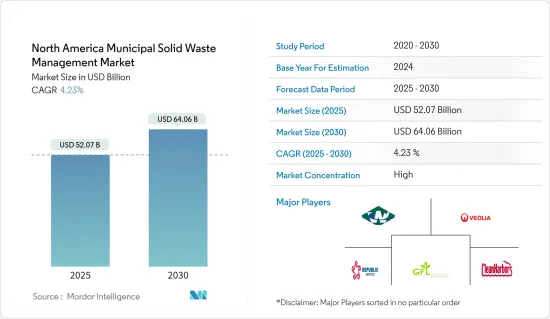

The North America Municipal Solid Waste Management Market size is estimated at USD 52.07 billion in 2025, and is expected to reach USD 64.06 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The North American municipal solid waste (MSW) management market is pivotal in the environmental services industry. It encompasses the collection, transportation, processing, recycling, and disposal of solid waste from residential, commercial, and industrial sources. North America, particularly the United States and Canada, significantly contributes to the MSW management market. Given the rising waste generation and the adoption of advanced waste management practices, the market is poised for steady growth in the coming years.

Managing municipal solid waste (MSW) in the United States is generally satisfactory. Private entities predominantly handle the transportation and disposal of MSW, ensuring adequate funding. Annually, Americans produce around 258 million tons of MSW. Of this, roughly 53% finds its way to landfills, a figure that has stabilized. Presently, 34.6% of MSW is recycled, while 12.8% is incinerated for energy generation.

Stringent environmental regulations at the federal, state, and local levels, such as the US Resource Conservation and Recovery Act (RCRA), underscore the importance of proper waste management. Urbanization and population growth are directly linked to increased waste generation, necessitating scalable waste management solutions.

Public awareness and government initiatives drive the push for recycling, waste reduction, and waste-to-energy practices. Technological innovations, like automated sorting and IoT-based waste collection, are enhancing the efficiency of waste management processes. Also, as economic development and income levels rise, so does consumption and subsequent waste generation, further bolstering the demand for advanced waste management services.

North America Municipal Solid Waste Management Market Trends

The Primary Driver of Growth in Municipal Solid Waste is the Increasing Generation of Food Waste

Every year, Americans generate billions of pounds of food waste, significantly impacting the environment and the economy. On average, an American discards over 400 lbs (181 kg) of food annually, equating to a staggering 30%-40% of the entire US food supply. Several factors contribute to this alarming trend, including unsustainable practices in the food supply chain, stringent aesthetic standards set by retailers and consumers, and often uninformed consumer behavior.

The repercussions of this waste are far-reaching, encompassing heightened greenhouse gas emissions, squandered water resources, and substantial economic setbacks. However, initiatives like redirecting surplus food to entities such as food banks and churches combat food waste and address food insecurity in the nation. Also, household composting emerges as a pivotal strategy, diverting food from landfills and curbing greenhouse gas emissions.

The US food waste scale is staggering, with Americans squandering a colossal 108 billion lbs (49 billion kg) annually, steadily climbing. This waste contributes to unsustainable food production and transportation practices, the insistence on near-perfect aesthetics for fruits and vegetables, and a myriad of consumer habits. The consequences of this rampant food waste are dire, leading to significant carbon dioxide and methane emissions, contamination and depletion of water resources, and substantial economic losses. However, the nation can significantly reduce its annual food waste output by redistributing excess food and encouraging household composting.

Food waste in the United States holds the dubious distinction of being the primary material in landfills, constituting a substantial 24.1% of all municipal solid waste. Americans discard 46% of fruits and vegetables, 35% of seafood, 21% of meat, and 17% of dairy products. The United States discards 30% to 40% of its food supply annually.

The scale of food waste in the United States is alarming, with significant environmental and economic repercussions. Addressing this issue through initiatives like food redistribution and household composting can substantially mitigate its impact, promoting sustainability and reducing food insecurity.

An Expanding Urban Population is Driving Growth in the US Municipal Solid Waste Management Market

The US municipal solid waste management market is driven by a growing urban population with rising disposable incomes, a trend poised to impact market growth significantly.

Across the United States, most trash is either landfilled or incinerated. Incineration reduces waste volume and weight by 90% and 75%, respectively. However, both incineration and landfilling pose notable environmental threats. Consequently, policymakers in many states increasingly advocate for sustainable waste management, strongly focusing on recycling. In the recycling process, segregated waste is reprocessed into various useful materials.

The US municipal waste management market has seen marked improvements. Stringent regulatory mandates aimed at promoting eco-friendly waste disposal have bolstered the market. Regions are now ramping up investments in recycling and composting AD industries.

The COVID-19 pandemic raised challenges for waste management companies in the United States. They needed help maintaining workforce continuity and operational efficiency, especially given the logistical complexities of waste disposal during lockdowns.

Regulations that discourage plastic use have impacted the consumption of paper and paperboard, especially in packaging and non-durable goods like newspapers, cups, and tissue paper. On the other hand, products like milk cartons, bags, and corrugated boxes fall under packaging and containers and are highly recyclable, leading to a surge in demand and application scope.

According to the US Environmental Protection Agency, the recycling rate for paper and paperboard stood at nearly 65%, the highest among all materials. Moreover, incinerating these materials has minimal environmental impact, further fueling their preference for waste management.

The West, South Central, South Atlantic, Northeast, and Pacific States collectively hold over 65% of the US municipal waste management market share. This market is poised for substantial growth, driven by a heightened focus on advanced waste treatment technologies.

Urbanization, rising disposable incomes, and eco-friendly regulations fuel notable US municipal solid waste management market growth. The market is witnessing heightened investments in recycling and composting, underpinned by a robust emphasis on sustainable waste management practices, all set to amplify its growth trajectory.

North America Municipal Solid Waste Management Industry Overview

In North America, the municipal solid waste management market exhibits a notable concentration, with a handful of critical players holding significant sway. Some key players in this market are Waste Connection, Veolia, GFL Environmental, Republic Services, and Clean Harbors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Public Awareness of Environmental Concerns

- 4.2.2 Rapid Urbanization and Growing Population

- 4.3 Market Restraints

- 4.3.1 High Initial Investment and Operational Costs

- 4.4 Market Opportunities

- 4.4.1 Adoption of Advanced Waste Management Technologies

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights on technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Waste Type

- 5.1.1 Paper and Cardboard

- 5.1.2 E-waste

- 5.1.3 Plastic Waste

- 5.1.4 Metal Waste

- 5.1.5 Glass Waste

- 5.1.6 Other Waste Types

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Construction

- 5.2.4 Other Sources

- 5.3 By Disposal Methods

- 5.3.1 Landfill

- 5.3.2 Incineration

- 5.3.3 Recycling

- 5.3.4 Other Disposal Methods

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Waste Management

- 6.2.2 Republic Services

- 6.2.3 Waste Connections

- 6.2.4 Casella Waste Systems

- 6.2.5 Advanced Disposal Services

- 6.2.6 Clean Harbors

- 6.2.7 GFL Environmental

- 6.2.8 Veolia

- 6.2.9 Covanta Holding Corporation

- 6.2.10 Stericycle

- 6.2.11 Rumpke Waste & Recycling

- 6.2.12 EDCO Disposal Corporation

7 FUTURE TRENDS