PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636196

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636196

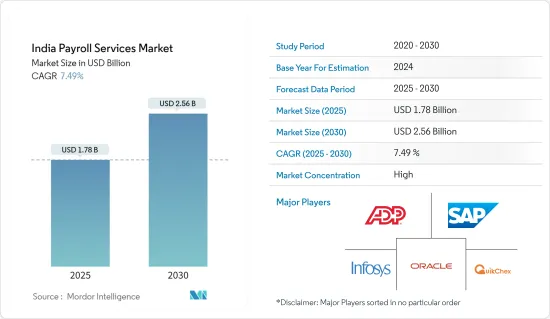

India Payroll Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Payroll Services Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 2.56 billion by 2030, at a CAGR of 7.49% during the forecast period (2025-2030).

Payroll services encompass a diverse range of payroll management solutions. The Indian payroll market is characterized by a mix of established multinational payroll service providers and local companies that address the different needs of businesses in various jurisdictions.

Key services offered in this market include payroll processing, tax calculation and filing, compliance with local and international regulations, and handling of employee benefits. Given the region's diverse and complex regulatory landscape, payroll service providers must navigate varying labor laws, tax codes, and reporting requirements, ensuring accuracy and compliance.

The market is driven by several factors, including the increasing adoption of cloud-based payroll solutions, the growth of multinational corporations with operations in the region, and the rising demand for outsourcing payroll functions to improve efficiency and reduce operational costs. In addition, the digital transformation trends in the region, mixed with advancements in cloud computing, automation, and digital transformation, are enhancing the capabilities and offerings of payroll service providers.

Overall, the Indian payroll service market is poised for significant growth, driven by economic expansion, technological advancements, and the increasing complexity of payroll management in a diverse regulatory environment.

India Payroll Services Market Trends

Technological Advancements and Cloud Services Driving the Market

- Cloud business process-as-a-service (BPaaS) has experienced significant revenue growth across India, marking a transformative shift in how businesses manage their operations. This surge can contribute to several key factors driving adoption and investment in BPaaS solutions.

- Firstly, businesses in India are increasingly recognizing the scalability and flexibility benefits offered by BPaaS. By outsourcing critical business processes to cloud-based service providers, companies can streamline operations, reduce costs, and enhance overall efficiency. This model is particularly attractive in a region known for its diverse market landscapes and rapidly evolving regulatory environments.

- Secondly, the COVID-19 pandemic accelerated the digital transformation agenda, prompting organizations to prioritize cloud solutions that support remote work and digital collaboration. BPaaS not only facilitates remote operations but also integrates seamlessly with other cloud-based technologies, such as software-as-a-service and platform-as-a-service (PaaS), further enhancing its value proposition.

- In addition, the growing maturity of cloud infrastructure and the increasing availability of specialized BPaaS offerings tailored to regional market needs has fueled adoption. Service providers are leveraging advanced technologies like AI, automation, and analytics to deliver more sophisticated and customized BPaaS solutions, catering to diverse industry requirements.

- In conclusion, the significant increase in BPaaS revenue in India highlights a strategic pivot toward agile, scalable, and digitally integrated business processes. This trend positions the country as a major player in embracing and driving global digital transformation initiatives.

Digital Payment Mechanism Fueling the Market

India is witnessing a significant shift in its payroll landscape, termed the "paycheque revolution." This revolution is primarily fueled by two pivotal factors: the changing preferences of today's workforce and the rising availability of varied mobile payment solutions. The traditional scene of paper payslips and bank queues is fading. Modern employees demand immediate, hassle-free, and secure salary access. The integration of digital payments into payroll systems is not a passing trend. It is a strategic shift that promises concrete advantages for both employers and employees.

India Payroll Services Industry Overview

The Indian payroll services market is fiercely competitive, with various big firms competing for dominance. Due to the consolidated nature of the market, a select few players currently hold the majority of the market share. These market leaders are aggressively pursuing growth at home and in international markets. The key players include ADP, SAP, Oracle, Infosys Limited, and Quikchex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions

- 4.2.2 Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 4.3 Market Restraints

- 4.3.1 Cost Sensitivity, Especially for SMEs

- 4.3.2 Intense Competition Among Payroll Service Providers

- 4.4 Market Opportunities

- 4.4.1 Expansion of Cloud-based Solutions

- 4.4.2 Emerging Markets in India Provides Untapped Opportunities for Payroll Service Providers

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hybrid

- 5.1.2 Fully Outsourced

- 5.2 By Organization Size

- 5.2.1 Small and Medium-Sized Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-User

- 5.3.1 BFSI

- 5.3.2 Consumer and Industrial Products

- 5.3.3 IT and Telecommunication

- 5.3.4 Public Sector

- 5.3.5 Healthcare

- 5.3.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 ADP

- 6.4 SAP

- 6.5 Oracle

- 6.6 Infosys Limited

- 6.7 Quikchex

- 6.8 Paysquare

- 6.9 ZingHR

- 6.10 Excelity Global

- 6.11 Hinduja Global Solutions

- 6.12 Osource

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US